This is an advanced guide to understand the mechanics of the margin short and long tracking that can be monitored for Bitfinex.

Bitfinex is one of the most trusted exchanges in the crypto ecosystem. Its spot and 3x margin leverage accounts support over a billion dollars of trading during high volatility days.

Let’s kick off with a little bit of background on margin. Margin is gambling. It is the ability to leverage assets at a trusted third party.

Trust is built through personal and peer experiences of others you know, as well as local community and history. Key areas include the way the exchange dealt with different attacks (hacks or reputation as an organisation).

Funding to go margin long

At the time of writing, there were about 25,000 BTC margin longs and 30,000 BTC margin shorts. As Bitfinex trades at 3x leverage we can divide that number by three to work out the total margin requirement needed to be deposited at Bitfinex. In USD terms, at the time of writing, that means that more than $86 million of funding is required to be locked to keep these trades open.

The people who have taken custody of this one-third deposit will lend out the other two-thirds worth of capital to speculate on the price of Bitcoin going up or down. For lending out this BTC or USD you can expect that the people offering funding want a return. That rate is calculated daily (in a specific order book) for both BTC and USD.

The daily rate is currently 0.006% a day for USD and 0.008% a day for BTC. It’s worth noting that this rate changes each day based on supply and demand. There is even an order book to place bids and offers for funding, if you want to participate yourself.

So a few more details of funding for today to help you understand the various ratios on an annual compounded basis (if you invested for a whole year)…

So we know that there are 30 thousand BTC margin longs. At today’s price that is valued around $140 million, with two-thirds from funding valued at $93 million. At today’s rate that means payment of interest for today is $5,600.

For the 30 thousand BTC margin short at today’s rate, you will again see two-thirds go through funding at a current price of 0.008% a day. It works out as an interest cost of 1.6 BTC to borrow 20,000 BTC.

Please note that, today, funding only earns a compounded rate of between 2-3% a year. The cost of funding obviously corresponds with the supply and demand for daily interest earned for funding. Today’s rate is particularly low but a few months ago the up daily rate was up at 0.028% a day (or 11% a year)

The best website that tracks this data is datamish.com.

Near the bottom of the website, you can also see a chart monitoring its API data inputs, direct from Bitfinex. See some key information below to help you navigate around the site to check out the data yourself.

Pick a coin and time frame

Using the menu on the top right of the website you can find the tab to select your desired time frame for analysis (up to five years back). You can look back over longer time frames the data relating to margin short and long positions. Also in the top right is a button to refresh the charts (to make sure you are staying up to date).

Using the menu in the top left of the screen you will see the button to switch between different funding markets. Datamish covers funding data from eight popular lending markets from Bitfinex. This list includes: Bitcoin, Bitcoin Cash, Ethereum, Monero, Zcash, IOTA, EOS and Litecoin.

For the remainder of the guide we will focus on the most liquid funding book of Bitcoin.

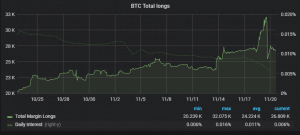

BTC Longs

On the left-hand side of the screen, you will see the ‘BTC Total longs’ data. The chart above shows the historic data over the last 30 days. This is a good time frame to look into moves on the chart and understand impacts from the recent volatility (as BTC price collapsed below $6000 support).

From the chart we can see the solid green line that trends upwards, then spikes and collapses in margin long positions between 27 and 33 thousand BTC (or a $28 million funding move). You can also see the dotted green line displaying the daily interest rate (Axis on the right-hand side).

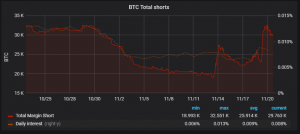

BTC Shorts

On the right-hand side of the screen, you will see the ‘BTC total shorts’ data. The chart above shows the historic data over the last 30 days.

From the chart, we can see the solid red line is the total margin short positions. We spiked up over 10,000 shorts in the last few weeks ($47 million in BTC funding change). You can also see the red dotted line that shows the daily BTC funding rate (Axis on the right-hand side).

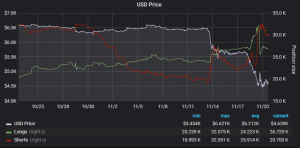

A look over the breakdown from $6000

The above chart is underneath the margin longs on the left-hand side. On it, you can see both the margin longs and shorts (over the last 30 days) and also the change and drop in BTC price under $6,000.

You can see in the data as the margin shorts spiked above 5,000 BTC in volume as Bitcoin crashed down below $6,000 support. In the same period of time, you can see the BTC margin longs also increase but at a much smaller relative size (only a 1,000 BTC move).

This means that the shorts heavily profited with their highly speculative play before taking profit as the price started to stabilise around $5,500. You can then see a moment where the price dips again (between $5,500 to $4,500). In this instance, the longs start opening in anticipation of a price rise, but they suddenly close up nearly 5,000 shorts as they are forced to close their leveraged position at a loss.

Conclusion

Due to the fact that Bitfinex is such a respected exchange in this space, you know many crypto whales will choose to trade there. By watching the key battles, it will give key insights into trading sentiment.

Like we have seen on the charts, it’s also good to evaluate every short-term move up or down in relation to the change in margin shorts or longs. An example could be if a big move happens on Bitfinex, with the margin shorts or longs, generally unchanged – you can tell that people are buying or selling in an unleveraged spot position.

Bitcoin has historically gone through many short squeezes as it pushed through multiple all-time highs, we have not seen one in quite a while, but if one is brewing you will probably spot the data first by using this tool.

For more guides on cryptocurrencies, exchanges and blockchain technology, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.