SOL reached an all-time high of $68.76 today amid a surge of interest in the Solana ecosystem.

The token is among one of the top performers in a recent altcoin rally, with a 38% increase in the past 24 hours and a weekly price increase of 65%.

The rally pushed Solana into the top 10 cryptocurrencies ranked by market cap on CoinMarketCap, overtaking Uniswap in the process.

Formed in 2017, Solana is a blockchain that utilises an open infrastructure to provide more stable scalability on a larger scale. Solana introduces an array of new, unique technologies that provide users of the Solana network with transaction speeds of up to 50,000 per second and robust security.

Dubbed an “Ethereum killer”, it has attracted heavy investment and backing from VC firms including a recent fundraising round of $314.5m led by Andreessen Horowitz and Polychain Capital. FTX CEO Sam Bankman-Fried’s investment arm Alameda research also participated in the landmark fundraising.

Bankman-Fried’s participation and usage of Solana extends to building Serum DEX to handle fast and scalable trading on the Solana blockchain and being a long-time fan of the network. Due to his interest in the project, SOL has also been dubbed a “Samcoin” – a prestigious group of coins approved by Bankman-Fried.

Solana recently launched its Wormhole portal, which acts as a cross-chain bridge and allows for communication between smart contracts operating on two different chains, enabling token swaps or transfers between the two networks.

Other Solana-based projects such as Luna and native DeFi platform Raydium saw impressive price moves, with their values increasing by 58% and 65% respectively in the past week.

The Solana network was exposed to its first real test of scalability this weekend when NFT collection “The Degenerate Ape Academy” went on sale on NFT platform Solanart and started the minting process for the pieces of digital art.

Following the minting process, the entire collection of 10,000 apes sold out in eight minutes and raised an approximate $2.5m. To mint an ape, users had to use SOL to complete the process. The mint price of an ape was 8 SOL, which at the time of minting was approximately $400. Since its launch, Degen Ape sales have reached more than 100k SOL in volume traded, with a price floor of almost 15 SOL.

The sudden surge of interest in the Degen Ape project promptly lead to the surge in prices to above $60 and highlighted the growing interest in the Solana ecosystem.

A key driver behind the popularity of the project is the almost negligible fees paid for transactions on the Solana network. This meant that despite the somewhat high price of minting a Degen Ape, users paid negligible transactions fees, allowing them to profit more from their collection.

Users on Ethereum-based NFT platforms such as OpenSea and those who wish to mint NFTs on Ethereum often face high transaction fees and exorbitant minting fees, which can peak to over $1,000 when many users are trying to mint an NFT simultaneously.

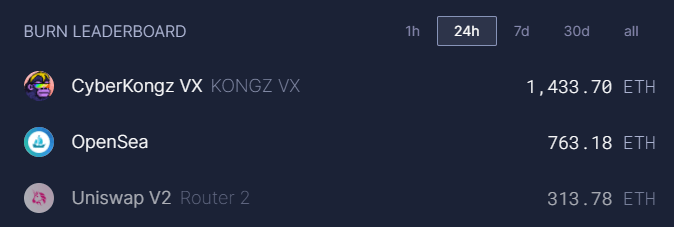

Another gorilla-based NFT project launched over the weekend on the Ethereum network and prompted the burning of more than $4m in ETH in little over five hours. NFT project CyberKongz, a collection of pixelated apes, sparked a “gas war” following their minting process, which saw gas for a transaction reach 1,800 gwei and prompt users with fees of over a reported $1,500.

All 10,000 CyberKongz were minted minutes after the contract went live, and in the process burned an incredible 1,433 Ethereum. Overall, the CyberKongz mint resulted in approximately $4 million worth of Ethereum being burned, almost doubling the amount consumed by leading NFT marketplace OpenSea.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.