Community favourite Avalanche DEX Trader Joe has launched its much-anticipated lending product – ‘Banker Joe’ – in a bid to become the leading “one-stop-shop DeFi trading platform” on Avalanche.

Users can now deposit and borrow a range of assets including ETH, BTC, LINK, AVAX, USDC, USDT and DAI on Banker Joe.

And with one step forward, a new era begins. Banker Joe is here 🎩

Swap, Farm, Lend, Borrow…All under one roof.

Borrow up to 80% on Stables (Including USDT) and up to 75% on Avax, Eth, Btc 🦍

Stay tuned for:

▶ Joe Rush

▶ Roadmap

▶ +More pic.twitter.com/V6JhC3DChQ— Trader Joe (@TraderJoe_xyz) October 11, 2021

According to Trader Joe, the lending product will make it the first platform to offer a “fully-fledged, in-house DEX and Lending protocol” on the Avalanche ecosystem. The DEX also revealed future plans for leveraged trading, derivatives and limit orders.

To secure the price feeds from Banker Joe, the DEX revealed it had partnered with Chainlink to ensure that all data was accurate and lending pool positions were better managed.

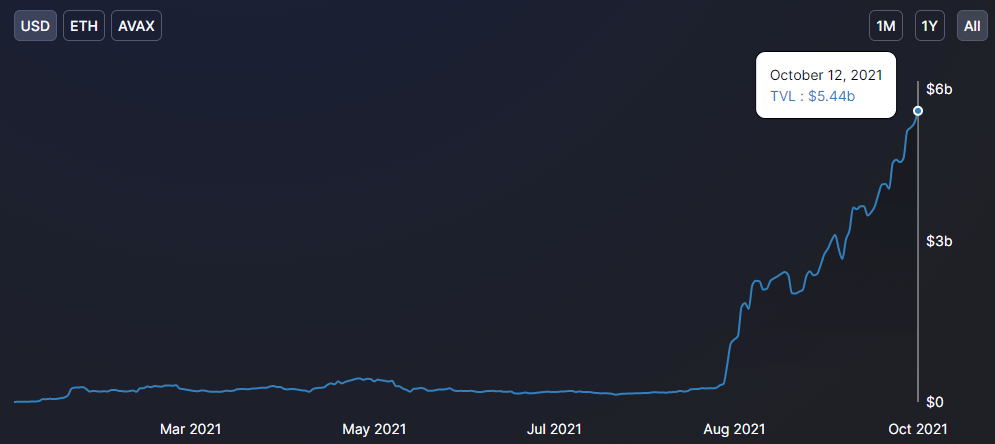

The launch of Banker Joe comes a week after Aave launched on Avalanche and kickstarted Avalanche Rush. A week after its October 4 launch, Aave now secures $1.8b in assets on Avalanche and has propelled the ‘total value locked’ (TVL) across the entire ecosystem to more than $5.4b.

The TVL on Avalanche is now over $5.4b

According to data from DeFiLlama, Trader Joe now sits second in the TVL rankings behind Aave and has overtaken fellow lending product BENQI.

Trader Joe now secures $1.1b in assets and remains the most popular DEX on Avalanche by trading volume and TVL.

The platform has become a fan-favourite on Avalanche due to its “familiar and friendly UI that users love”, incentivised DeFi products and its meme-based presence on social media communities.

Trader Joe Co-founder 0xMurloc commented on the importance of Banker Joe to the growth of the platform.

“Banker Joe is an essential step towards our vision of turning Trader Joe into a one-stop-shop DeFi trading platform,” he said.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.