Everything changed at the beginning of 2022, with the launch of LooksRare in January, 2022 and X2Y2 in February 2022. The new competitors brought different relationship dynamics with users and collections, adding new features and perks to get transaction volume.

The chart below from Footprint Analytics shows the Daily Volume of transactions in USD value for each protocol. As we can see, there was a lot of action going on in the NFT marketplaces during the year so far.

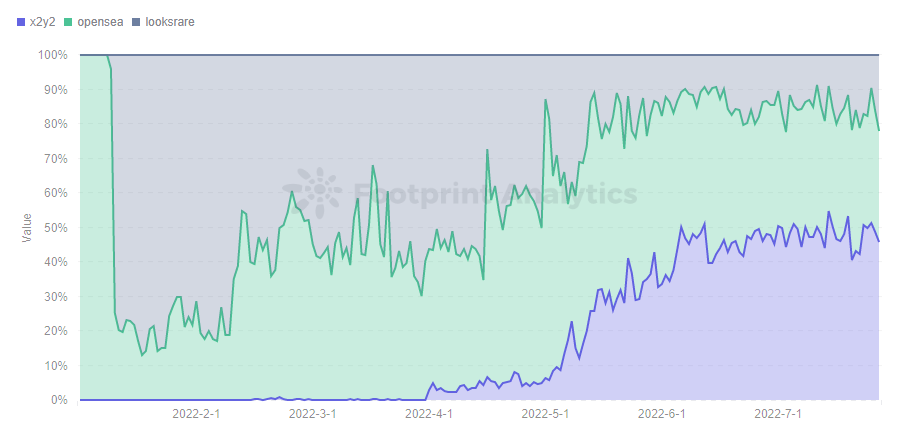

Footprint Analytics – Market Share of OpenSea & X2Y2 & LooksRare Volume

LooksRare got an increasingly large market share following its launch, but when X2Y2 debuted with better trading conditions and a different proposal for their native X2Y2 token, a slice of LooksRare market share migrated to X2Y2. Since mid-May, X2Y2 consistently has had a bigger market share of trading volume than OpenSea. X2Y2 now has over 50% of recorded trades. This begs the questions:

At launch, LooksRare and X2Y2 took the same approach to take users from OpenSea —to airdrop tokens to active users that switched from one platform to the other. This strategy is known as a “vampire attack” and aims to provide a financial benefit with the native token issued by the platform.

But these two new platforms weren’t a simple “copy and pasta” from OpenSea. The table below shows what new features they introduced besides the native token offering.

Source: Official Website

New functionalities such as bulk buying (shopping cart) and lower fees collected by the platform are helping LooksRare and X2Y2 differentiate themselves in the market. The rewards also provide an extra revenue source for the token holders, as these tokens also are entitled to a piece of the revenue generated by the platform.

When taking a look at the number of users over time, the new platforms were able to get some traction at launch, but the dominance remained with OpenSea, as seen on the Daily Active Users chart below. Its daily count is 8x higher than the second one, X2Y2.

Footprint Analytics – OpenSea & Looksrare & X2Y2 Daily Active User

As the number of transactions usually reflects the number of users, Opensea also

remains dominant on this metric. The Footprint Analytics chart below shows us similar numbers, with OpenSea averaging an 8x transaction volume than the second place.

Footprint Analytics – Number of OpenSea & Looksrare & X2Y2 Transactions

It is clear that OpenSea has the most significant number of transactions and users, with X2Y2 in a distant second place. However, when we take a closer look at the average value of each transaction, the picture changes: LooksRare and X2Y2 have a higher average price.

Footprint Analytics – Average Daily Trading Volume of OpenSea & Looksrare & X2Y2

OpenSea has more trades, but the larger ones went to the competition. The average trade size on OpenSea since May has been 260USD. The combination of high-value transactions and a growing user base enabled X2Y2 to become the number one marketplace USD volume-wise, as seen on the chart at the beginning of this article.

The charts below, provided on the Footprint Analytics dashboard, looks at some of the “Blue Chip” collections that consistently have the most prominent trading volume. From these, we can verify how transaction distribution happens between OpenSea, Looks Rare, X2Y2, and other marketplaces.

Meebits transaction distribution, last 30 days – source: Footprint Analytics

BAYC transaction distribution, last 30 days – source: Footprint Analytics

MAYC transaction distribution, last 30 days – source: Footprint Analytics

Otherdeed transaction distribution, last 30 days – source: Footprint Analytics

Building from the information gathered in the previous sections, we have the confirmation that some of the main NFT collections are being traded at X2Y2, when possible.There are several explanations:

There is a high chance that these conditions will drive a higher adoption by retail traders (that trade items of a lower value), thus making the X2Y2 native token a good investment opportunity to get exposure to the NFT market without buying a specific collection.

Footprint Analytics – Volume of BAYC/MAYC/Meebits/Otherdeed in Different Marketplace(Last 30 Days)

After combining the information presented in the charts, a clear picture is presented: X2Y2 is the leading market for the blue chips NFT collections, which brings a consistent high USD volume transactions. Smart NFT traders have already figured out that a smaller fee saves a lot of money. Therefore, the market with the lower cost (X2Y2) is preferred when possible.

As X2Y2 shares the revenue from the trading fees with the X2Y2 token holders, a sound investment strategy is to buy their native token to gain exposure to the NFT market.

Data Source: OpenSea & Looksrare & X2Y2 Overview

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire