London, United Kingdom, 4th May, 2022, Chainwire

DeFi Is awesome, right? But often it is still very complicated for mere mortals. This is why Etherspot.io and LI.FI teams have created a new primitive, a game-changing cross-chain approach, which brings DeFi users to the forefront of DeFi investing, while keeping it simple and abstracting unnecessary steps along the way.

The Challenge With DeFi Protocols

DeFi is a financial realm where individual investors can bypass centralized corporations and brokers, saving high service fees and taking the opportunity to partake in a new sphere of investing that has consistently produced astounding results. For instance, KlimaDAO’s 1,000% APY for staking KLIMA token. That said though, the DeFi onboarding friction point also exists here as it does in other cross-chain investing opportunities.

So what is the downside of cross-chain investing? It’s the complexity of the journey towards arriving at the desired goal. Much like Bitcoin when it first arrived on the scene, it was very complicated for non-technical or non-developer users. That is why our main focus is to remove the current complexities and build a user journey that is simple, easy to interact with and intuitive. One that allows people from all communities across all chains to interact seamlessly with your dApps.

Bridging The Chasm of Cross-Chain UX

Many DeFi & ReFi (Regenerative Finance) investing strategies still retain the mentioned complexities and are limited by their specific chain exclusivity. Sometimes the mechanics of setting up the actual investments, interacting with multiple different dApps, to go cross-chain can be overwhelming and expensive for users to the point that it is an obstacle to adoption. On the other side, projects can not always afford to put up liquidity for each chain they want to be on, and are forced to stick with only one. We realized that the chasm of cross-chain investing needed to be bridged.

This relates to all the steps that are necessary for DeFi & ReFi strategies but sometimes these are just a step too far (a chasm) for the average user, like switching blockchain networks; paying multiple transaction fees for swaps to various tokens and additionally switching between multiple dApps to do all that.

What Solution Are We Offering?

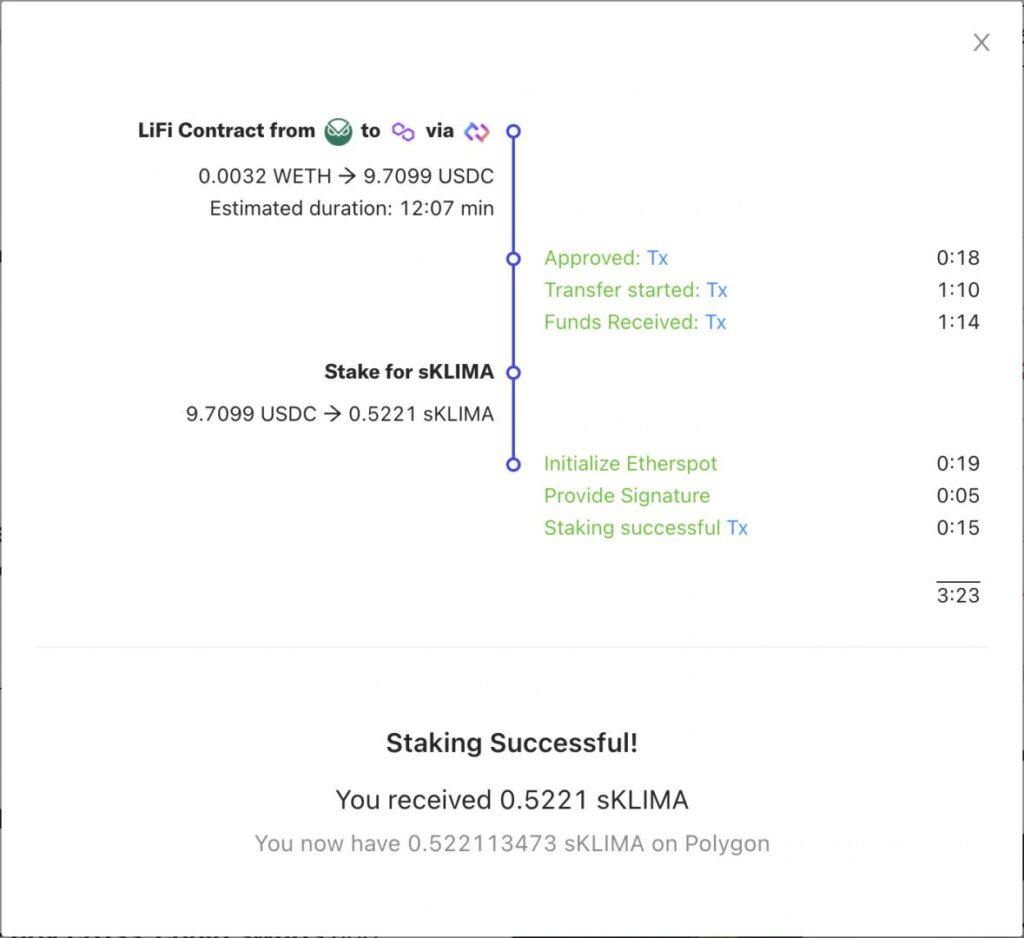

LI.FI and Etherspot teams have joined hands to offer a solution that allows everyone to perform several cross-chain transactions at once on the same dapp without RPC network switching.

The initial app supports cross-chain deposits into the Klima staking contract that will not only make staking KLIMA simpler, but will pave the way for Klima staking to be offered across multiple chains while only having liquidity on their chosen blockchain. This simplifies DeFi investing for projects and users going forward.

“You can take any EVM chain and stake Klima from it. It’s mind-blowing. I went from Ethereum all the way to staked Klima. It’s super cool. It’s one of those sophisticated pieces. This allows us to go cross-chain without having to go cross-chain. It allows us to remain on Polygon and people come to us for things.”

– Archimedes – Co-founder of KlimaDAO

Our first iteration of this tool uses Etherspot’s SDK to sign cross-chain transactions from any network without switching RPC, while bundling or batching transactions in one powered by LI.FI‘s cross-chain aggregation protocol.

This means any user can perform any action on any EVM compatible chain by just signing transactions on their wallet.

This 100% removes the complexity in staking KLIMA tokens with KlimaDAO.

Normally this process would involve: A long and winding road!

- Connect your wallet to Gnosis Chain.

- Bridge WETH to Polygon (Gnosis tx fee. DAI is required).

- Add Polygon Mainnet to your wallet RPC networks.

- Switch wallet network from Gnosis to Polygon.

- Connect wallet to DEX (for instance SushiSwap).

- Buy MATIC, to cover Polygon tx fees (Polygon tx fee. MATIC is required).

- Swap WETH for USDC (Polygon tx fee) – (there is a KLIMA/USDC pool on SushiSwap).

- Swap USDC for KLIMA (Polygon tx fee).

- Connecting to KLIMA app.

- Stake KLIMA token for sKLIMA (Polygon tx fee).

What Etherspot / LI.FI app allows: Ultimate convenience

- Approve your token if you haven’t yet (1 interaction).

- Sign a transaction on Gnosis to bridge to Polygon (1 interaction).

- Sign a transaction on Polygon to swap and stake into Klima (2 back to back interactions/signatures).

Everything else is done in the background for you, no more switching networks, only two tx fees and voila, you have staked sKLIMA on the KlimaDAO app – the easy & cheap way! Test it out here.

This relatively simple sounding evolution of the Cross-Chain investing process is set to make huge ripples in the DeFi space with the ability to extrapolate the same system into various apps and strategies in the future.

We have just built a new DeFi primitive. Just imagine the simplification of processes and abstraction of steps one currently has to do.

Now imagine depositing into Yearn from any EVM chain, or interacting on Trader Joe without having to be on Avalanche. Imagine specific chain P2E games suddenly opening their platform to any EVM user to participate. The possibilities are endless and very exciting.

Our teams are very proud of what has been achieved and look forward to opening it up to even the most recent entrants into the world of DeFi investing. We believe DeFi should be open and available to all!

Who’s involved?

LI.FI is an advanced bridge & DEX aggregation platform that provides cross-chain bridging, swapping and messaging.

Twitter | Discord

Etherspot.io is a smart-contract SDK that gives projects access to the best features (batched transactions, NFTs, ENS, Payment Channels) of the Ethereum blockchain and EVM compatible chains.

Twitter | Telegram | Discord

KlimaDAO is a decentralized autonomous organization (DAO) and DeFi protocol that aims to drive climate action via a carbon-backed, algorithmic currency – KLIMA token.

Twitter | Discord | Telegram

Contacts

- Kyle Young

- Etherspot

- marketing@pillarproject.io

Press release disclaimer: This is a paid press release. Coin Rivet recommends readers to undertake their own research on the company. Coin Rivet does not endorse and is not liable for any content or products on this page.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.