TL:DR

- Chainlink (LINK) failed to break its resistance at $20

- LINK is now hovering at $17.50 support

- LINK is conforming into a tight wedge and looks ready to breakout

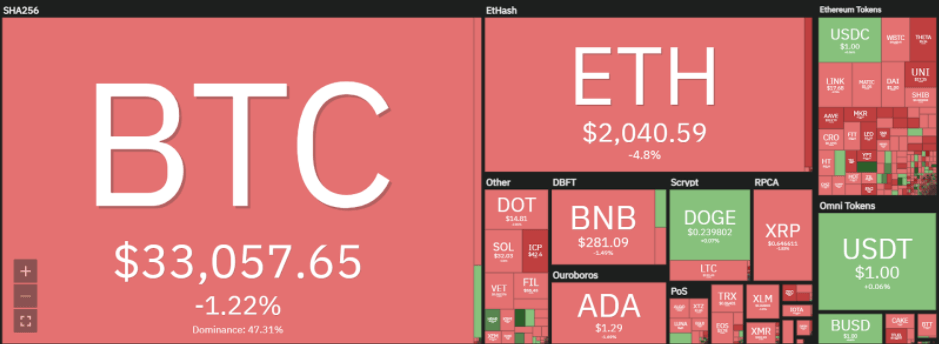

Cryptocurrency heatmap by Coin360

The markets have experienced another red day across the majority of the board. An estimated $42 billion has been lost in the total cryptocurrency market cap. Unsurprisingly Doge reacted positively to yet another tweet by Elon Musk, rapidly rising 9% within one hour.

However, it’s clear to see that Musk’s tweets are having a smaller effect on the markets as soon after, the price started recoiling again. LINK currently ranks at #15 on CoinMarketCap with a circulating market cap of $7.7 billion.

Chainlink’s price movement over the last 48 hours:

Over the last 48 hours, Link has attempted to break out of its longer term trend twice, with both attempts failing. It is now making (short term) lower lows and lower highs which invalidates the previous upwards movement from the swing low.

More importantly, price is now trending beneath the 200 period Moving Average (MA) which has historically been an indication of which way the markets will move. Price is now retesting support at $17.50, and if it holds, could mean a final retest of the upper trend line resistance.

It is also important to note that the RSI indicator is now starting to show bullish divergence which further supports the theory that this support level could prove to be stronger than investors think.

LINK/USD price chart by Tradingview

LINK/USD 4-hour chart: Violent breakout imminent

The higher time frame chart for LINK shows that price is conforming into a tight wedge, and is primed for breakout either side. However, it is important to note that the 50 period MA continues to stay below the longer 200 period moving average which signifies that the overall market sentiment is still bearish.

As the saying goes, history doesn’t repeat itself but it often rhymes. Previous tests of the longer term resistance were met with sharp rejections and this indicates that the same could happen again. Furthermore, combined with the overall bearish sentiment for BTC, the demand for LINK is quickly drying up.

Should the current support at $17.50 not hold, the next area or interest would be $16. If the opposite happens, and LINK breaks to the upside, a target of $20 can be expected to be hit.

LINK/USD price chart by Tradingview

For more news, guides and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.