Bitcoin has been in freefall this morning more panic sets into the cryptocurrency market. The cryptocurrency industry doesn’t seem immune to the panic that has engulfed traditional markets in recent weeks. Gold, however, despite a drop as well today appears to be behaving much more like a safe haven asset.

For many years now have Bitcoin maximalists portrayed the idea of Bitcoin as a store of value. This narrative was reinforced further by the split between Bitcoin and Bitcoin Cash in 2017.

Yet, with traditional markets in free fall, Bitcoin received a shock to the system this morning plunging almost $2000. Those that missed the volatile days of Bitcoin have received a rude awakening.

It would be unfair to say that the store of value narrative of Bitcoin is dead in the water. However, this is the first true test of such and coming out of the starting blocks, Bitcoin has stumbled, if not fallen over.

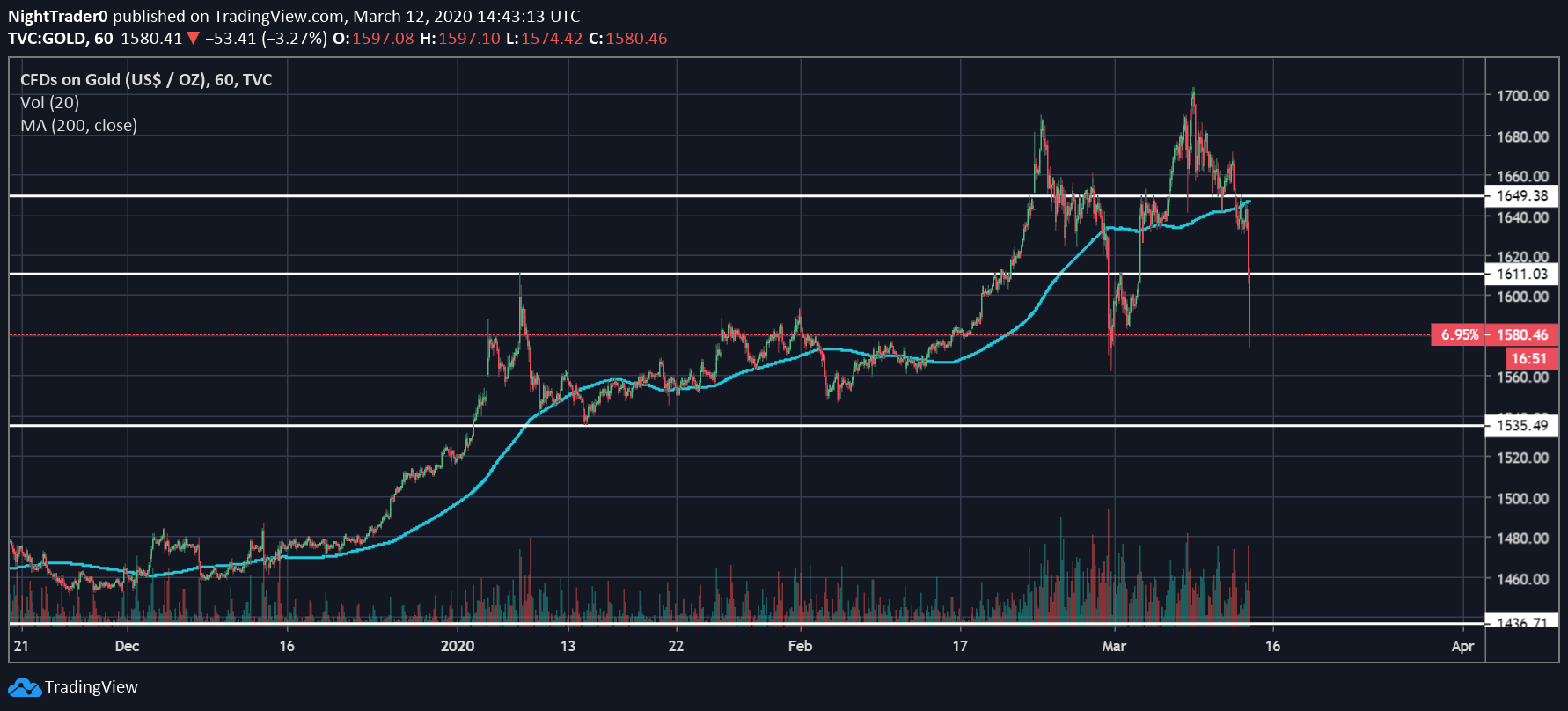

Gold has reacted in a similar fashion but by no means on the scale of Bitcoin. The original store of value for traditional markets. Gold appears to be holding a little more steady for now providing some relief for weary investors.

There is a key difference that should be noted between both gold and Bitcoin liquidity. Bitcoin, remains a rather illiquid market when compared to the legacy of traditional assets. This is why such volatile moves occur.

The gold market is much more liquid. This explains why price movement appear on a much lower scale. When compared to Bitcoin, historically this has proved disadvantageous. As Bitcoin has rocketed in price, gold has been tumbling through uninteresting ranges.

However, in times of such uncertainty, gold is now able to provide a little more stability for scared investors.

As the panic throughout financial markets shows no sign of waning it is important to remember that there is a huge amount of uncertainty everywhere. Chainlink has been performing surprisingly well in the cryptocurrency markets up until today when it was faced with a sudden 42% drop.

As to whether gold can continue to act as a safe haven is also uncertain. Traders may force a sell off to cover their leveraged positions in the stock market, as it appeared so this morning. This could mean that gold suffer losses as the tumble continues to drag on.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire