exc-5b3b563f562fa77d9341cb87

There are currently approximately 1,894 cryptocurrencies with a total market capitalisation of £275 billion. If you are new to this space and think there seems to be a new offering launched every week, then the stats will back you up. This 1,894 represents currencies being traded and doesn’t include various failed Initial Coin Offerings (ICOs).

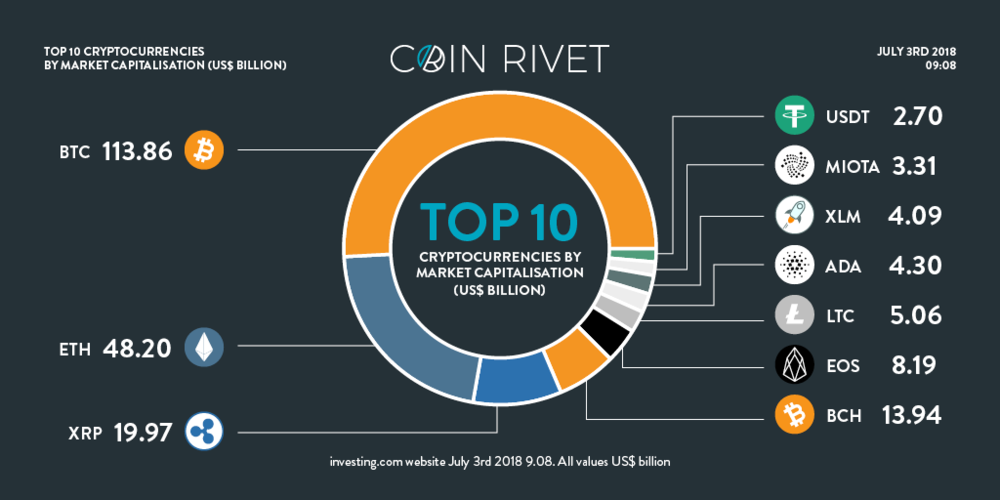

We’ve taken the top 10 cryptocurrencies by market capitalisation and outlined some of the histories of each. We expect this list to change fairly frequently so will be updating our top 10 on a monthly basis. This is our third top 10 so we’ve indicated any movers or new entries compared to the June 2018 top 10.

Since our last top 10 the total market capitalisation has fallen by 21% from S281 billion to $224 billion. If you’re in any doubt that investing in cryptocurrencies is risky and volatile, then this should make it clear.

New entries are not necessarily new currencies. There is frequent movement in the top 10 as values fluctuate, so expect older currencies to drop out and re-enter the list regularly.

Finally, the top 10 is showing relative positions rather than changes in market capitalisation. So, when we say “Bitcoin $x billion – no change” we are saying Bitcoin relative ranking in the number one spot is unchanged irrespective of changes to its market capitalisation.

1. Bitcoin: $114 billion – no change

In August 2008, the domain name bitcoin.org was registered. On 31st October 2008, a paper was published called “Bitcoin: A Peer-to-Peer Electronic Cash System”. This was authored by Satoshi Nakamoto, the inventor of Bitcoin. To date, no one knows who this person, or people, are.

The paper outlined a method of using a peer-to-peer network for electronic transactions without “relying on trust”. On 3rd January 2009, the Bitcoin network came into existence. Nakamoto mined block number “0” (or the “genesis block”) which had a reward of 50 Bitcoins.

2. Ethereum: $48 billion – no change

Ethereum was launched by Vitalik Buterin on 30th July 2015. He was a researcher and programmer working on Bitcoin Magazine and he initially wrote a white paper in 2013 describing Ethereum. Buterin had proposed that Bitcoin needed a scripting language. He decided to develop a new platform with a more general scripting language when he couldn’t get buy in to his proposal.

The development was funded by an online crowdsale between July and August 2014. The system went live with 11.9 million coins already mined for the crowd sale (about 13% of the total supply in circulation). Following the collapse of The DAO project in 2016, Ethereum was split into two blockchains. The new version became Ethereum and the original blockchain continues as Ethereum Classic.

3. Ripple: $20 billion – no change

Ripple is a real-time gross settlement system (RTGS) developed by the Ripple company. It is also referred to as the Ripple Transaction Protocol (RTXP) or Ripple protocol. It can trace its roots to 2004 when a web developer called Ryan Fugger had the idea to create a monetary system that was decentralised and could effectively allow individuals to create their own money.

RipplePay.com was launched in 2005 to provide a secure payment system for members of an online community via a global network. Jed McCaleb began developing a digital currency system in 2011 in which transactions were verified by consensus among members of the network, rather than by the mining process used by Bitcoin which relies on blockchain ledgers. This new version of the Ripple system was designed to eliminate Bitcoin’s centralised exchanges, use less electricity than Bitcoin, and perform transactions much more quickly.

Ripple was launched in 2012 to facilitate secure, instant global transactions supporting tokens representing fiat currency, cryptocurrency or any unit of value.

4. Bitcoin Cash: $14 billion – no change

Bitcoin Cash was born out of the idea of making Bitcoin more practical for small day-to-day payments. In May 2017, Bitcoin payments took about four days unless a fee was paid which was proportionately too large for small transactions.

On 20th July 2017, a Bitcoin Improvement Proposal (BIP 91) was locked in to activate at block height 477120. BIP 91 was designed to reject blocks created by miners not supporting Segregated Witness (generally referred to as SegWit). SegWit is the name used for a change in the transaction format which had also been implemented on other cryptocurrencies. The purpose was to minimise potential fraud and to mitigate a blockchain size limitation problem that reduces Bitcoin transaction speed. This is achieved by splitting the transaction into two segments, removing the unlocking signature (“witness” data).

A change to the code was implemented and Bitcoin Cash was born on 1st August 2017. Bitcoin Cash inherited the transaction history of Bitcoin on that date, but all later transactions were separate.

5. EOS: $8 billion – no change

The EOSIO platform was developed by private company block.one and released as open source software on 2nd June 2018. One billion tokens are being distributed on the Ethereum blockchain by block.one. EOS is based on a white paper published in 2017 and the CEO of block.one (Brendan Blumer) announced it will be supported with over $1 billion.

6. Litecoin: $5 billion – no change

Litecoin was released in October 2011 by Charlie Lee, a former Google employee. It was a fork of Bitcoin with the main difference being a smaller block generation time, increased maximum number of coins and a different script-based algorithm.

7. Cardano: $4 billion – no change

Cardano claims to have tried to change the way cryptocurrencies are designed and developed, balancing the best of the functionality of several cryptocurrencies into one coin. The project began in 2015, the work of a global team of scientists and academics.

At the core is a new method Proof of Stake (PoS) invented by Cardano. They opted against the high energy consuming Proof of Work (PoW) algorithm used by, for example, Bitcoin. Their website also discusses at length the philosophical aspects around the introduction and use of new cryptocurrencies. ADA was released in September 2017.

8. Stellar: $4 billion – no change

Stellar was founded in 2014 by Jed McCaleb and Joyce Kim. At launch it was based on the Ripple protocol but the network eventually forked. Stellar is an open source protocol for exchanging money where servers use the internet to connect to and communicate with other Stellar servers, forming a global value exchange network.

9. IOTA: $3 billion – no change

The IOTA Foundation was incorporated in Germany as a non-profit corporation. The Foundation is “dedicated to building sustainable ecosystems around IOTA to accelerate its development and commercial adoption as an open source technology”.

In November 2017, the Foundation had a US$100 million fund to promote IOTA use. The funds are distributed as IOTA tokens to companies building technology with IOTA. It is an open source distributed ledger cryptocurrency focused on providing secure communications/payments between systems on the Internet of Things (IOT). Instead of blockchain it uses directed acyclic graph (DAG) technology.

10. Tether: $3 billion – new entry

Tether was issued on the Bitcoin blockchain. In their own words “Tether converts cash into digital currency, to anchor or “tether” the value of the coin to the price of national currencies“. So, the value is meant to mirror that of the US dollar and each unit of Tether is backed by $1 held in reserve.

One of the main uses of Tether is to facilitate trading between cryptocurrencies with a rate fixed to the US$ allowing traders to take advantage of trading opportunities.

Notes:

Market capitalisation values from investing.com website 3rd July 2018, 9:08

TRON dropped out of the top 10 into the number 11 spot

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire