Squid Game crypto

A meme coin based on dystopian TV show Squid Game looks to have ‘rug-pulled’, sending the price of the token straight to zero after a massive rise.

The $SQUID token – which was used to buy-in to a round of an associated game – is known as a ‘play-to-earn’ cryptocurrency, where people buy tokens to play an array of games on the platform.

A flurry of investors started to jump on the token following its launch on October 27 and play the game while also chasing a quick profit.

Early suspicions did arise when investors reported they were unable to sell their tokens due to ‘innovative anti-dumping technology’, which restricted investors from swapping or selling their tokens and taking profits.

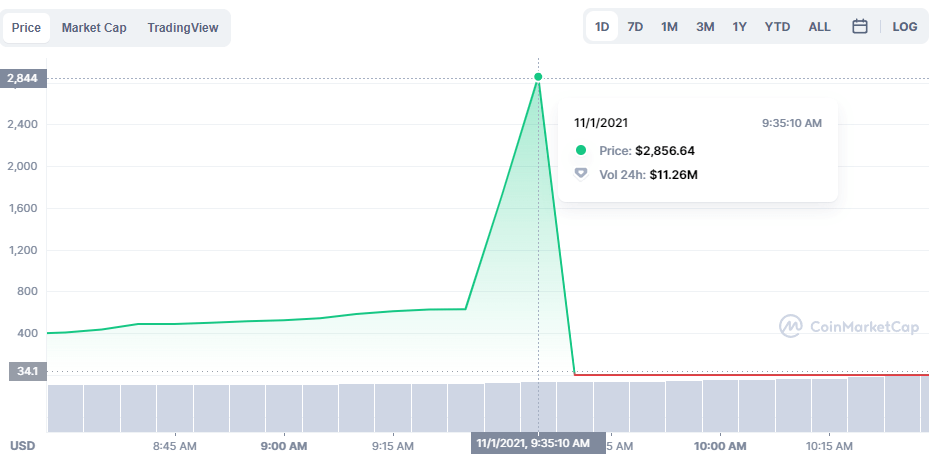

The price of $SQUID reached a peak of $2856 before crashing straight to zero Source: CoinMarketCap

A number of repeated warnings across social media and the crypto community also appeared to warn investors away from the project due to the risk involved.

However, despite the warnings, investors continued to pile money into the project and risk their capital in the speculative game.

CoinMarketCap even posted a notice on its token page for $SQUID, which informed users the coin may be a ‘honeypot’ scam.

Then, much like the TV show’s ‘Red Light, Green Light’ contest, the colours on the charts changed quickly and the price dropped sharply after reaching a peak of approximately $2,850 – with the price crashing to zero after the game developers seemingly removed the liquidity and ‘rug-pulled‘ the project.

Based on wallet activity, it’s alleged that the developers of the game walked away with approximately $2.5m of untraceable BNB after using Tornado Cash – a site used to privatise and hide transactions on the blockchain – to ‘clean’ the stolen funds.

The game’s website, Twitter and other social media platforms have now all been deleted.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire