Originally released in 2014, Stellar cryptocurrency is a real-time platform that connects banks, payment systems, and people. It was created to move money quickly, reliably, and at almost no cost.

Stellar’s goal is to become the go-to network for micro-payments, including inter-banking and intra-banking payments and settlements, through the use of its Lumens (XLM) token.

Source: Stellar.org

The current financial infrastructure is a mess of closed systems, and gaps between these systems mean that transaction costs are high and money moves slowly across political and geographic boundaries. This friction has slowed the growth of financial services, leaving billions of people unbanked or with a complete lack of access to financial institutions.

Stellar cryptocurrency is based on a decentralised network which consists of peers that can run independently of each other. The power to transmit information is completely distributed among a network of servers, instead of being driven from one primary source.

This means that the Stellar network does not depend on any single entity, as the general idea is to have as many independent servers participating in the Stellar network as possible, so that the network will still run successfully even if some servers fail.

The Stellar servers communicate and sync with each other to ensure that transactions are valid and get applied successfully to the global ledger through its Stellar Consensus Protocol, or SCP. This is essentially an improved version of a Federated Byzantine Agreement, where Stellar Lumens (XLM) holders can become validators or vote for validators.

|

Purpose of Token |

TPS | Confirmation Time |

Consensus Protocol |

|

XLM, a bridge for payments between Stellar accounts |

1,000

to 10,000 |

2 – 5 seconds |

SCP |

Token – XLM

Stellar’s goal is to connect agents with institutions, allowing a single frictionless process for sending and receiving money globally. Stellar Lumens, or XLM, offer enormous advantages to users, such as:

- Real-time settlement (2-5 seconds)

- Cryptographically secure transactions

- Regulatory compliance

- Payments that move like email

- International reach with a single integration

- The best solution for micro-payments – a $0.01 fee handles around 600,000 transactions

- Automatic currency exchange

Use cases

- Banks: Financial institutions can process cross-border payments in real time, with end-to-end tracking and certainty. Some key advantages are low transaction costs, easy integration, and new sources of revenue.

- Payment providers: Stellar offers faster, more transparent, and predictable payment services for customers with greater ease and reach.

- Digital assets exchanges: XLM offers a reliable way to source liquidity for payments. Some important benefits are faster settlements between accounts, as well as a new and reliable source of volume.

- General users: XLM owners can enjoy near-free transactions to any account across the globe, with a settlement time of 2-5 seconds.

Technology

Stellar uses technology derived from Ripple, although its consensus mechanics are rather different than its predecessor, and it does seem to offer a number of advantages.

Source: Stellar.org

Source: Stellar.org

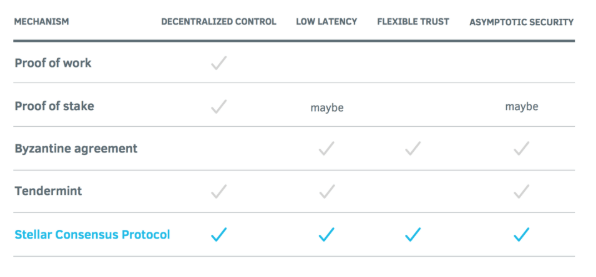

The Stellar Consensus Protocol (SCP) provides a way to reach consensus without relying on a closed system to accurately record financial transactions. SCP has a defined set of safety properties that optimise for security over liveness – in the event of partition or misbehaving nodes, it halts progress of the network until consensus can be reached. SCP simultaneously enjoys four key properties:

- Decentralised control

- Low latency

- Flexible trust

- Asymptotic security

Stellar cryptocurrency has also started using anchors to settle transactions. Simply put, anchors are entities that people trust to hold their deposits and issue credit into the Stellar network for those deposits. All money transactions in the Stellar network (except XLM) occur in the form of credit issued by anchors, so anchors act as a bridge between existing currencies and the Stellar network. Most anchors are organisations like banks, savings institutions, farmers’ co-ops, central banks, and remittance companies.

What next?

Want to know more about altcoins and what they’re looking to achieve? Read our definitive series.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.