On December 31, Taiwanese singer Jay Chou posted the ‘Phanta Bear NFT’ on his Instagram, followed by other Taiwan stars such as JJ Lin and Ashin from Mayday, which led to a rapid increase of Phanta Bear transactions.

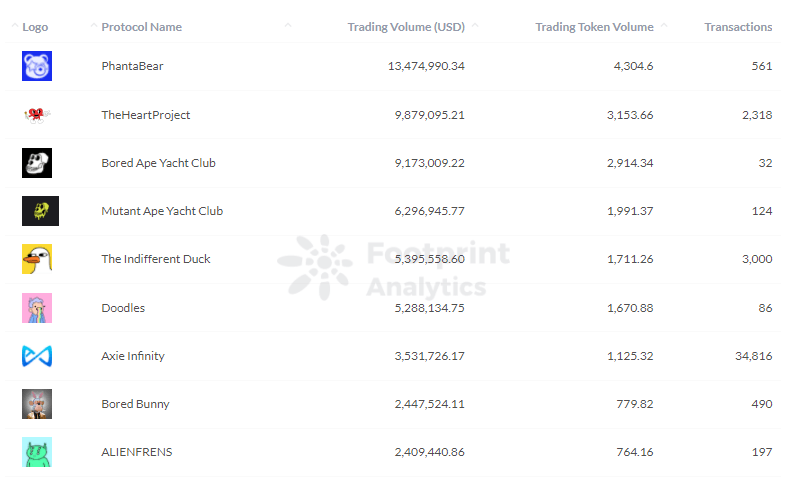

By January 9, Phanta Bear and The Heart Project became the top two of NFT projects by trading volume, according to Footprint Analytics, exceeding even BAYC.

Footprint Analytics – NFT Trading Volume on Jan .10

Instagram – Jay Chou’s Phanta Bear NFT

The Phanta Bear NFT collection, which contains 10,000 algorithmically-generated digital avatars, was released on January 1 by metaverse platform Ezek and Jay Chou’s fashion brand PHANTACi. Phanta Bear owners could get members-only benefits on Ezek in the future.

Footprint Analytics – Phanta Bear & The Heart Project Trading Volume

Meanwhile, another NFT project, The Heart Project, has seen its trading volume rise exponentially, approaching $1 billion in a single day on January 9. The project, created by artist Stefan Meier and Italian photographer Aidan Cullen, was first shared on September 23 on Instagram by actor Edison Chen with whom it is partnering.

Instagram – Edison Chen’s The Heart Project NFT

As the NFT market has developed, more celebrities and sports leagues have entered into various segments. With the popularity of an NFT collection being highly dependent on its popularity, celebrity support can greatly increase the value of particular projects.

However, celebrities can also sway the market as a whole, and the impact of Jay Chou and Edison Chen on the volume of transactions is evident. In addition to introducing their fans to NFTs, celebrities have also added off-chain value by tying NFTs to concert tickets.

Physical artwork tends to conserve value over time or appreciate. However, celebrity NFTs are mostly co-branded items with a short lifespan, and are limited to a fanbase. According to Footprint Analytics, the number of transactions for both Phanta Bear and The Heart Project levelled off immediately after a pump.

Footprint Analytics – Phanta Bear & The Heart Project Trading Count

As a type of collectible, the liquidity of NFTs is not comparable to that of tokens. Although these NFTs are backed by celebrities and are prone to a rise in trading volume in the short term, celebrity NFTs tend to have difficulty sustaining value and liquidity. This is because the buyers are mostly fans and others FOMOing in, driving up the price so quickly that there’s a little resale market outside the existing fanbase.

Currently, many projects such as NFTX and Unicly are making efforts to increase NFT liquidity, but the impact of these efforts on celebrity NFTs is still small.

In the world of NFTs, decentralisation tends to be valued because NFT is trying to get more rights for artists and original people. As with other areas of the blockchain industry, the movements to get autonomy and participant rights are manifested in the NFT space in a number of ways:

However, celebrity NFTs are highly centralised. This is because the success of a celebrity NFT project is almost entirely determined by the actions and decisions of the celebrity’s marketing team. As a result, NFT holders have very little control over the direction of the project. Moreover, the owners of the celebrity NFTs mostly pay more attention to the celebrities but not the project itself.

Additionally, membership benefits are dictated and interpreted by the institution behind the project, which means the institution can make the rules for all things. For example, Ezek, which is the institution that launched Phanta Bear, said there will be some benefits for the NFT owners before selling, but there are no specific rules for their future rights. This is in stark contrast to popular decentralised NFT projects, where the members decide the development of the project.

In 2021, celebrities played a huge role in the boom of the NFT market. However, their short-cut to popularity also brings a high degree of price and liquidity volatility. In the future, celebrity NFTs will have to do more than ride on hype, but provide more application scenarios to maintain their value.

Footprint Analytics is an all-in-one analysis platform to visualise blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customised charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Telegram: https://t.me/joinchat/4-ocuURAr2thODFh

Youtube: https://www.youtube.com/channel/UCKwZbKyuhWveetGhZcNtSTg

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire