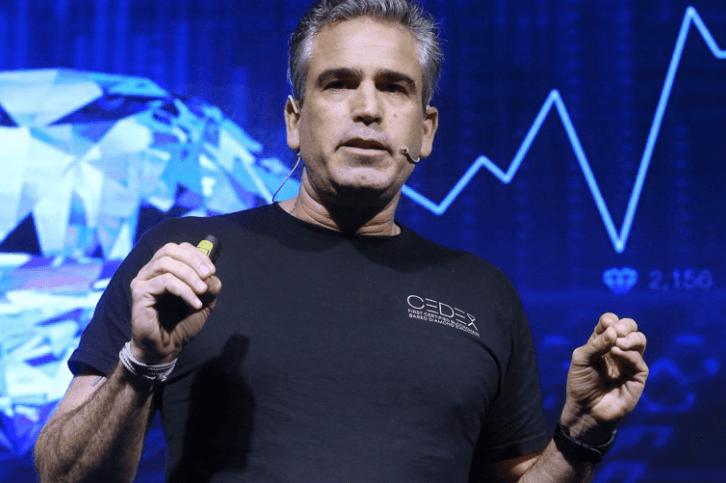

Saar Levi is the co-founder of the CODEX exchange

Saar Levi was one of the multitude of traders who was caught up in the financial market crash of 2008, some of whom were photographed clutching their belongings in a box outside Lehman Brothers in New York.

It’s fair to say the experience has not held him back.

An entrepreneur for the last 25 years, his experience in the global financial markets stretches back more than 15 years.

He’s experienced the highs – as well as the lows in the fiat markets. In addition to Lehman Brothers, he held senior roles at Barclays Capital and Intesa Sanpaolo and has worked in Exchange Traded Funds (ETF). He was the CEO of Luxemburg Art Exchange, where he first became interested in blockchain.

He speaks of the difficulties digitising a commodity such as diamonds as the CEO and co-founder of the newly-launched CEDEX blockchain-based exchange for diamonds, which only went live this week.

He points out there is “$350 billon potential when the diamond and financial markets are linked”. He says it is a “much stronger commodity – even than gold”.

The exchange allows diamonds to be traded, for the first time, like commodities from any other financial asset class.

Gold is 20% used for jewellery with the remainder for gold and derivatives on the market. With diamonds, it is mostly a consumer product with 99% used for jewellery and he says “barely 1%” for investment.

The exchange is powered by the DEX, which removes the obstacles preventing diamonds from being viable to trade in this way. All activity on the exchange is conducted using the CEDEX coin, which is ERC-20 compliant.

Fungibility is an issue when it comes to trading in diamonds, as each one is unique. Whereas one gold bar is pretty much the same as the next gold bar.

“One of the biggest barriers to overcome include standardisation,” he says. “No two diamonds are the same.”

“There’s no transparency nor liquidity in the market.”

The public currently holds more than $500 billion of diamonds without profitable liquidation channels. The market has huge potential, whereas the gold market is saturated, he argues.

The exchange aims to bring transparency and efficiency to the market by using the DEX and removing the barriers that exist to prevent success in this field.

Investors can keep track of every transaction which makes the market more attractive.

One year on from the initial announcement of the concept of his blockchain-driven platform, he’s raised $20m, his team have written the white paper and “delivered on our promises”.

The exchange went live earlier this week, which Levi described as “a very exciting and busy day”.

While the price of cryptocurrency has crashed in recent weeks, he explains it is “one of the reasons why we created CEDEX. It’s exactly the scenario as we offer a safe haven where people can take their crypto portfolio,” he explains.

“That’s exactly why we are here.”

He hopes, eventually, to join forces with the big financial institutions such as Deutsche Bank, Credit Suisse and JP Morgan as the exchange continues to grow.

“As for the bounce back with Bitcoin, what goes up also goes down and from my own experience, I know that very well.”

He says they are the only company to offer a crypto investment to a physical asset with “zero risk”.

Going forward into the next year, he envisages full financial regulation for CEDEX and says he would be “happy to have a strong financial institution and to join forces with global commodity traders”.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire