Trezor is a leading hardware wallet that allows users to store cryptocurrency holdings. It currently supports over 500 different crypto coins. The leading feature and most important aspect of a wallet is security, and the Trezor is considered one of the most secure available.

Before looking at the features and benefits of the Trezor, it’s worth taking a quick look at the different types of cryptocurrency wallets. Trezor is a hardware wallet, but there are also desktop wallets and paper wallets. Each type has its own features, benefits, and advantages.

When deciding which is the best option, there is generally a decision to be made around usability, functionality, and security. Ultimately, what users are using a wallet for will determine the best option. A high frequency trader may decide easy access is the most important feature. A long-term investor looking to hold (or hodl) crypto for the long term may be more interested in a cold wallet.

What are the different types of cryptocurrency wallet

Hardware wallets

A hardware wallet is a small digital device you can connect with a computer or device. Arguably the safest way to hold your cryptocurrency is on a hardware wallet. The Trezor wallet is one of the most reputable brands on the market (Nano Ledger and KeepKey are also well regarded by the crypto community). The benefit of using a hardware wallet is that your private keys stay rooted in the device, meaning they can’t be exported into plaintext and making it almost impossible to hack.

Desktop wallets

A desktop wallet is an application installed locally on a computer or device. Leading cryptocurrency exchange Coinbase offer one of the most established wallets in the market. A big advantage with the Coinbase wallet is crypto stored on the wallet is insured. Jaxx and Electrum are two other well regarded desktop wallets.

Paper wallets

A cryptocurrency paper wallet is a way of storing crypto offline in cold storage. To have a paper wallet, you must print out your public address and private keys on a piece of paper then store it securely where nobody has access.

Users can create a Bitcoin paper wallet easily on Wallet Generator. The most reputable Ethereum wallet with paper wallet facilities is MyEtherWallet (as it can hold every single ERC-20 token as well as Ethereum).

Features of the Trezor hardware wallet

Connectivity

The Trezor can connect to a device in three main ways. Trezor recommend wallet owners download and install software called Trezor Bridge to optimise user experience. However, users can also connect directly via WebUSB as long as they are using Chrome. Trezor can also be used via Android devices in terms of initialising the device, recovering the device, and setting up PIN codes.

Transferring cryptocurrency to Trezor

Existing cryptocurrency assets can be sent to the Trezor using a receiving address that is generated by the wallet. Trezor recommends that you buy crypto on an exchange and transfer funds to your Trezor rather than holding them in the exchange’s online wallet. Trezor can also support the use of cryptocurrency ATMs by generating a QR code for your account. This can be used with an ATM to change cash into crypto.

Receiving funds

To receive funds, users need to plug in their Trezor device and go to the account page. They can then select which cryptocurrency they are receiving, and it’s important to ensure the right address is used for the right currency. Once the currency is selected, users can click the receive tab and it will generate an address.

The address can be displayed as a QR code or as text. Trezor recommends you make sure the address on your Trezor device matches that in the wallet. Once an address is generated, it can be used multiple times to receive funds.

Sending funds/payments

To send funds or receive payments, once again users need to select the currency the transaction is being made in. Users can then type in the destination address for the transaction or scan it in the form of a QR code (this can be achieved by holding the QR code up in front of a computer webcam).

Users then enter the amount and select the destination account. It’s possible to send payments to multiple addresses at the same time, which reduces overall transaction time compared to sending them individually.

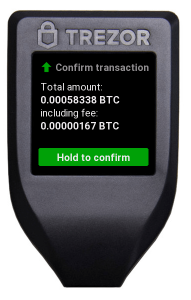

Users will be asked to confirm the transaction to give the opportunity for a final check of the amount and destination address.

Transaction details

Users can select the transactions tab in the wallet and all payments and received funds are detailed. There is a timestamp on each transaction which will be marked either as ‘confirmed’ or ‘unconfirmed’. Until a transaction is confirmed, they shouldn’t be considered as complete.

Security

PIN

The most commonly used PIN codes are 1111, 0000, 1212, and 7777. These are obviously easily guessed, so best advice is to use something random and non-sequential. But it needs to be remembered. Trezor recommends that users write their PIN on their recovery card if they feel they may not be able to remember it.

Recovery seed

In crypto, a recovery seed is really important. It is a list of words in a set order which stores all the information required to recover a wallet. The security of the recovery seed is the most important aspect of keeping crypto safe and secure. If a user loses their Trezor or it breaks, the recovery seed is the only method to get the crypto back. It is vital the recovery seed is not stored on a computer/drop box/online file.

Trezor recommend writing it down on paper, making copies, and keeping them in a place where they’re unlikely to be lost. A recovery card is included in the Trezor box, which is recommended as one place to record the seed and possibly PIN.

Passphrase

Trezor allows users to add a passphrase to the device, but this is only recommended to experts and users who understand completely how this type of security feature works. If a Trezor is set up with a passphrase that is forgotten, the user will lose their crypto forever.

We have a range of wallet guides on our site along with the latest cryptocurrency news.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.