IBM is looking to take on global payments provider SWIFT by presenting a blockchain alternative to the latter’s decades’ old system at Sibos 2018, which takes place in Australia next month. However, SWIFT may have an ace up its sleeve.

The new offering is called the IBM Blockchain World Wire, based on Ripple’s Stellar blockchain. IBM says its “new financial rail … can simultaneously clear and settle cross-border payments in near real-time”. It adds that Blockchain World Wire can be integrated with banking institutions’ existing payment systems, replacing “costly opacity with affordable transparency” and creating financial opportunities.

“The world has been using the same network to process financial transactions for 50 years. And even though globalisation has changed the world, payment fees and other financial barriers remain the same,” says IBM on its website. It adds that “now, there’s a new way to move money”.

“Using blockchain technology and the Stellar protocol, Blockchain World Wire makes it possible for financial institutions to clear and settle cross-border payments in seconds.”

“Two financial institutions transacting together agree to use a stablecoin, central bank digital currency or other digital assets as the bridge asset between any two fiat currencies. The digital asset facilitates the trade and supplies important settlement instructions,” IBM says.

It goes on to explain that institutions will still use their existing payment systems, “seamlessly connected to World Wire’s APIs, to convert the first fiat currency into the digital asset. World Wire then simultaneously converts the digital asset into the second fiat currency, completing the transaction. All transaction details are recorded onto an immutable blockchain for clearing”.

According to IBM, its new offering has the potential to revolutionise the payments industry with faster payment processing, simultaneous clearing and settlement, reduced time to dispute resolution and reconciliation, eliminating multiple parties processing transactions and lower costs among other improvements.

By 2020, the payments industry is expected to grow to $2 trillion a year with an annual average growth of 7%.

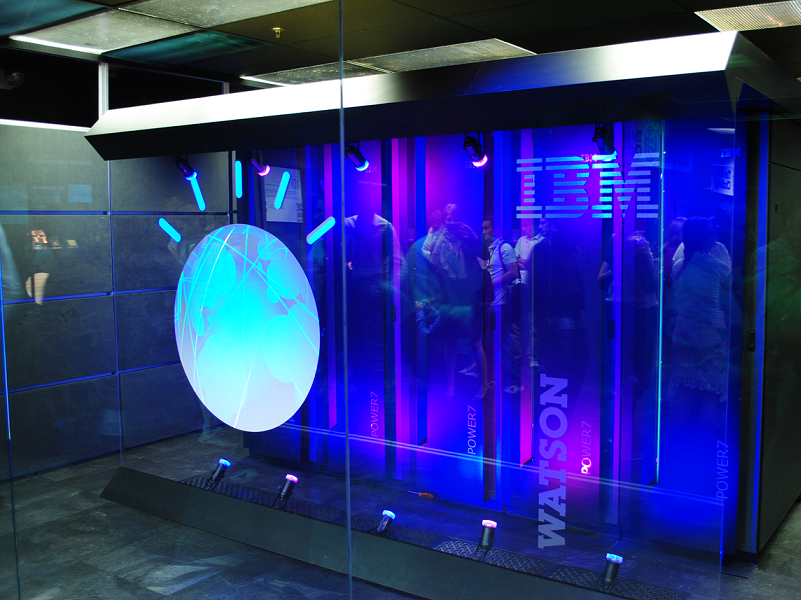

IBM claims to have “built and deployed more than 400 blockchain solutions already changing the way business is done. Also, it runs over 60% of the world’s transactional systems. 97% of the world’s largest banks are IBM clients, and 90% of global credit card transactions are processed on IBM mainframes”.

In July, IBM announced a partnership with FinTech startup Stronghold to launch a new cryptocurrency pegged to the US dollar in a bid to add stability to a sector known for its volatility. IBM’s stablecoin dubbed Stronghold USD was launched on the Stellar blockchain platform. Buyers of the digital asset will deposit dollars with tech firm’s partner bank Prime Trust for Stronghold to issue the tokens based on a 1:1 ratio.

Also recently, SWIFT announced its new payment system called SWIFT gpi (global payments innovation), which has already been adopted by 174 banks. The organisation currently services 10,000 banking institutions.

It claims its new system enables banks to send and receive funds quickly and securely to anyone, anywhere in the world with full transparency. “SWIFT gpi dramatically improves cross-border payments across the correspondent banking network.”

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire