Less than one week after the historic Uniswap token (UNI) airdrop, the price of the aforementioned token has started to dwindle.

Despite being listed on Coinbase Pro, Binance and derivatives exchanges like FTX, UNI has succumbed to sell pressure after reaching a quite astonishing high of $8.

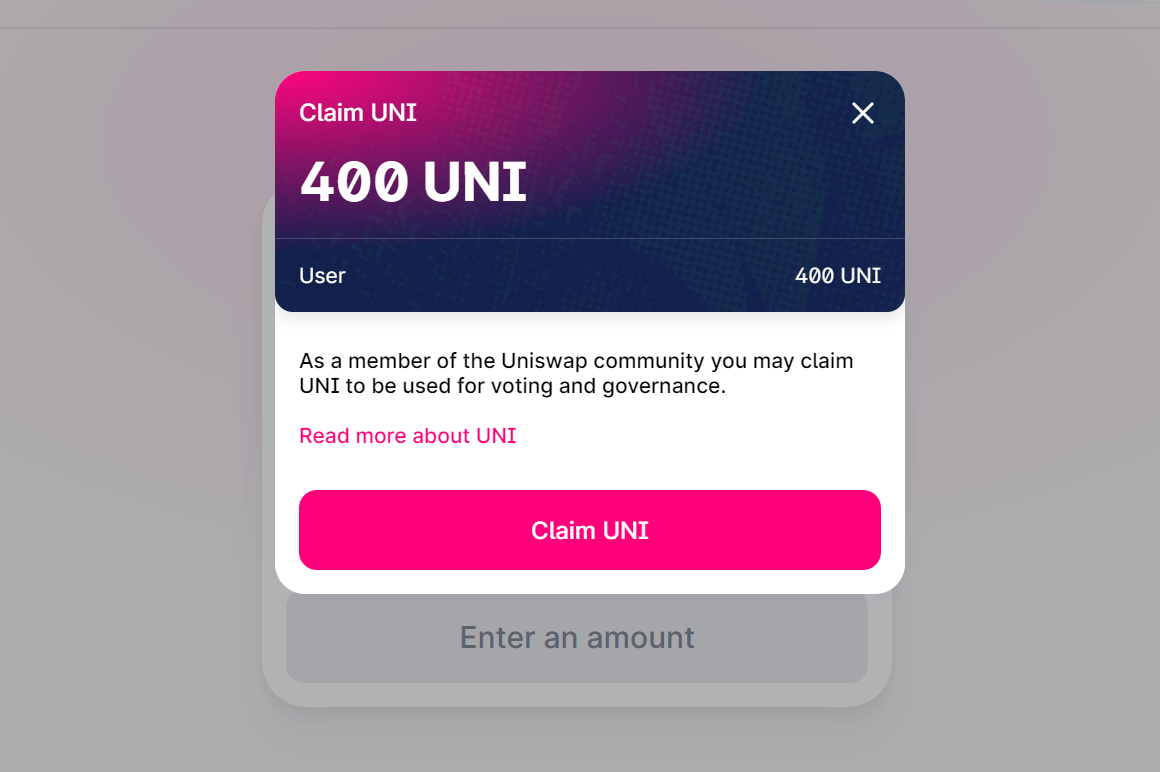

Considering the majority of Uniswap users received a 400 UNI airdrop, which was worth around $1,200 on the day of release, the fact that is is trading above $4 does demonstrate its value.

The value of UNI lies within its governance protocol that allows token holders to vote on key proposals, which may be financially beneficial for users in the future.

The proposals can be viewed at Uniswap’s Governance Portal, with current proposals suggesting reward schemes for holders of the token.

However, as with the majority of DeFi projects and tokens, UNI is still very much in its infancy, which means it is subject to volatile swings in price.

With Ethereum transactions on Uniswap getting more and more expensive, when the wider market tumbles as it has this week DeFi tokens face the brunt of the sell pressure as liquidity gets pulled from its trading pairs.

If Ethereum takes another leg down in price over the course of this week, the Uni token will most likely plunge back to its original price point of $1.50.

It’s worth noting that Uniswap facilitates an obscene amount of trade volume considering it is an entirely decentralised protocol, which means that if Ethereum can successfully launch its 2.0 version in November, the UNI token may benefit as a result of enhanced scalability and transaction efficiency.

For more news, guides and cryptocurrency analysis, click here.

Disclaimer: This is not financial advice. The author of this article does not hold or have a vested interest in UNI.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire