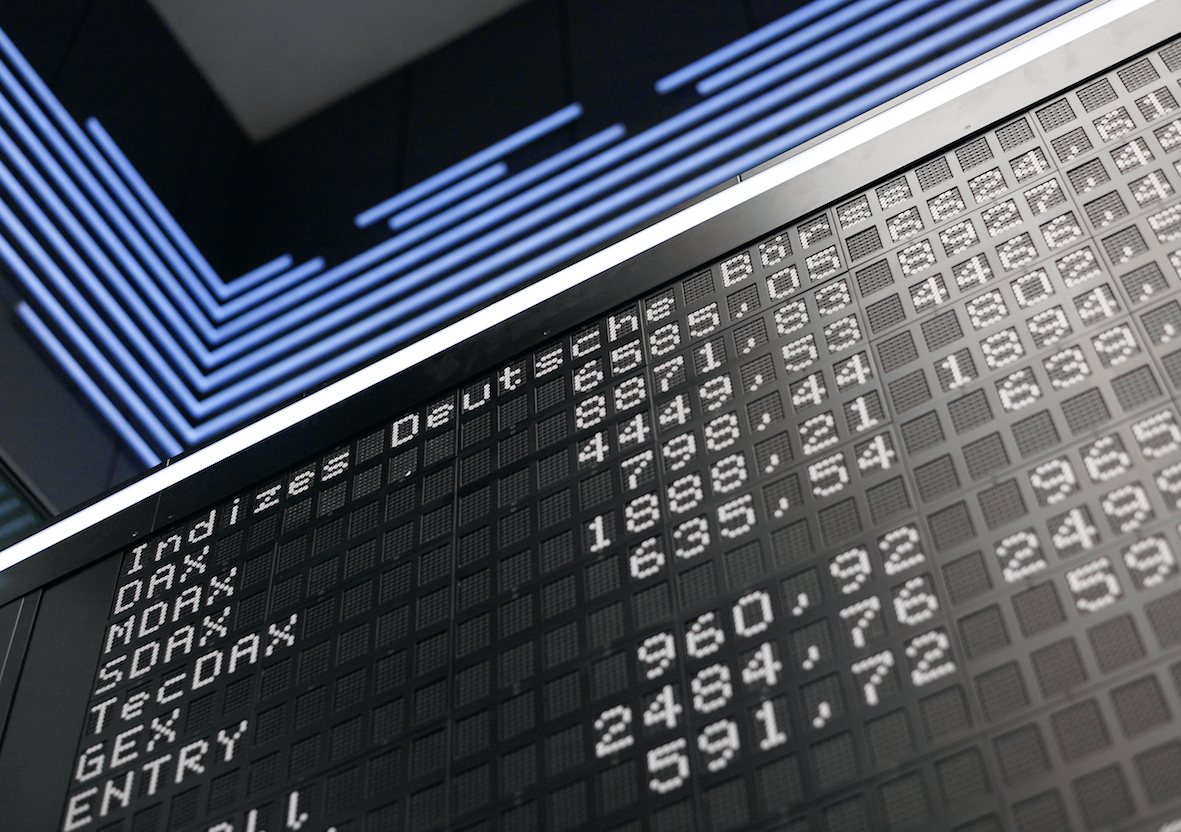

Deutsche Börse is establishing a DLT, Crypto Assets and New Market Structures unit as it looks to tap into the “transformational potential of blockchain technology”.

The German exchange has set up a 24-person team led by Jens Hachmeister. “DLT/blockchain technology is a key opportunity for the creation of new market structures, adding new products onto our present structures and enhancing our existing offerings,” he says.

He adds that its potential cuts across the group’s entire value chain – pre-IPO/listing, trading and clearing, settlement and custody, and even the data and analytics business. At the same time, however, he stresses that expectations are high and not all of them will be fulfilled; blockchain will not be the answer to all its questions.

“Yet the digital economy in general is heading for decentralisation. In future, there will be more peer-to-peer governed marketplaces and less intermediaries,” he comments. “In that regard, blockchain has the potential to disrupt the capital markets infrastructure. It is a decentralised ledger of all transactions across a peer-to-peer network, where participants can confirm transactions without the need for a central certifying authority. Many other industries have also acknowledged the significance of this technology.”

Deutsche Börse has invested in various initiatives to understand the technology and its potential within the traditional segments of its value chain. However, these steps have not been coordinated on a group-wide level. “In order to use the full potential of the technology for our businesses, to generate efficiencies and create revenues, a centrally steered approach is necessary to make a greater impact,” Hachmeister says.

“All initiatives in the field of DLT/blockchain will now be operated by one team, in a joint group-wide approach. We will, of course, work in close cooperation with the business segments and IT and in close alignment with colleagues from Group Legal and Group Regulatory Strategy.”

He concludes by stating that Deutsche Börse is witnessing the beginning of a new era that could disrupt the entire industry. “The challenge is that we don’t exactly know where this will lead to. The possibilities this new technology offers are fascinating and it is great to have the opportunity to hopefully make significant contributions and to drive this topic forward for the group. My team and I are very motivated to drive this journey for Deutsche Börse, as I am personally convinced of the great potential for our company.”

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire