This regular column is part of our cryptocurrency analysis and features the Ripple price plus daily, weekly and monthly Ripple price movements. We analyse the Ripple price against US dollars (XRP to USD). One of the founding principles of Coin Rivet is to promote understanding of cryptocurrencies and blockchain technology. Part of that understanding is looking at pricing trends for cryptocurrencies. This column is a regular analysis of the Ripple price (XRP to USD). We compare against the US dollar for ease of comparison (all our cryptocurrency analysis will put values in the US dollar equivalent).

In discussing cryptocurrency prices, we are not recommending a coin neither are we recommending that you should invest in one. In fact, the more you learn and study the more you will realise that cryptocurrency prices fluctuate a lot and can be volatile. As we all know the value of investments can go up as well as down. In the case of cryptocurrencies that can be a lot – in both directions.

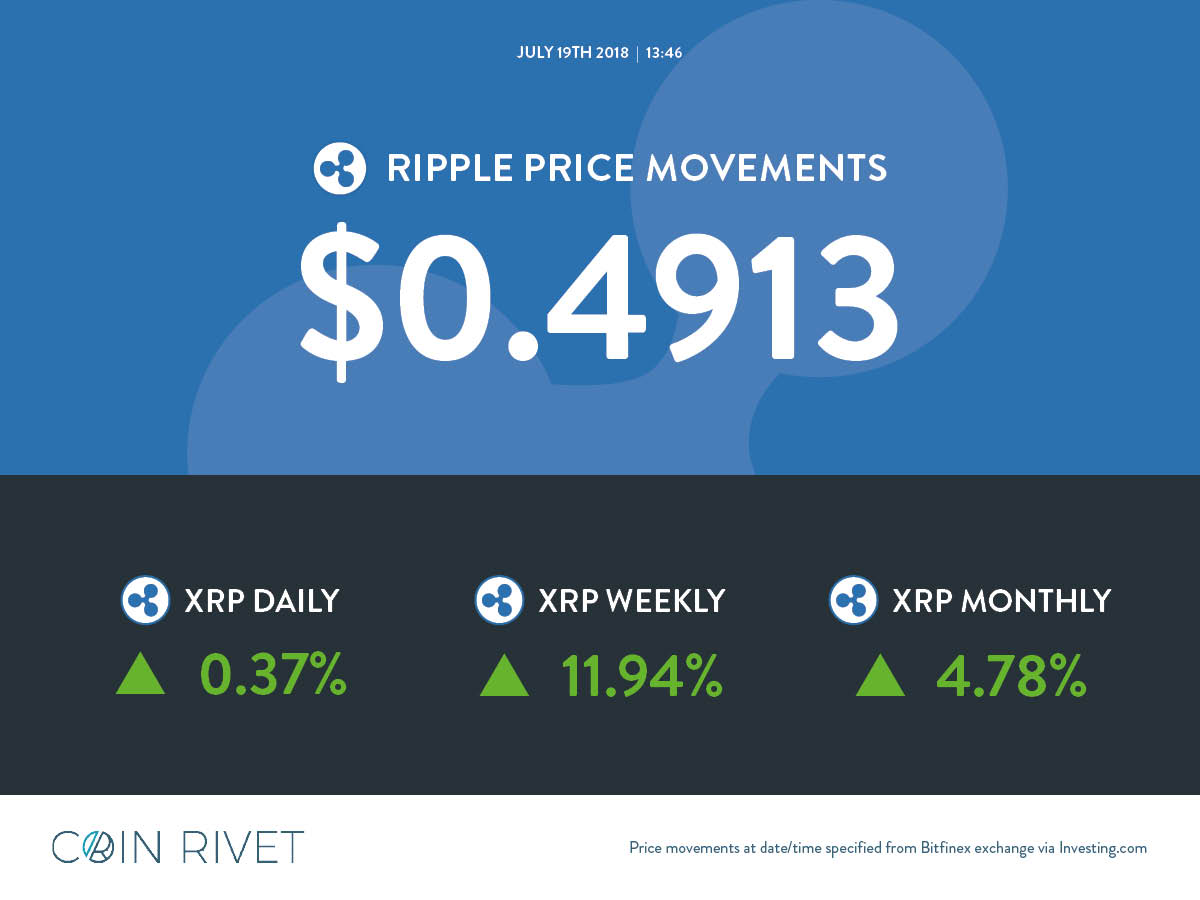

A good week to be a Ripple holder. The Ripple price is green across the board with a big weekly rise putting it green across the month. Marginally up today it has seen daily rises most of the week although it is flat today (at the time of writing this article).

Price: US$ 0.4913

Daily: 0.37%

Weekly: 11.94%

Monthly: 4.78%

Ripple is a real-time gross settlement system (RTGS) developed by the Ripple company. It is also referred to as the Ripple Transaction Protocol (RTXP) or Ripple protocol. It can trace its roots to 2004 when a web developer called Ryan Fugger had the idea to create a monetary system that was decentralised and could effectively allow individuals to create their own money.

RipplePay.com was launched in 2005 to provide a secure payment system for members of an online community via a global network. Jed McCaleb began developing a digital currency system in 2011 in which transactions were verified by consensus among members of the network, rather than by the mining process used by Bitcoin which relies on blockchain ledgers. This new version of the Ripple system was designed to eliminate Bitcoin’s centralised exchanges, use less electricity than Bitcoin, and perform transactions much more quickly.

Ripple was launched in 2012 to facilitate secure, instant global transactions supporting tokens representing fiat currency, cryptocurrency or any unit of value.

Our regular article lists The Top 10 Cryptocurrencies.

If you would like to find out more about Ripple and other Cryptocurrencies, then some of the information and links to other articles, news stories and guides on our site will be useful. As a starter here is a selection of some of the Ripple and cryptocurrency related material available on our site:

Ripple (XRP) has announced a donation of $50 million to 17 of the highest ranked US universities. “As globalisation increases, so does the demand for technological solutions and talent to solve the world’s hardest financial problems, such as retail remittances,” says Ripple SVP of Business Operations, Eric van Miltenburg.

The donation is aimed at funding research and development in blockchain, cryptocurrency and digital payments at the likes of the University of North Carolina, MIT and the University of Pennsylvania.

Find out more by reading the full article.

Kahina Van Dyke has joined Ripple as Senior Vice President in Business and Corporate Development. Van Dyke most recently led the Global Financial Services team at Facebook and has also worked at Mastercard and Citibank. “Ripple offers a compelling opportunity to be a transformative force for good in the world of money movement,” she says.

Find out more by reading the full article.

Cryptocurrencies are likely to become heavily regulated amid fears they are in a bubble and facilitating illegal activities, it has been suggested. The comments by Andrew Cornell, Managing Editor of ANZ publication bluenotes, follow a report by the Bank for International Settlements (BIS) which referred to cryptocurrencies as a “combination of a bubble, a Ponzi scheme and an environmental disaster”.

Cornell writes in a blog that there has been a growing resistance to cryptocurrencies, which has contributed to speculators cashing out. The BIS, for example, warned they have a limited ability to satisfy the signature property of money, are unable to scale with transaction demand and fluctuate greatly in value. The bank regulatory body said the emergence of cryptocurrencies calls for a globally coordinated approach to prevent abuses and strictly limit interconnections with regulated financial institutions. “In brief, like it or not, cryptocurrencies will be regulated, heavily,” Cornell writes.

Find out more by reading the full article.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire