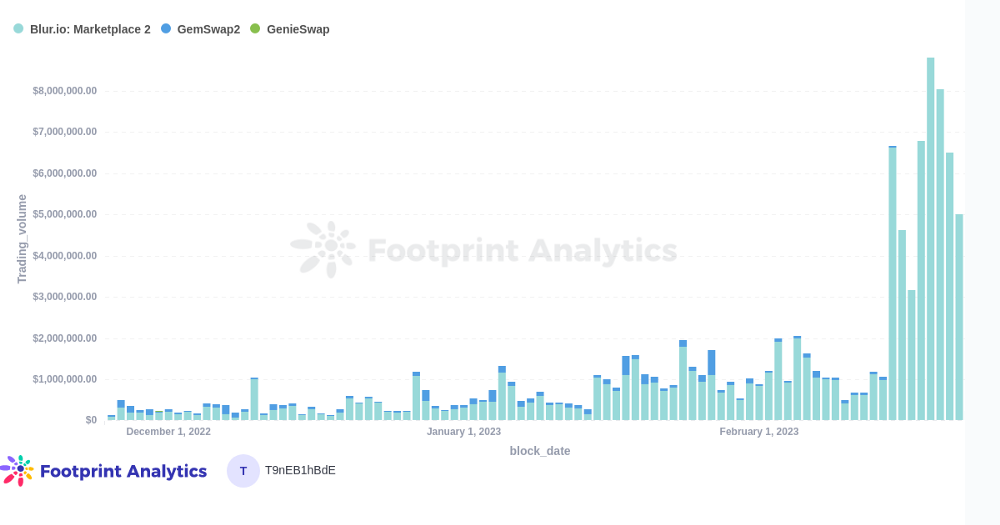

One year ago, the volume of NFT transactions going through aggregators began to snowball, even exceeding the volume going directly through marketplace platforms at times.

While aggregator usage declined from October to January, Blur.io has since exploded in popularity in 2023, even engaging in a public confrontation with OpenSea over royalties.

This month, Blur overtook OpenSea in transaction volume and had a massive airdrop event.

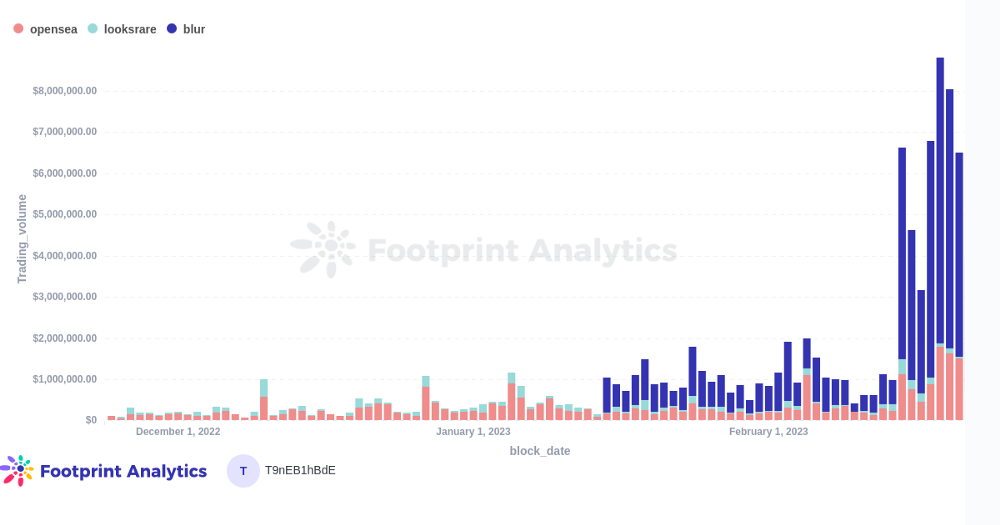

Blur Aggregator Trading Volume vs. Marketplaces

Footprint Analytics has been covering the rise of aggregators for the last year. However, what are these platforms, and what value do they bring to the market? What was the Blur Airdrop that gave out 300M in Blur tokens? How is Blur performing relative to its competitors in light of this airdrop?

What are NFT Aggregators?

NFT aggregators are platforms or websites that curate and display NFTs from various marketplaces, allowing users to browse and discover NFTs from different sources in one place. They aggregate NFTs from multiple blockchains and marketplaces, such as OpenSea, Rarible, and SuperRare, and present them in a unified and user-friendly interface.

NFT aggregators typically provide a variety of features, such as search and filter options, customizable watchlists, and price alerts, to help users find NFTs that meet their criteria. Some NFT aggregators also offer services such as portfolio tracking, NFT valuation tools, and social features that enable users to interact with other NFT collectors.

Blur Takes Majority of Market Share

Blur’s features are tailored explicitly to expert NFT traders and flippers. Blur has zero trading fees and incorporates sweeping functions—i.e. buying many NFTs at their floor price—like advanced bulk-buying.

Other trader-friendly features include trade analytics and identification of projects, and the accessible listing of projects. It also claims to be faster than marketplaces and other aggregators.

In the bear market, where there is little public interest in NFTs but continuing activity from insiders and traders, Blur’s positioning and tech allowed it to blast past more beginner-friendly platforms.

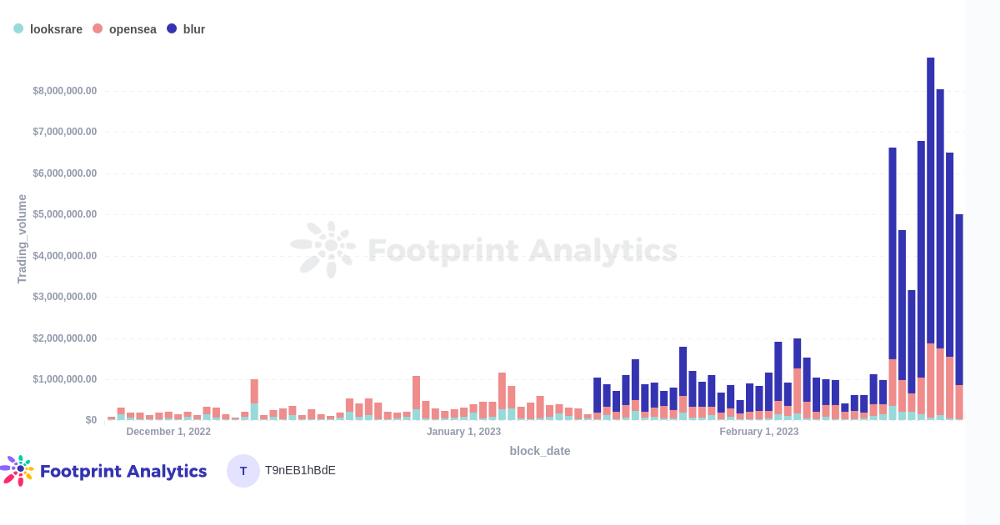

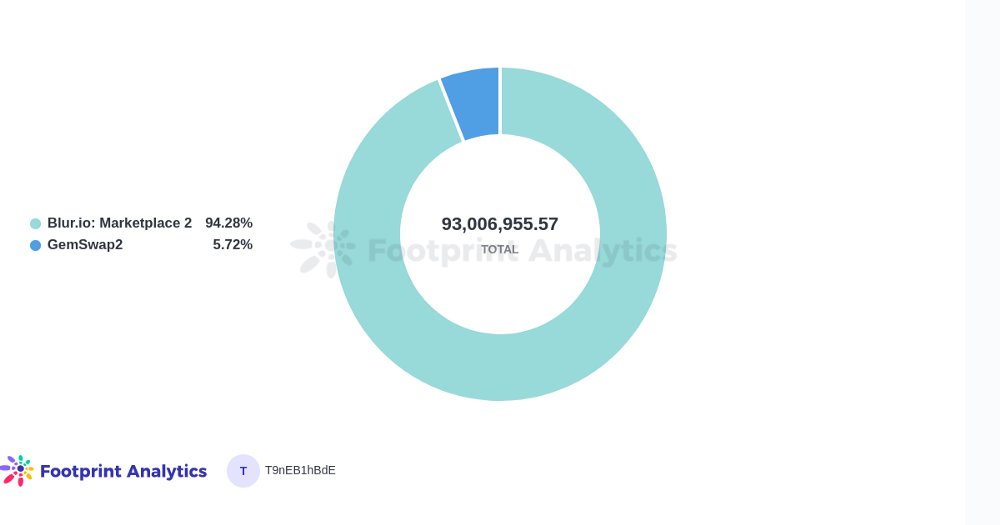

Blur Aggregator Trading Volume by Marketplace

Besides its features, its massive airdrop was a significant part of its marketing strategy.

What is the Blur Airdrop?

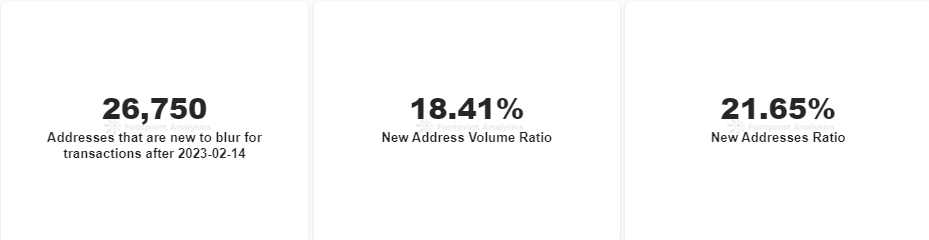

One of the factors fuelling Blur’s popularity was its long-teased airdrop, which was delivered this month. According to data from Footprint, more than 26,000 new users were brought to the Blur marketplace since Feb. 14, accounting for 22% of the total traders on the platform.

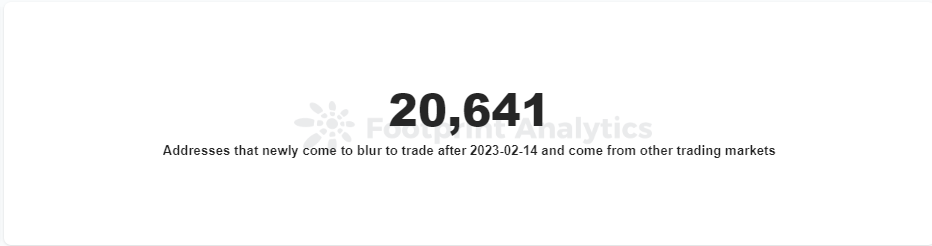

Furthermore, among those new users, more than 20,000 users were brought from other marketplaces, making the airdrop a successful vampire attack.

Blur launched its first round of airdrops on Feb. 14, dropping “care packages”, which can be redeemed for $BLUR to everyone who traded in the 6 months prior. Airdrop 2 was for traders who actively listed on Blur through November. Airdrop 3 will be for traders who place bids on Blur and will be the largest Blur airdrop (around 1-2x the size of Airdrop 2).

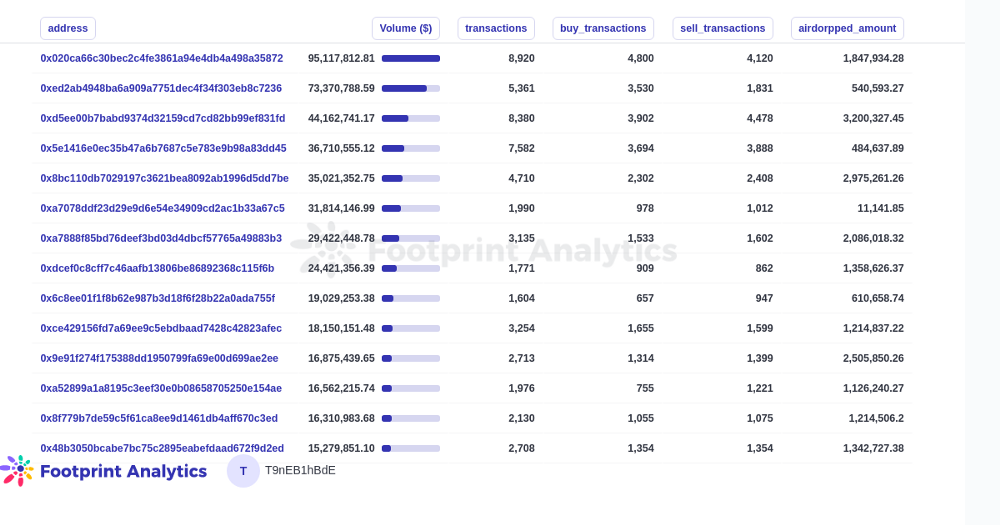

Transaction Volume of Blur Airdrop Addresses

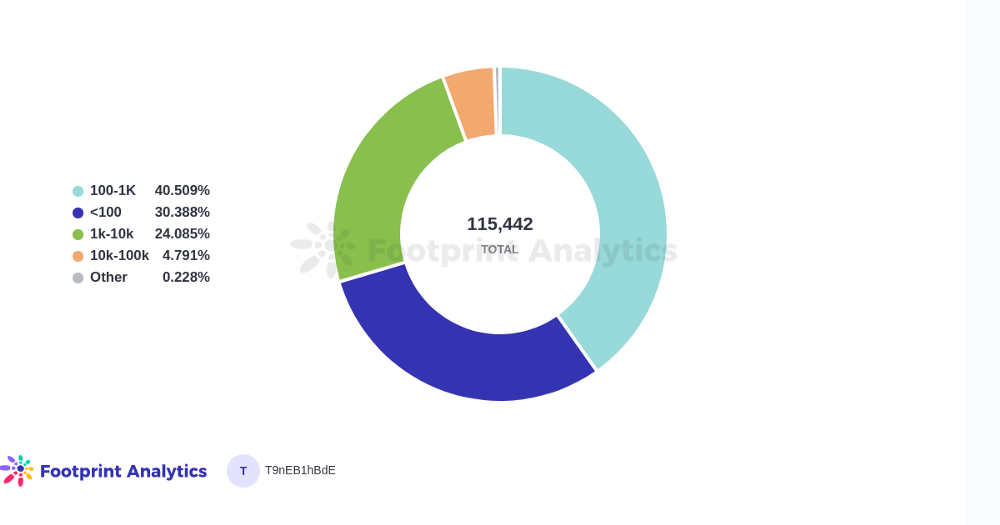

The total amount of $BLUR distributed has been 360M, 94% of which has been claimed. While most recipient wallets received under 1K, 4.7% received 10K-100K. On Feb. 22, the price of $BLUR was $1.06.

The top address, which clocked an astounding $95M in Blur trading volume, received 1.8M. However, the largest airdrop recipient (getting $3.2M) traded $44M in volume.

Blur vs. Competitors in 2023

Since January, Blur has grown to trade 94% of the aggregator market in trading volume, while OpenSea-owned competitor Gem has just 6%. Gem targets a similar market as Blur, namely experienced traders.

Earlier in the year, it appeared that Gem had a realistic chance of becoming the top aggregator, with about half the trading volume of Blur on some days. However, since the airdrops began, Blur has completely overtaken Gem.

Note that around 15% of trading volume was done by top 15 traders using the platform.

Aggregator Daily Trading Volume (Share)

This piece is contributed by Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.