Cryptocurrency exchange YoBit has been in the news more in the past week than it has in the past year, mainly due to the unashamed advertising of illicit pump-and-dumps on its exchange.

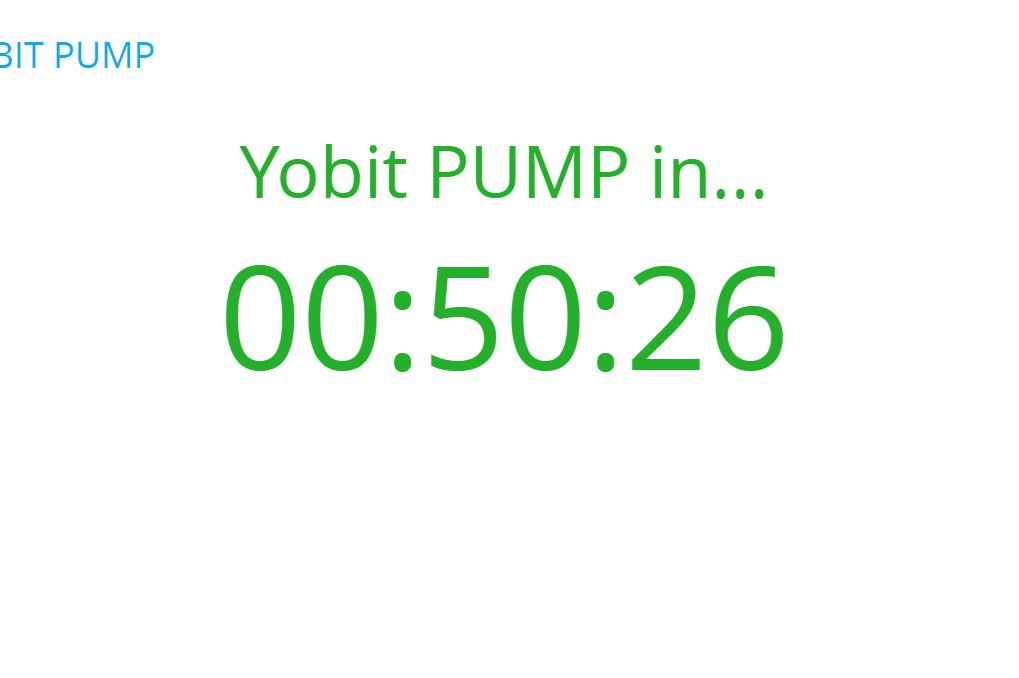

The Russia-based company announced another pump-and-dump earlier today, just days after they pumped Putin Coin 1600% to the upside before dumping it back to normality within 30 minutes.

Pump-and-dump schemes have been happening in the stock market for decades, with Jordan Belfort, made famous by the film Wolf of Wall Street, landing time in prison for capitalising on unsuspecting investors through the scheme.

YoBit are a prime example of an exchange exploiting their reputation to profit from their customers through pump-and-dumps. But their elaborate scheme won’t go unnoticed for long, with the SEC and CFTC coming down hard on pump-and-dump groups throughout 2018.

Participating in such schemes poses a huge risk to investors as the organisers, in this case YoBit, often pre-buy the digital asset before the announcement, proceeding to sell into their customer’s buy orders making a large profit.

If regulatory bodies came after YoBit staff it wouldn’t be the first time they have found themselves in hot water. Pavel Krymov, the alleged founder of YoBit, was reportedly arrested in Moscow last year pending an investigation into ‘establishing fraud financial schemes’.

While the topic of regulation in crypto is a controversial one, it must be said that regulation in terms of removing these fraudulent schemes is undoubtedly a positive step.

In a brazen attempt to warn investors, YoBit tweeted the following: “It’s high risk! Never invest money that you can’t afford to lose. (Most Important Rule of Investing) No more refunds.”

Another potential risk of unregulated exchanges like YoBit is the possibility that the exchange could cease existence, thus taking customer’s funds in the process. By advertising 1600% gains they have the power to attract more traffic to the site, meaning that if they were attempting to ‘exit-scam’, it would be very lucrative… and very illegal.

Update: By 1pm GMT on 17th October YoBit announced the pump of Chat/BTC, which rose over 5000% before rapidly tumbling. Binance responded to YoBit’s actions by delisting Chat from their exchange.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire