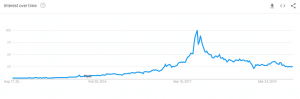

One of the most widely discussed and searched topics on the web during 2017 and 2018 was blockchain technology.

Of course, with time, the hype has settled. As you can see below, courtesy of Google Trends, the number of people searching for information about the blockchain has decreased.

However, similar to the ICO craze of 2017, the reality is the space has now managed to cleanse itself of phony projects seeking to jump on the blockchain bandwagon with no real plan, and instead we’re left with a number of strong projects developing real-life use cases for the promising technology.

There are use cases in various different fields such as supply chain management, healthcare, and energy. However, my goal today is to focus on projects that offer tailored solutions on-the-go and which aim to bring non-crypto-related businesses into the field.

Payment providers

One of the best use cases for cryptocurrencies is as a means of payment for everyday items.

There’s already a plurality of established businesses offering this service like Coinsutra, BitPay, or Bitrefill (even Coinbase has created a payment card for its customers), but today I want to focus on two in particular that are currently gaining traction in the crypto space.

Should Bitcoin payment processors targetting big vendors be compliant with current regulation? Watch the discussion on the topic of #kyc and #aml below. @OpenNodeCo @BtcpayServer https://t.co/p1sVj5IKzS

(08:43:00) https://t.co/bWjyRsHMOr— Pedro Febrero (@Febrocas) September 16, 2019

The first is Open Node, a project led by Rui Gomes and financed by Draper Ventures. The second is Utrust, a payment provider led by Nuno Correia, which had a very successful ICO during 2017.

While the projects differ from each other in a number of ways – one is a company directly funded by Bitcoin VC money while the other ran an ICO on the Ethereum blockchain and created its own token, UTK – their goals are quite similar: to bring cryptocurrencies to as many merchants as possible.

To achieve that dream, both companies are currently following KYC/AML regulation, which helps facilitate the adoption of cryptocurrencies by organisations worldwide.

Rui Gomes recently spoke at the Baltic Honeybadger 2019 conference where he highlighted the importance of complying with current banking frameworks in order to attract more business. His argument makes sense, especially today, as most businesses are unaware of cryptocurrencies and just want to get by.

In addition, I spoke with Utrust CEO Nuno Correia last week and he mentioned the exact same problem. Regarding the use of privacy coins, he said:

“I know that people are entitled to their own privacy, but not for everything. Even though I would like for every transaction to be private, we must also stop the bad actors in society.”

Not only that, but Nuno added an interesting remark about the worldwide adoption of cryptocurrencies and what it would take for that to happen:

“I think projects like Libra, or central bank cryptocurrencies, could be the catalyst for mass adoption. (…) People will understand the difference between Libra-like coins and Bitcoin, and the great thing for adoption is that with banking licences, governments can cry all they want, but they won’t be able to block these cryptocurrencies.”

In his view, it’s absolutely necessary for payment providers that sit directly on top of the Bitcoin layer to be fully compliant with regulators in order to promote the mass adoption of cryptocurrencies through payments.

Software and consultancy providers

Let’s take a look at some projects that have developed useful business offerings (with sensible pricing models) that integrate blockchain technology with other platforms and organisations. The companies I’m looking at today are Unibright and CPI Tech.

Thank you @CoinRivet and @Febrocas for the opportunity to explain our vision on blockchain integration and many other topics. #blockchain #integration #ERP #SAP #cryptonews #vision #business #deutschland $ubt https://t.co/ZTbllpvCWk

— Unibright (@UnibrightIO) April 11, 2019

Earlier this year, I conducted an interview with Unibright CTO Stefan Schmidt where we discussed the utility of the UBT token as well as why and how blockchain can be leveraged to improve the transparency, auditability, and efficiency of some business practises.

The current product, which can be tested here, has connections to the most widely used ERP software vendors such as SAP. The idea behind Unibright’s ERP is to link company processes with blockchain protocols – currently Ethereum and EOS, maybe more – so that organisations can record information in an immutable ledger or make use of smart-contract applications.

The ultimate goal is that any individual or organisation can leverage the use of these tools via APIs. The token is simply used to run the software and contracts, much like ETH is used to power the Ethereum network.

CPI Tech is a consultancy which is targeting businesses that want to develop blockchain solutions.

Even though the company is quite young, according to its website, it has already developed more than 20 solutions, such as exchanges and payment software. Its goal is to build blockchain software and help founders market the product to the right set of customers.

The solution the firm offers is not only to develop the product, but to market it to the right people as well.

If CPI Tech succeeds in building a portfolio of successful use cases with paying customers, we could see the popularity of blockchain technology skyrocketing once again.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.