New York – 13th December 2018 – Paxos announced today that its Paxos Standard token (PAX) has been used for over $5 billion worth of transactions in its first three months since launch.

Paxos Standard has become the second most widely traded stablecoin with three times the 24-hour trading volume of its next closest competitor. The demand for a regulated stablecoin led to Pax’s listing as a base currency on Binance, the world’s largest cryptocurrency exchange, and is now available through over 50 partners including OKEx, KuCoin, Gate.io, ZB.cn, DigiFinex, BitPay, TrustWallet and more.

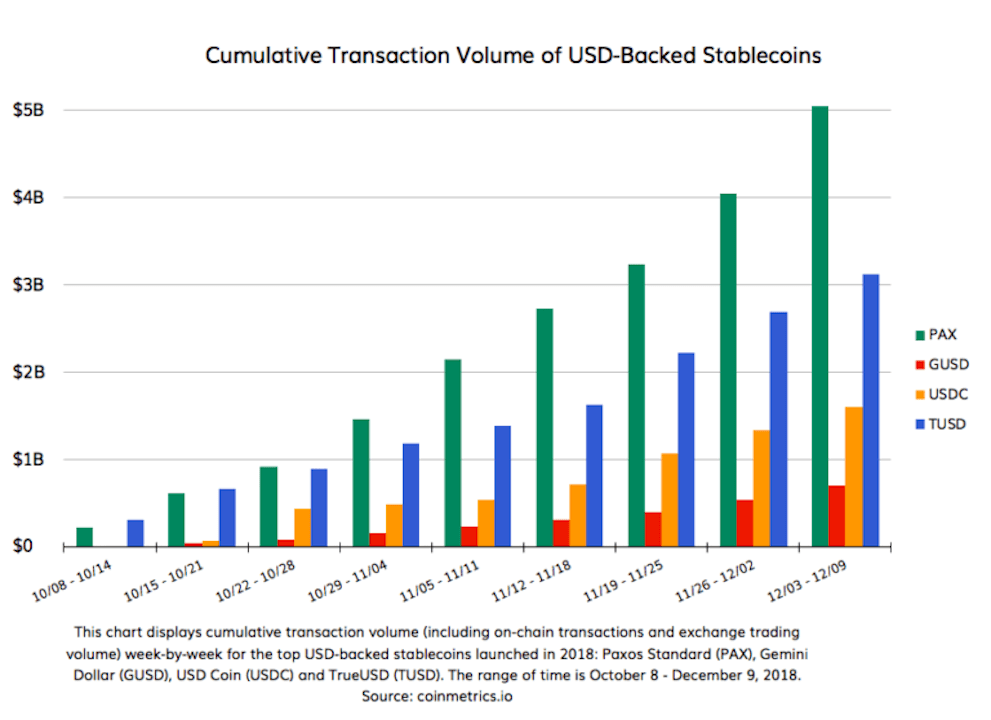

PAX to date has been used in $5,245,958,124.65 worth of transaction volume, including exchange trading volume and on-chain transaction volume. The current market cap is over $174 million, and the company has redeemed over $136 million, serving as a reliable crypto-to-fiat gateway. With over $60 million in daily exchange transaction volume, PAX is the most utilised stablecoin of all recent market entrants.

“We have seen tremendous adoption around the globe as people increasingly value and understand our unique position as a regulated stablecoin. Paxos Standard now has the liquidity of crypto assets while matching the dollar in value,” says Chad Cascarilla, CEO and Co-Founder of Paxos. “We aim to continue to offer the most reliable, transparent and redeemable stablecoin and support frictionless commerce worldwide.”

Over the course of its first three months in circulation, PAX has maintained a stable price and reliably provided redemptions to dollars and withdrawals of these dollars on a daily basis to customers. PAX has proven its ability to maintain an exact reserve for all coins in circulation through third-party attestations conducted by Withum, a top-ranking auditing firm.

Withum performs attestations to independently verify that the entire supply of Paxos Standard tokens is consistent with USD in FDIC-insured US bank reserve accounts held and managed by Paxos. Every attestation report that has been published since the launch of Paxos Standard are available online: September 28, 2018, October 31, 2018, and November 30, 2018. Launched 10th September 2018, Paxos Standard is the first token issued directly by a regulated Trust company and approved for issuance by the New York State Department Financial Services.

Stablecoins emerged as an answer to the volatility of crypto asset markets, which lost more than half of their overall market cap in the past year. According to Google Trends, web searches for stablecoin have surged 985% compared to last year with interest at its peak during this quarter’s bear market. While stablecoins are most commonly used as a liquidity tool for cryptocurrency exchanges and traders, fiat-pegged stablecoins represent an $84 trillion global monetary base that can bridge the gap between digital and physical assets.

In addition to Paxos’ steadfast adoption, the company has remained committed to its mission of creating a more transparent digital financial system with the launch of the Association for Digital Asset Markets (ADAM). Together with Genesis Global Trading, BTIG, Genesis and several other market leaders, ADAM aims to create a “code of conduct” for the cryptocurrency sector with guidelines for market integrity, risk management, KYC and AML, custody, record keeping, clearing and settlement, market manipulation, data protection, and research.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire