Over the course of the last three months, the DAI stablecoin has seen momentary fluctuations from its $1 price tag, but it has mostly held against its stable peg.

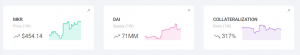

The Ethereum backed stablecoin currently has a market cap of over $70 million. It also has around 6% of its total issued tokens, trading each day on exchanges.

How DAI works

The way the MakerDAO system works is that users pool Ether together (referred to as PETH, or pooled ETH), and after this pooling, the issued DAI tokens are collateralised against this asset-locked reserve.

If required to do so, the contract can auto-liquidate PETH reserves to stabilise the DAI token at $1. This auto-liquidation is governed through ownership of MKR tokens.

Today $71 million worth of DAI is backed by €226 million of pooled ETH and $335 million worth of MKR governance (to manage CDP rates and liquidation mechanisms).

In December, Coin Rivet brought you the story that 1.5% of Ethereum was locked into the smart contract behind the DAI project.

The last three months of ETH volatility

Aleks Larsen has been looking at DAI price vs outstanding supply. Looking at the data over the last three months, he went on to discuss an interesting sequence of events.

Looking at Dai price vs outstanding supply tells an interesting story:

1. ETH price drops from above $200 to ~$85 from mid-November to mid-December

2. This causes CDP liquidations, with Dai losing ~27% of supply by early-Dec pic.twitter.com/iTOcJsmTYp

— Aleks Larsen (@_alekslarsen) January 16, 2019

It started with ETH price dropping from above $200 down to $85 from mid-November to mid-December 2018. This significant depreciation in the price of ETH caused CDP (collateralised debt position) liquidations, with DAI losing around 27% of supply.

He went on to state: “Over the next several weeks, DAI demand outweighs supply and price is roughly 2-4% (above its target on average).”

On December 21st, MKR token holders voted to change the stability fee (the interest charged to CDPs) “from 2.5% to 0.5%, making it 5x cheaper to create CDPs.”

The outcome since the stability fee change? The price of DAI has returned to its $1 peg against the US dollar.

Key takeaways

Mr Larsen went on to notice a few takeaways from what he had just witnessed, most notably that DAI supply scales with demand for CDPs.

The MKR vote to change the stability fee successfully stabilised the price of DAI. In his opinion, this was a major “win for Maker’s on-chain governance process. That said, MKR voter participation needs to improve (only ~10% of circulating supply voted for the change).”

He did, however, notice that “with the stability fee at 0.5%, there is now much less wiggle room should ETH price plunge again. Rates below 0% might be helpful at some point, though this is controversial (essentially a ‘pay people to use your service’ growth hack), as someone has to pay.”

Just like central banks today

Negative rates aren’t just for central banks. Just like how the central banks today back up their state ‘peg’ with QE (free money) and negative interest yields, you could also allow DAI to trade at less than $1 (for sustained periods of volatility). This would cause the collateral asset prices to depreciate – a strategy that risks compromising DAI’s brand and future growth prospects.

Aleks Larsen’s most interesting takeaway was “the balancing act between the demand for DAI and demand for CDPs results in a user surplus, as MKR holders are restrained by market forces from charging excessive fees / seeking rent.”

He did also mention that there are still a large number of challenges for Maker (including Oracle, on-chain governance, and finding ‘good’ liquid collateral).

He concluded by stating: “This dynamic is one of the clearest illustrations of the potential for decentralized financial protocols to eliminate rent-seeking and create user surplus.”

Not the only stablecoin

According to data from stablecoinstats, we can see that DAI is still behind the other major players in the stablecoin space, such as Tether, TrueUSD, USDC, and Paxos.

DAI may not be the biggest, but I think today it is by far the most transparent. Only time will tell whether this innovative smart contract and governance platform has what it takes to keep growing (whilst holding its pegs).

For more news, guides, and analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.