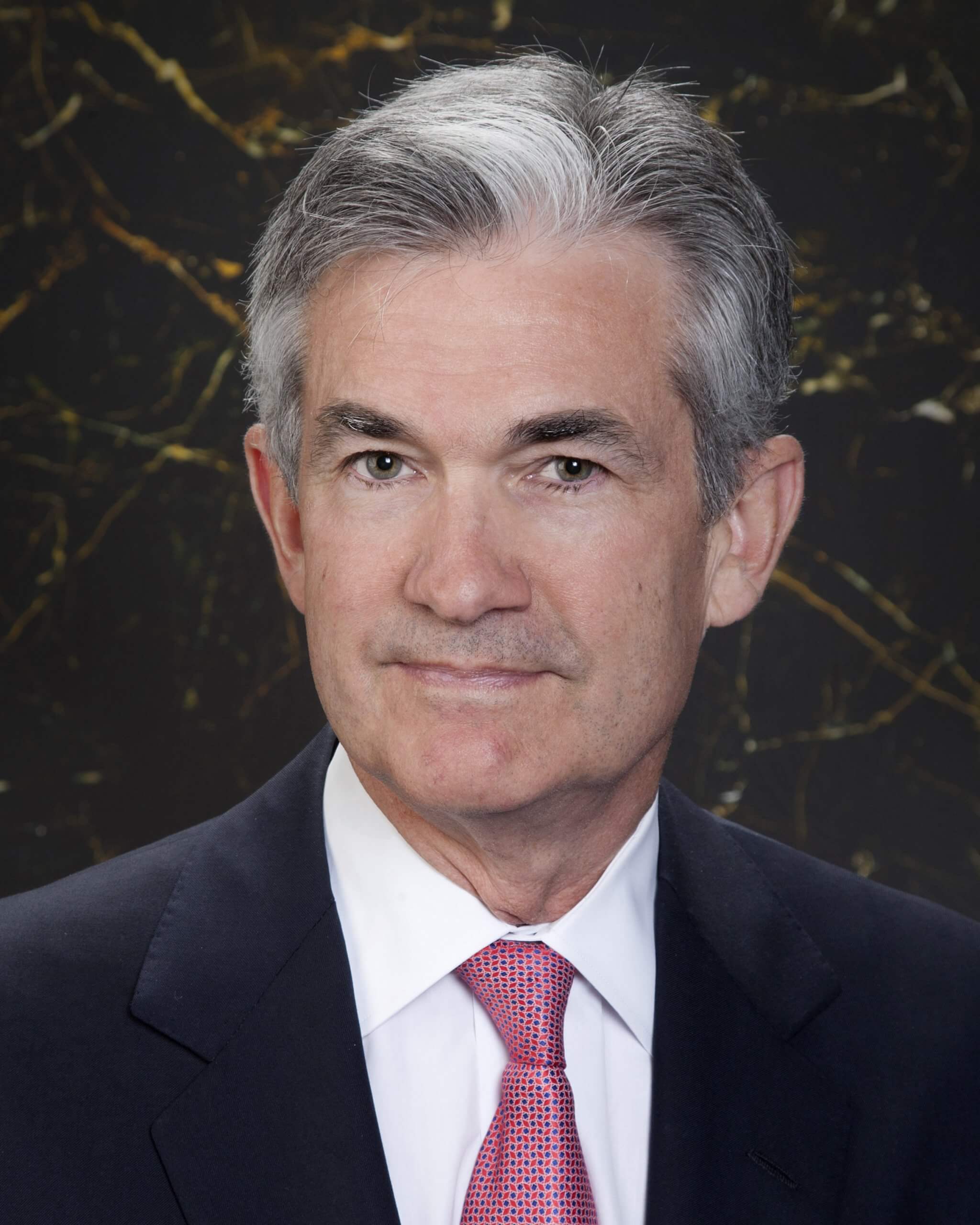

Official portrait of Governor Jerome H. Powell. Mr. Powell took office on May 25, 2012, to fill an unexpired term ending January 31, 2014. For more information, visit http://www.federalreserve.gov/aboutthefed/bios/board/powell.htm

Federal Reserve chairman Jerome Powell has said he doesn’t view cryptocurrencies as a “financial stability concern at the moment”, but added they were “really speculative”, unlike stablecoins that need to be insured by banks.

Speaking at a press conference after the Fed’s announcement of accelerating the pace of its tapering of bond purchases and pencilling in three hikes of its benchmark interest rate next year, Powell added he thinks crypto assets were risky as they’re not backed by anything.

“And I think there’s a big consumer issue for consumers who may or may not understand what they’re getting,” he said.

Powell also highlighted the role of stablecoins, and said he supports new legislation that would require stablecoins to be issued and regulated by insured banks.

“Stablecoins can certainly be a useful, efficient consumer serving part of the financial system if they’re properly regulated, and right now they aren’t,” he said.

His statement was backed by US Senator Pat Toomey who said “stablecoins can speed up payments, especially cross-border transfers”.

“They can reduce costs, including remittances and they can help combat money laundering and terrorist financing through an immutable and transparent transaction record,” he added.

Toomey proposed possible regulation options, including operating under a traditional banking charter, receiving a ‘special-purpose banking charter’ (to be designed in the future) and/or registering as a money transmitter.

However, the Chairman of the Senate Banking Committee – Sherrod Brown – headed for a more ‘bearish’ approach, saying that it was necessary to be clear of the fact that “if you put your money on stablecoins, there’s no guarantee you’re going to get it back”.

“And if there’s no guarantee you’re getting your money back, that’s not a currency with a fixed value – it’s called gambling,” Brown added.

Famous crypto advocate – investor Anthony Pompliano – argued that if the government allows people to gamble, it’s because it gets taxes.

“You also allow people to, and put their money in the banks, and if I put more than $250,000 in the bank, there’s no guarantee I’ll get it back either. How about that?” Pompliano asked.

He added that this could be characterised as gambling as well – “according to Sherrod Brown’s definition”.

Jaret Seiberg, managing director and financial analyst at Cowen Washington Research Group, stressed that it will ultimately be the Senate that will dictate the specifics regarding any crypto legislation that could be passed – not the House of Representatives.

“The House can pass as many crypto-related bills as it wants, but if Sherrod Brown doesn’t become a champion of crypto legislation, it’s simply not going to become law,” he said.

“And this is our best indicator that we’ve had in the last 12 months as to what he’s going to do.”

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire