Market analysts have been calling for Bitcoin to finally succumb to selling pressure over the past few weeks, with price target predictions being called at $8,450 and $7,650.

However, the world’s largest cryptocurrency has defied the naysayers by surging 9% overnight.

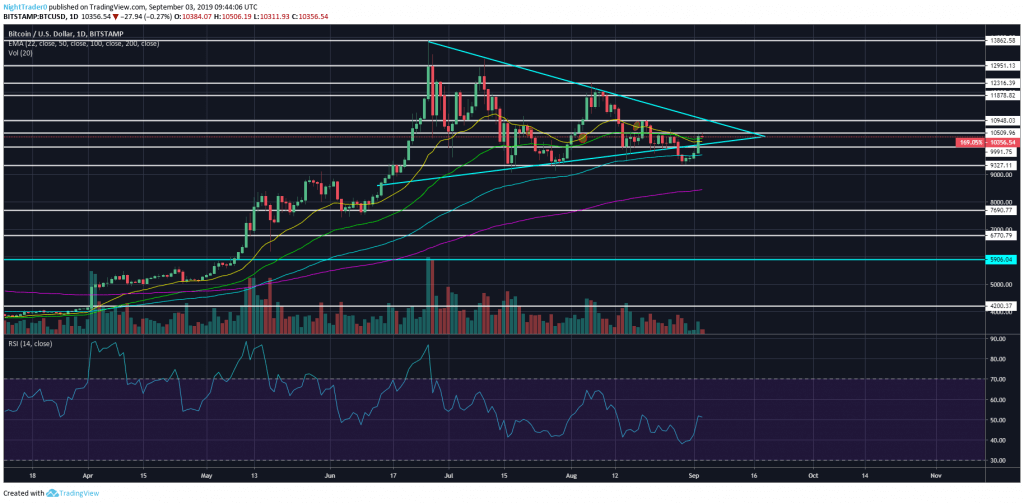

Bitcoin catapulted off the 100 EMA on the daily chart at $9,750 all the way to $10,500, leaving it firmly back in the bullish control zone.

While the overnight rally was certainly a bullish move by Bitcoin, it still needs to take out the dreaded $11,000 level of resistance, which is currently in confluence with the diagonal resistance dating back to the $14,000 high on June 26.

A break above $11,000 would also signal the first higher high since the consolidation pattern began in June.

Currently, there have been four consecutive lower highs at $14,000, $13,250, $12,375, and $11,000, which is typically a bearish signal – as seen in the 2018 bear market.

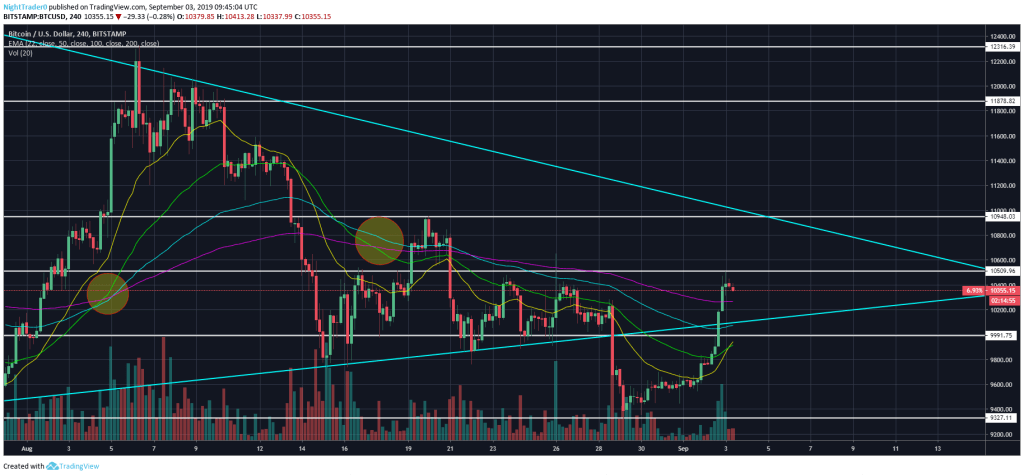

From a short-term perspective, the $10,500 level is the first stumbling block as it has been a level of resistance dating back to mid-August.

The daily relative strength index (RSI) is currently at an indecisive point of 51. It stuttered at this point on August 19, with price proceeding to fall from $11,000 to $9,780 in a matter of days.

If price gets rejected again at $10,500, it would signify a fourth lower high that would almost certainly drive a bearish move to the downside.

If $9,350 breaks, targets remain at the 200 EMA on the daily chart at $8,450 and a historical level of support at $7,650.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.