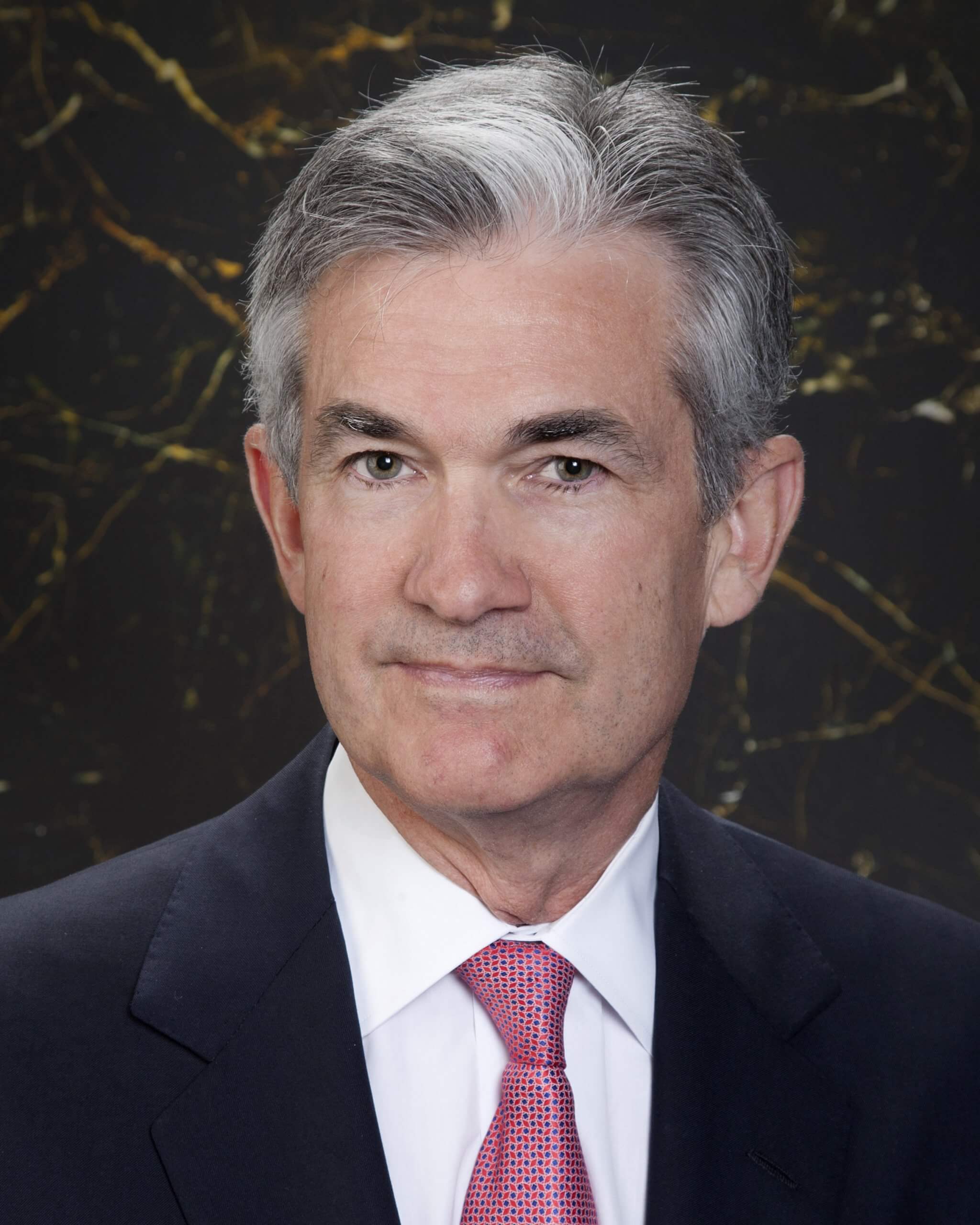

Official portrait of Governor Jerome H. Powell. Mr. Powell took office on May 25, 2012, to fill an unexpired term ending January 31, 2014. For more information, visit http://www.federalreserve.gov/aboutthefed/bios/board/powell.htm

Mike Novogratz, former Goldman Sachs executive and CEO of Galaxy Digital, has cautioned that Federal Reserve Chairman Jerome Powell could slow down the crypto market in his second term in office.

Novogratz said the “macro story has changed a little bit” and added that Powell getting reappointed could allow him “to act more like a central banker than a guy that wants to be reappointed”.

“If we have to start raising rates much faster than we thought, that would slow all assets down including the Nasdaq and crypto market,” he said.

Mike Bailey, director of research at FBB Capital Partners, also commented on the effect Powell’s second term in office could have on the crypto industry.

Recently, he said that for “die-hard crypto bulls” another Powell term may provide some confirmation bias, since these investors often view crypto as a hedge for loose Fed policy.

On the other hand, Douglas Boneparth – president of the financial advisory firm Bone Fide Wealth – commented there was uncertainty about how markets will react without additional support from the Fed.

Meanwhile, Novogratz remains bullish about the overall crypto future by saying the amount of institutions Galaxy sees moving into the space was staggering.

“I was on the phone with one of the biggest sovereign wealth funds in the world today, and they’ve made the decision on a go-forward basis to start putting money into crypto,” he claimed.

“I’ve had the same conversations with big pension funds in the United States.”

Microstrategy CEO Michael Saylor recently said that Bitcoin will grow 100X to become a $100 trillion asset class.

In May, investment bank Goldman Sachs said the fear of missing out (FOMO) was driving institutional investors to Bitcoin.

US President Joe Biden recently declared Jerome Powell would serve his second four-year term as Federal Reserve chair while Governor Lael Brainard, who was among the candidates for the prestigious spot, is promoted to vice-chair.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire