Bitcoin’s weekly candle closed at just above $8,400 last night as bearish sentiment creeps back into the cryptocurrency market.

It marked Bitcoin’s worst weekly performance since the end of September with a 6% decline over the course of seven days.

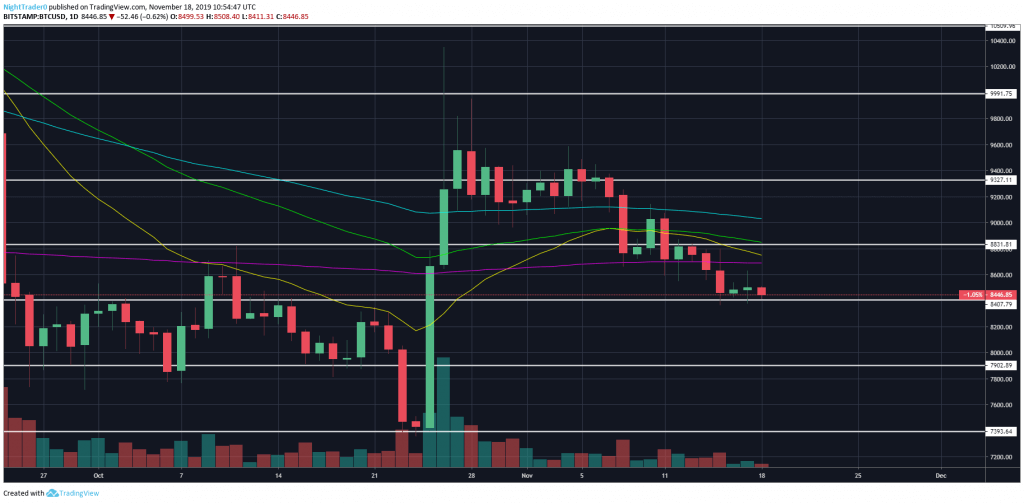

With price now trading below the 200 exponential moving average (EMA) on the daily chart, it is expected that Bitcoin will slump back towards the $7,900 level of support that held during October.

However, another fall in price of that magnitude will see Bitcoin enter death cross territory, with the 50 EMA sloping down rapidly towards the 200 EMA.

An exponential moving average death cross has only happened twice since 2014, with Bitcoin proceeding to fall by more than 60% on both occasions.

Daily trade volume has also significantly dropped off over the past week, averaging around $17 billion. This is in stark contrast to last month’s high of $48 billion.

The lack of volume at this price point suggests that Bitcoin may need to go lower in order to lull in disinterested traders.

From a bullish perspective, if Bitcoin can defy the the current sentiment and rally to the upside, it would need to close a daily candle above the 200 EMA at $8,700.

If this can be achieved, Bitcoin will most likely rise to the $9,300 region as it looks to take aim at the psychological $10,000 level of resistance.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.