Bitcoin has experienced a tremendous rally in 2018, rising from $3,150 to as high as $14,000, but retail interest is still significantly lower than it was during the bull market in 2017.

According to data from Google Trends, the current interest in Bitcoin is actually at the same level as it was in June 2018 – in the midst of last year’s gruelling bear market.

The number of people typing ‘Bitcoin’ into Google has actually fallen by 87% since December 2017, when the price of cryptocurrencies skyrocketed. Even during the recent rally to $14,000, it was 74% lower than in 2017.

The data presents a few questions. Firstly, why is there a lack of interest in cryptocurrencies at the moment? And how did the market rally by 320% in six months without sufficient interest in the asset class?

Lack of retail investments should drive institutional investment

While retail investment is clearly waning, institutional investment in cryptocurrencies seems to be on the rise.

Yesterday, crypto investment firm Grayscale revealed it has $2.7 billion in cryptocurrency assets under management. Boston-based Fidelity also took the leap of faith into digital assets this year, launching a native cryptocurrency investments platform.

8/19/19 UPDATE: Holdings per share, net assets under management and digital assets per share for our investment products.

Total AUM: $2.7 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/hyzxb6RI5V

— Grayscale (@Grayscale) August 19, 2019

Coinbase CEO Brian Armstrong reiterated the increase of institutional investments flowing into cryptocurrencies last week, revealing that the exchange was facilitating $200 million to $400 million in deposits per week from institutions.

This is not necessarily a good sign for ICOs and altcoins, many of which made incredible gains during 2017 at the height of the hype-induced bull market with retail investors experiencing high levels of FOMO.

Institutional investors, on the other hand, prefer assets that are more stable and have more liquidity, which would eventually make them easier to cash out.

Africa leading the charge for retail adoption

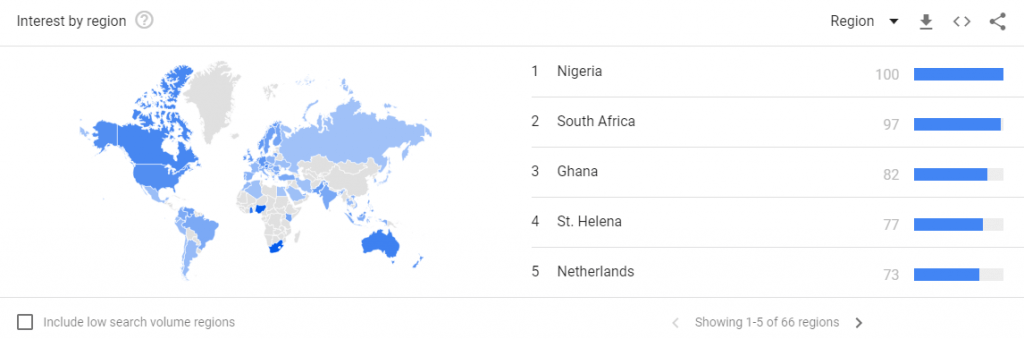

Although retail interest in cryptocurrencies is down on a global scale, Africa seems to be bucking the trend as Nigeria, South Africa, and Ghana make up the top three countries that are searching for Bitcoin the most.

In January 2018, Bloomberg reported on what triggered Nigeria’s adoption of cryptocurrencies. The article states that after cracking down on a 30-year-long Ponzi scheme, victims’ bank accounts were closed, leading them to use Bitcoin as a means of transferring money.

However, it hasn’t prevented the dark side of fraud from rearing its ugly head in Nigeria, with multiple cases of scammers capitalising on the anonymous nature of Bitcoin by defrauding unsuspecting victims.

Bitcoin spawned out of the 2009 financial crisis and seems to be bolstered by political and economic instability. A report in 2017 revealed how Nigeria is a “victim of high-level corruption, bad governance, political instability, and a cyclical legitimacy crisis”.

With this in mind, a move away from state-controlled banks to decentralised assets like Bitcoin seems like a logical step.

This could be a bullish socio-economic signal for Bitcoin as political instability in the West also seems to be on the rise. Uncertainty over the United Kingdom’s exit from the European Union coupled with Donald Trump’s turbulent term as the United States president presents the risk of a potential global recession.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.