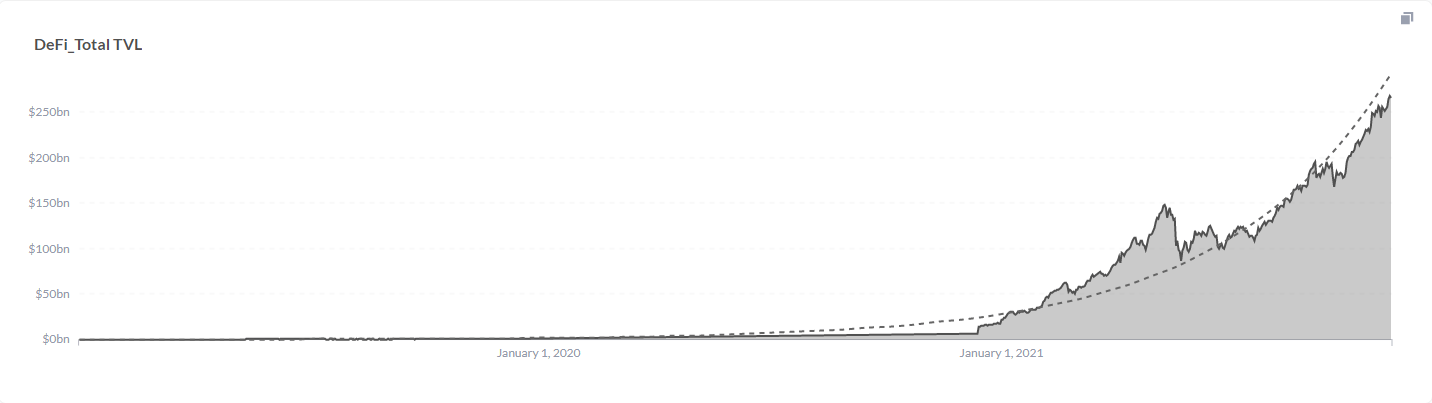

It’s hard to believe that decentralised finance – now central to the world of blockchain – only emerged two years ago.

At the beginning of 2019, the TVL of lending platforms (mainly MakerDAO) was $270 million. This momentum continued in 2020 as well, to the point where Compound launched its governance token, COMP which kicked off the craze and initiated the first call for liquidity mining.

By November 2021, the TVL of DeFi jumped 990x, reaching $269 billion. Some of the most significant projects that emerged are:

- Curve

- Aave

- Compound

- MakerDAO

- Sushiswap

- Yearn Finance

As new projects launched and these early players developed, many investors have begun using the term DeFi 2.0.

Footprint Analytics: DeFi TVL(since January 2019)

Whereas DeFi 1.0 gave people liquidity mining, token exchanges, lending, and AMMs, DeFi 2.0 promises to improve the user experience, introduce new finance technologies, and improve capital utilisation.

Among the most important projects likely to headline the next generation of DeFi are:

- Olympus

- Abracadabra

- Convex Finance

What do they do? What problems will DeFi 2.0 solve? Are these projects sound investments?

What is DeFi 2.0

First, let’s summarise DeFi 1.0.

DeFi 1.0 is the early decentralized financial infrastructure that constitutes the current DeFi ecosystem. It includes:

- Decentralised central trading applications and DEXs (Uniswap, SushiSwap)

- Lending applications (Aave, Compound)

- Stablecoin applications (MakerDao)

- Liquidity machine gun pool applications (Yearn)

- Synthetic assets (Synthetix, UMA)

- Insurance-type projects (Cover, Nexus Mutual)

DeFi 2.0 refers to a layer of applications built upon the first generation of the protocol. The core of DeFi 2.0 is to add liquidity into the infrastructure layer, making the development of the industry more sustainable .

What problems will DeFi 2.0 solve?

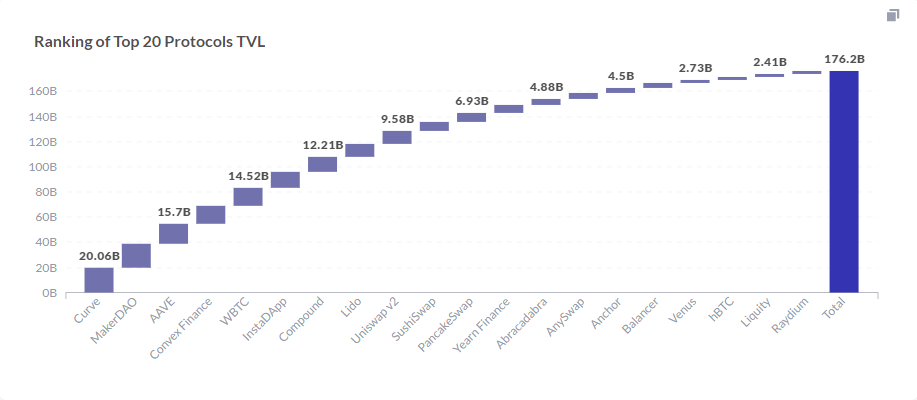

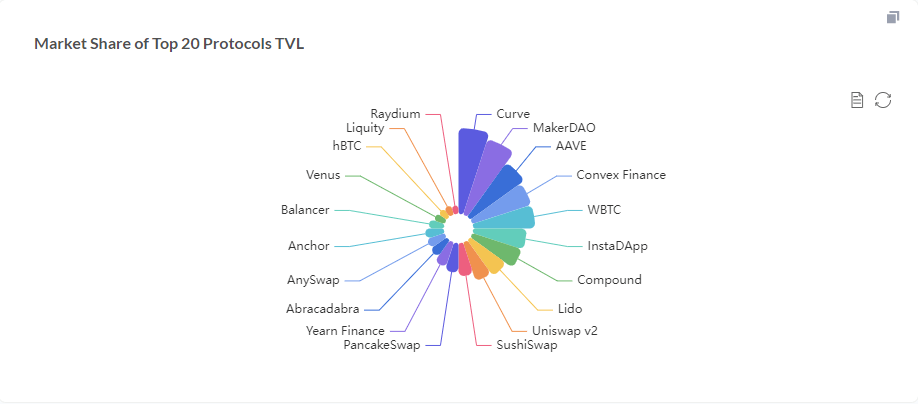

Many DeFi 1.0 projects demonstrated the powerful disruptive ability of decentralized finance. Curve, which occupies nearly one-third of the total TVL market share of DEXs, provides exchange services focused on stablecoins using an upgraded AMM formula. MakerDAO, one of the largest decentralised applications (dApp) on the Ethereum blockchain, is the platform to generate the first decentralised stablecoin DAI.

Footprint Analytics: Ranking of Top 20 Protocols TVL

Footprint Analytics: Market Share of Top 20 Protocols TVL

The innovation of DeFi 1.0 was to create pools whose liquidity were provided by users, specially pools in new projects. As time went on and more people started taking money out of the pool to finance their own crypto projects, problems emerged.

- More tokens are released as LP rewards leading to an increasing supply and selling pressure

- LP tokens without an attractive staking or burning mechanism might be relentlessly sold to the market, affecting the token price

- Lending requires over-collateralized assets and suffers from capital inefficiencies

These are just some of the problems that DeFi 2.0 projects aim to solve. Three representative projects are used below to explain their breakthroughs.

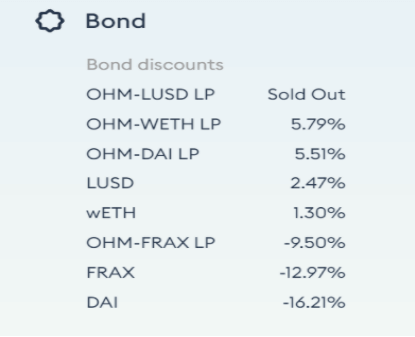

Olympus DAO is an algorithmic cryptocurrency protocol that aims to become a stable cryptocurrency. It is the first project to use a bond mechanism to create an alternative to the liquidity mining model.

By issuing its native token, OHM, at a discount, Olympus is able to purchase LP positions from the market to create protocol-owned liquidity.

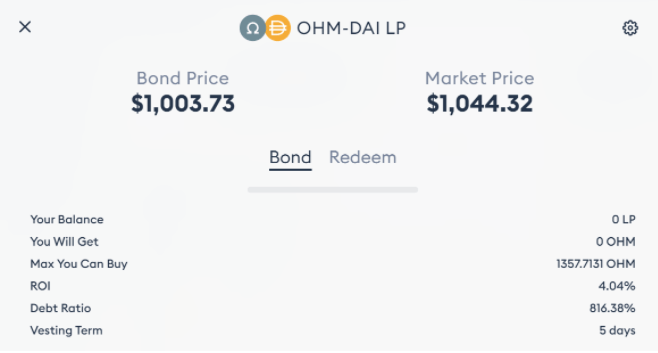

Olympus DAO: Bond discount status (from November 3 2021)

Each OHM is backed by 1 DAI, and the higher the OHM price, the more DAIs enter the pledge contract, resulting in more returns obtained from participating in the OHM pledge. This mechanism keeps the price of OHM staying above one DAI, and pushes its market cap to continuously approach the total value of overall assets of Olympus Treasury.

For example, users can create LP tokens, such as OHM-DAI LP, to issue ‘bonds’ and purchase OHM at a discounted price for a certain period. Thus, when a user buys OHM at a discounted price, the LP tokens made by the user will be exchanged with the agreement. Unlike existing methods where liquidity providers can stop providing liquidity at any time and the protocol receives it, Olympus’ pledge and bond structure can maintain liquidity by tying LP tokens to the protocol in the form of bonds.

Olympus DAO: LP Token Status (as of November 3, 2021)

In addition, it is the protocol itself, not the user, that owns the LP tokens, thereby generating transaction fees from the liquidity pool while preventing immediate selling pressure from the liquidity provider. Olympus DAO changes its relationship with the liquidity provider, turning the traditional DeFi liquidity model on its head.

- Abracadabra: Adding value to assets and improving capital utilization

Abracadabra is a lending platform with a protocol incentive token – SPELL – which has a similar model to MakerDAO in that it over collateralised assets to generate stablecoins. Unlike MakerDAO, the assets pledged by Abracadabra are assets with proceeds, and users can use interest-bearing tokens, such as yvUSDT and xSUSHI, to borrow or mint a dollar-pegged stablecoin called MIM (Magic Internet Money) on Abracadabra, thereby freeing up such assets liquidity and increase user revenue.

Its lending advantages…

- Convert already interest-bearing asset certificates into liquidity to increase capital leverage and earn more income

- Low borrowing costs and stable interest rates

- Stablecoin MIM has good liquidity on the multi-chain Curve

- Only independent liquidation risk, no linkage with other collateral

Looking at Abracadabra as a whole, in addition to improving the utilisation of funds, it also reduces the likelihood of liquidation. This is because these collateral assets increase in value. This is a category of innovation based on user needs.

- Convex Finance: Improving the user experience

Convex, which officially launched on May 17 of this year, surpassed Yearn as the platform with the highest percentage of CRVs locked on June 3 2021.

Convex aims to improve on Curve in terms of user experience by launching a one-stop platform for CRV pledging and liquidity mining. It thereby leverages CVX tokens through an easy-to-use interface to develop the CRV ecosystem by simplifying the process of Curve and CRV locking and pledging, and increasing the compensation for CRV holders and liquidity providers.

DeFi 2.0 by the numbers

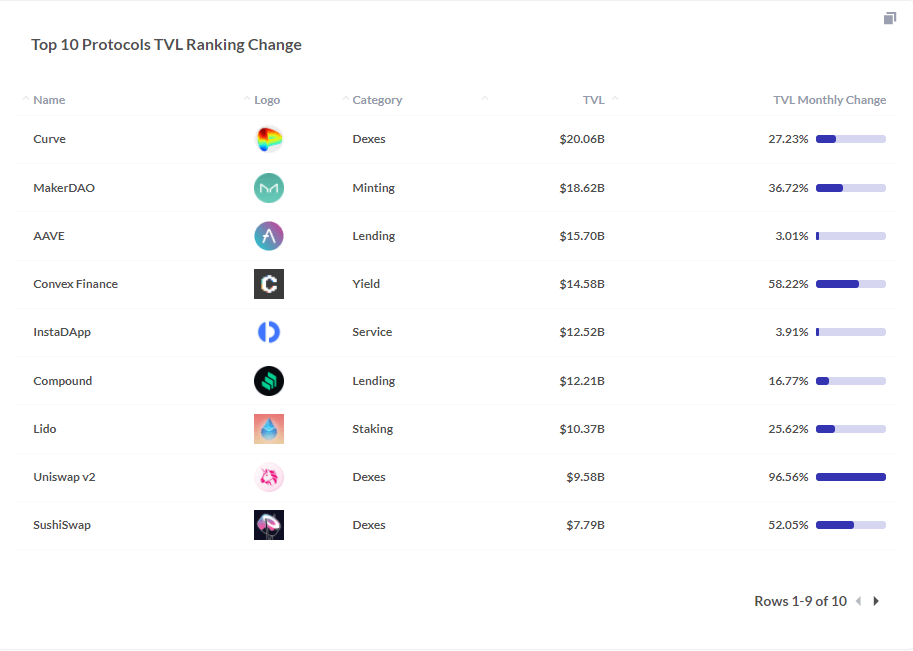

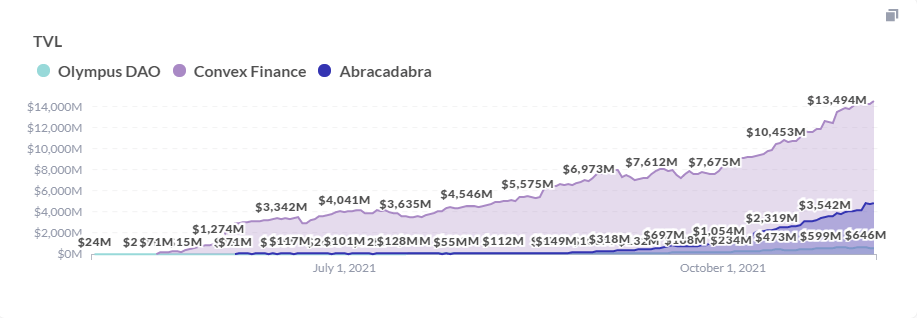

Olympus DAO, Abracadabra and Convex Finance have rapidly growing TVLs, one of the most important indicators of the scale of DeFi ecosystem’s development.

Footprint Analytics: Top 10 Protocols TVL Ranking Change

Footprint Analytics: DeFi 2.0 Platform TVL Trends

According to Footprint data, Convex Finance’s TVL ($14.55 billion) has overtaken Yearn Finance ($6.05 billion), making it the top yield farming project. It has grown so fast because it provides a better user experience compared to Curve, simplifies Curve and CRV locking and pledging, and improves returns for both coin holders and liquidity providers.

Abracadabra and Olympus DAO have also seen rapid TVL growth over the past 30 days, with current TVLs of $4.2 and $650 million, respectively, and greater TVL change growth for Abracadabra (205.2%) and Olympus (178.9%) when compared to Convex Finance’s past 30-day growth rates.

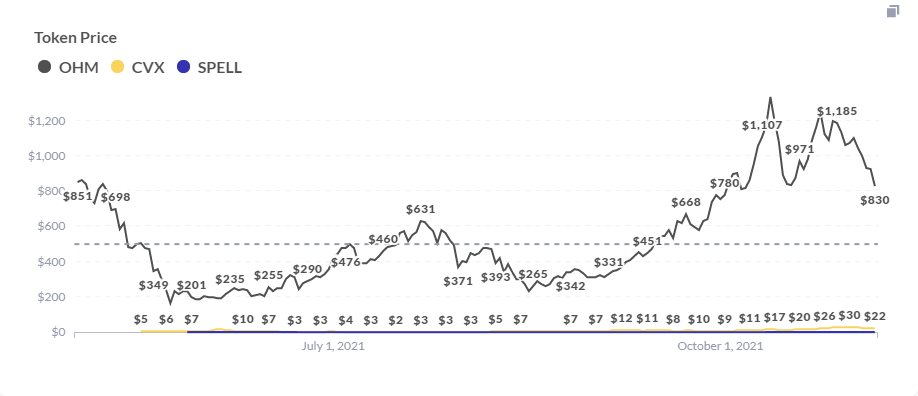

Footprint Analytics: Token Price Trends for DeFi 2.0 Platform

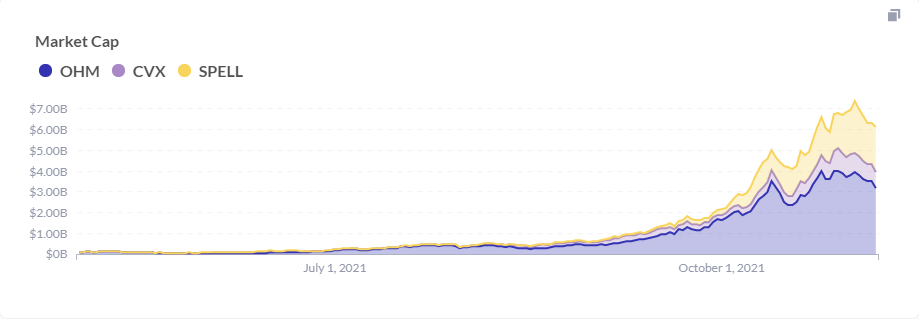

Footprint Analytics: DeFi 2.0 Platform Market Cap Trends

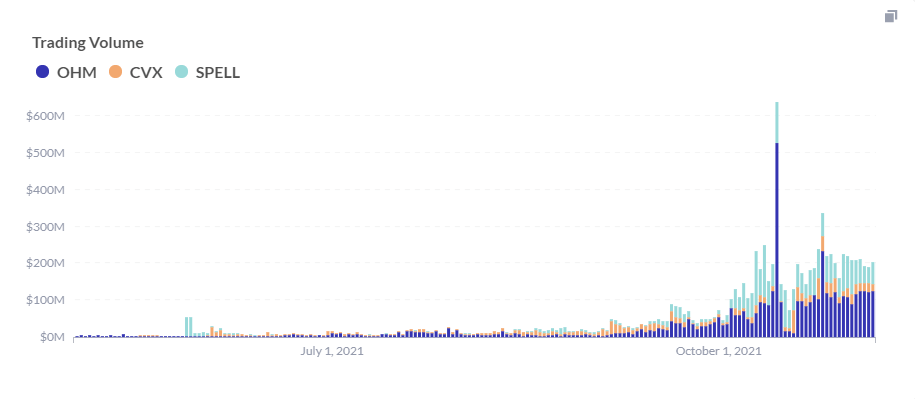

Footprint Analytics: Token Trading Volume Trends on DeFi 2.0 Platform

The market cap and trading volume of all three projects have also grown significantly in the last two months.

Opportunities & challenges

While DeFi has grown rapidly in the last two years, it’s obvious to anybody who uses the platforms and DEXs that there is a lot to improve on.

Clearly, the industry is very much in an embryonic state and primed for new projects that take on the shortcomings of the first—from: improving the efficiency of funds operations, and preventing immediate selling pressure from liquidity providers.

However, three projects listed above are by no means a sure thing. For example, the Abracadabra protocol will be affected by the loophole happening on the protocol of its collateralised asset. Regarding liquidation, the project’s mechanism relies heavily on the stability of MIM, relying on the Curve pool to have enough liquidity to support transactions. For Olympus, its token OHM first surged and then cut back before recovering to a price comparable to that of DAI, indicating high volatility.

For more data developments and content from the DeFi ecosystem, click on the Footprint link for more project dashboards and analysis.

The above content is only a personal view, for reference and information only, and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualise blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website:https://www.footprint.network/

Discord:https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.