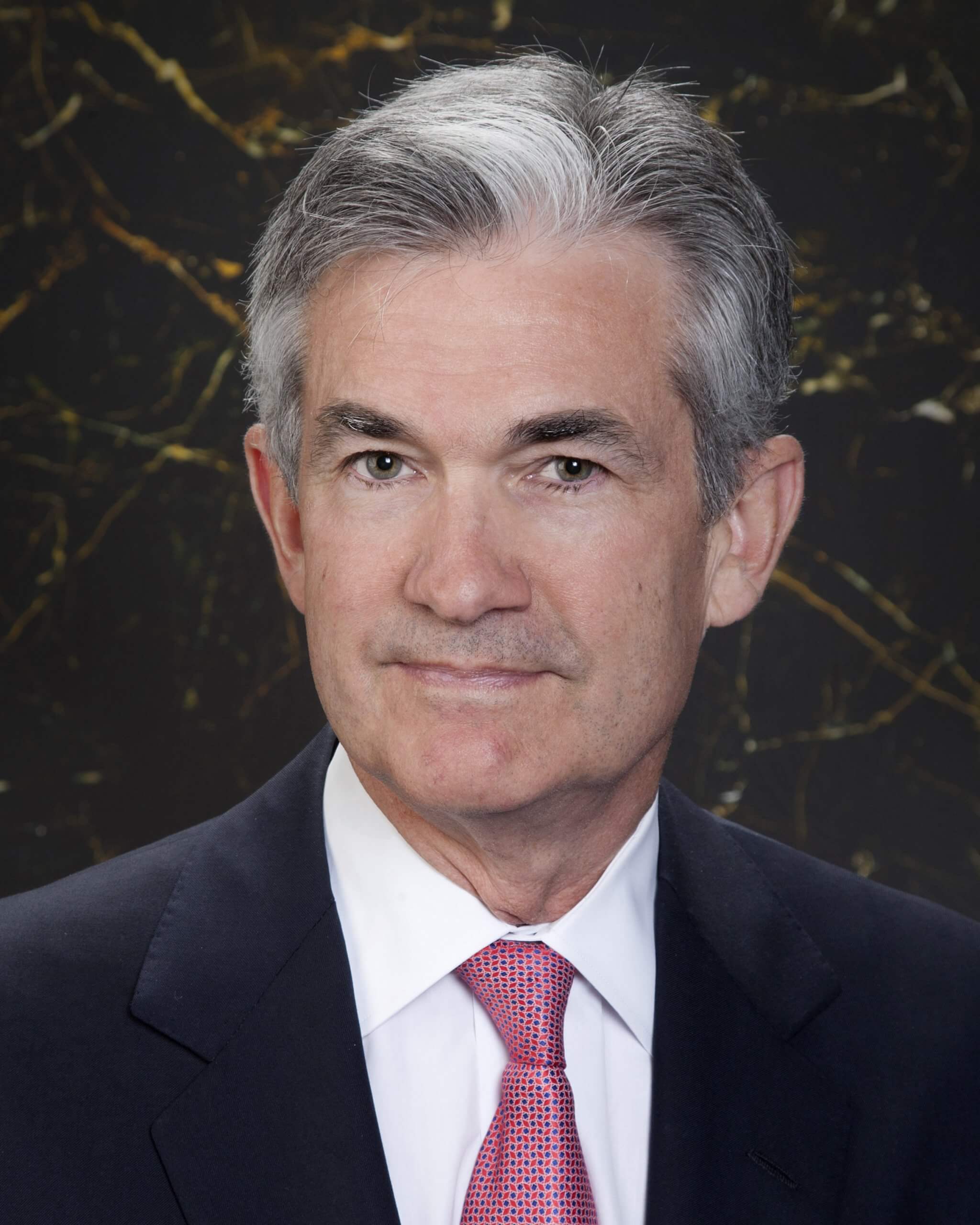

Official portrait of Governor Jerome H. Powell. Mr. Powell took office on May 25, 2012, to fill an unexpired term ending January 31, 2014. For more information, visit http://www.federalreserve.gov/aboutthefed/bios/board/powell.htm

US President Joe Biden has declared Jerome Powell will serve his second four-year term as Federal Reserve chair while Governor Lael Brainard, who was among the candidates for the prestigious spot, is promoted to vice chair.

Washington is facing one of the fastest inflation rises in decades, and the lingering effects of Covid-19 are only making the economic situation worse.

Biden stressed it was impossible to go back to how things were before the pandemic and added that the US has to build its economy back better.

“I’m confident that Chair Powell and Dr Brainard’s focus on keeping inflation low, prices stable, and delivering full employment will make our economy stronger than ever before,” the president said.

United States stock indexes started the session higher after the announcement while major cryptocurrencies recorded a slight fall.

Speaking recently about cryptocurrency, Powell said stablecoins needed greater regulatory oversight.

“They’re (stablecoins) to some extent outside the regulatory perimeter, and it’s appropriate that they be regulated. Same activity, same regulation,” he said.

However, some analysts claim both Powell and Brainard are seen as monetary policy doves – meaning they would likely be more tolerant of inflation.

That might be a positive for Bitcoin, given the cryptocurrency’s use by many investors as a hedge against rising prices.

Ian Katz, managing director of Capital Alpha Partners said both, Powell and Brainard, were mainstream Fed institutionalists who would want a strong role for regulators in overseeing crypto and making sure it doesn’t cause a risk to financial stability.

This move, announced by the White House, rewards Powell for helping rescue the American economy from the pandemic and tasks him with protecting that recovery from a surge in consumer prices.

A Republican, Powell now awaits probable confirmation in the Senate, where he was backed for his first term as chair in an 84-13 vote.

Kathy Jones, chief fixed-income strategist at Charles Schwab & Co commented “the market is looking at the likelihood that the Fed will increase the rate of tapering and move up the timing of the first-rate hike now that Powell is re-nominated”.

The nomination will be announced together with additional picks for open seats on the Board of Governors beginning in early December, the White House said.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire