Originally released in 2012, Ripple is a real-time gross settlement system (RTGS), currency exchange, and remittance network. It uses a common ledger which is managed and maintained by a network of independently validating nodes that can belong to anyone from individuals to banks. Ripple is based on a shared public database which makes use of a consensus process between validating servers to ensure integrity.

At its core, Ripple is not a blockchain, as it uses a HashTree to summarize data into a single hash that is compared across nodes to provide consensus. Unlike Bitcoin, there is no actual mining and energy expenditure as nodes do not compete among each other to find the hash, but rather listen to other nodes for confirmations.

To defend against attackers, Ripple heavily relies on a Unique Node List (UNL) to censor malicious validators, as any validator not in another validator’s UNL is ignored. Pending transactions are voted on by validators and only transactions accepted by at least 80% of validators are placed in the next block. This consensus mechanic can be described as a Federated Byzantine Agreement (FBA) consensus algorithm, similar to Stellar’s XLM – an actual fork of the Ripple protocol.

In terms of performance, the Ripple network takes about 4 seconds to confirm transactions and consistently handles 1,500 transactions per second (TPS), with the ability to scale up to 50,000 transactions per second. Comparatively, Bitcoin can do 6 TPS, about 0.4% of Ripple’s total throughput, and it has a confirmation time of 10 minutes per block (up to 1 hour when the network is clogged).

| Purpose of Token | TPS | Confirmation Time | Consensus Protocol |

| XRP, used as the payment currency and anti-spam mechanism within the Ripple ecosystem. | 1,500–50,000 | 4 seconds | FBA |

Ripple’s token – XRP

The goal of the Ripple network, or RippleNet, is to connect banks and payment providers, allowing one frictionless experience for sending and receiving money globally. The Ripple cryptocurrency, XRP, offers banks and payment providers a reliable, on-demand option to source liquidity for cross-border payments. At the time of writing, the XRP token is used within the Ripple ledger mainly to pay fees and to avoid spam, although at its core it still lacks some utility functionality.

Nonetheless, its current function is to serve as the base currency for the Ripple ledger. In a simple way, XRP provides liquidity to big-time players and allows for faster inter-banking payments between them.

Currently, there is about 40% of Ripple’s total supply of XRP in circulation:

- Total supply: 99,991,780,039.00 XRP

- Circulating supply: 40,327,341,704.00 XRP (about 40% of the total supply)

What is Ripple used for? – examples

- Banks: Ripple is used by some banks to process cross-border payments in real time, with end-to-end tracking and certainty. Some key advantages are low transaction costs, easy integration, and new sources of revenue.

- Payment providers: Ripple provides a faster, more transparent, and more predictable payment service for customers with greater ease and reach.

- Digital assets exchange: XRP offers a reliable way to source liquidity for payments. An important benefit is faster settlements between accounts, and it also offers a reliable source of volume.

What is Ripple technology?

The current Ripple business model is to develop and sell software built on top of XRP, the cryptocurrency. The three primary software products developed by Ripple are: xCurrent, xRapid, and xVia.

xCurrent

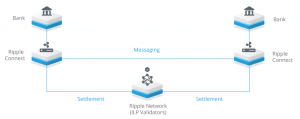

xCurrent is an interbank communications and settlement software built around the Interledger Protocol (ILP). xCurrent comprises of two primary layers:

- The first layer is a communications protocol that is used to perform tasks like validating payment information and transferring funds.

- The settlement layer ensures that funds are committed on both sides and then simultaneously releases the committed funds to each side.

By leveraging distributed ledger technology, xCurrent increases the efficiency of interbank communication by allowing banks to settle transactions (especially multi-currency transactions) faster with transparency and integrity. xCurrent is currently Ripple’s most popular product among its clients.

xRapid

When XRP is used in xCurrent as a bridge currency to settle transactions, Ripple defines that as a new product called xRapid. In simple terms, xRapid is a software solution to provide liquidity which allows companies to swap in and out of XRP to optimise exchange rate efficiency. Without a bridge asset, the spreads can be quite high between infrequently traded currencies, which results in expensive trades.

xVia

This product is the last stage in Ripple’s product ecosystem. xVia is a standardised payment interface into RippleNet, the current network of financial institutions using xCurrent or xRapid to settle payments.

Source: https://ripple.com/

We hope you enjoyed our guide ‘What is Ripple?’. For more guides on cryptocurrencies, exchanges, and blockchain technology, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.