The tech giants claim that the ban tackles the issue of consumers falling prey to fraudulent or misleading ads on cryptocurrency speculation. But Revolut’s Head of Mobile, Ed Cooper, argues: “Unfortunately, the fact that this ban is a blanket ban will mean that legitimate cryptocurrency businesses which provide valuable services to users will be unfairly caught in the crossfire.”

“It would seem heavy handed for example to put a blanket ban on all ads for job postings, anti-virus software or charities, just because ads for these products and service are also sometimes used as an entry point by scammers to target consumers,” he adds. “Hopefully moving forward, a more balanced approach can be applied to both keep consumers safe, but also allow legitimate businesses to advertise their services and add value.”

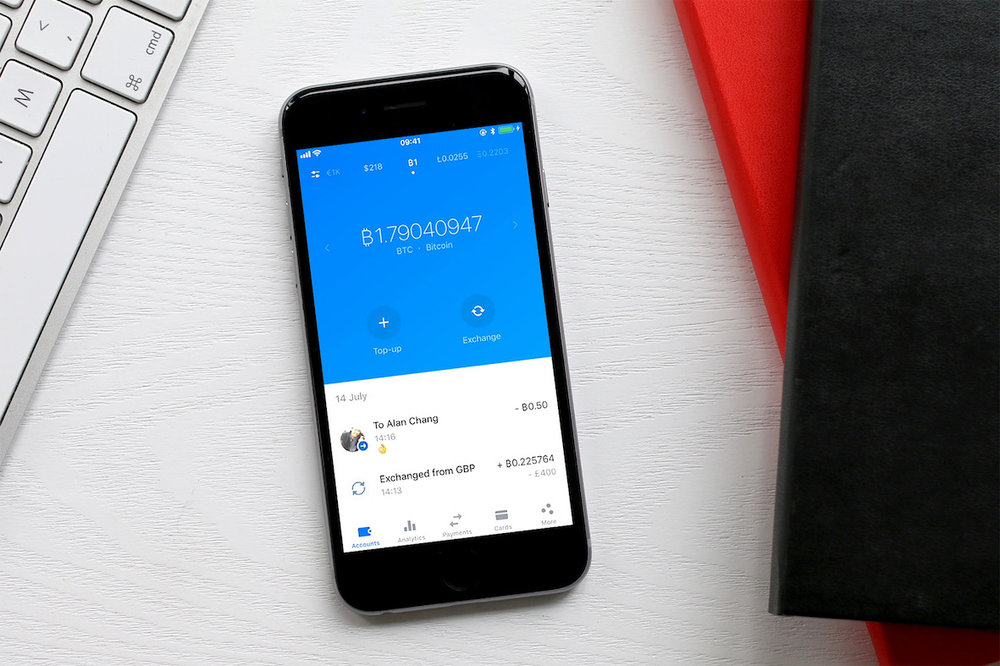

In May, Coin Revit reported that Revolut, which last year became the first banking app to let customers invest in Bitcoin, along with Litecoin and Ethereum, was now throwing Ripple (XRP) and Bitcoin Cash into the mix.

It said that “hundreds of thousands” of its 1.8 million customers have invested in virtual currencies since the service was launched in December. Vlad Yatsenko, Co-founder and CTO, Revolut, commented: “We’ve been asking the Revolut community which cryptocurrencies they would like to see next, and the demand for both XRP and Bitcoin Cash has been absolutely overwhelming. After months of negotiation and development work, we’re incredibly excited to offer exposure to these two digital currencies to the UK market.”

Last month, the startup rolled out Vaults which allows clients to round up their card transactions to the nearest whole number and convert all their spare change into cryptocurrencies. More than 50,000 have so far signed up. Yatsenko said: “We launched this world first feature in order to offer frictionless exposure of cryptocurrencies to the mainstream population. The idea of exchanges, private keys and cold storage is a complete turn off for some people, so we wanted to offer a simple way for consumers to get exposure in this area.”

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire