In fact, no researcher or investor should approach the market without recognizing that this type of inorganic activity dramatically skews the data. While some significant NFT projects have no obvious signs of wash trading, others are 100% wash traded, meaning there’s no real liquidity at all. Beyond individual collection, wash trading also misrepresents activity in NFT marketplaces and GameFi project.

In crypto, there are various actors and motivations to wash trade, which all merge to become a massive problem for wider NFT adoption and a discrediting force in the eyes of many.

This joint report by CryptoEQ and Footprint Analytics aims to educate readers about the state of wash trading in 2023 as one step towards making the industry more transparent.

Wash Trading in Traditional Markets

Wash trading is an illegal practice in most well-regulated markets, also sometimes referred to as “round trip” trading, which involves artificial trading activity in order to make an asset appear to have higher trading volume, a more liquid market and potentially to manipulate the price. The simultaneous (or swift) buying and selling, or vice versa, of the same asset leaves the trader(s) at a net position (as denominated in the traded asset) that washes out (nets to 0). At root, the increased trading volume, even if it has no impact otherwise, has the effect of making the asset appear more desirable than organic market activity might suggest.

Key Market Participants and Order Types

There are two categories of market participants in a healthy market: market makers and market takers.

Market makers are compensated with the “spread” between a buy-sell order for providing continual market liquidity. The spread is the difference between the bid and offer price. Market makers will typically attempt to purchase near the best offer and sell near the best bid, creating a market. Since market makers are compensated for providing liquidity, they are always willing to trade (buy or sell) and are often always positioned in the market. It is also the responsibility of the market maker to protect themselves during periods of increased volatility by withdrawing their liquidity.

Market takers require market liquidity and immediacy to earn an acceptable execution price when entering or exiting a position. The majority of people fall within the market taker category. If a market taker desires immediate execution of a trade, they are ready to incur the transaction fee (spread) charged by market makers for the liquidity service offered. By definition, market takers have a lower rate of position change compared to market makers. Hence, they are significantly less concerned with submitting the absolute best bid/offer (since they need immediate liquidity).

Additionally, in a market, there are two sorts of orders: limit orders and market orders. The remaining order kinds are variations of these two. Limit orders add liquidity to the market by advertising an offer/bid, whereas market orders remove liquidity from the market by executing at the current available price.

Institutions and professional traders are more prone to employ limit orders since they require substantial liquidity to be filled. These are comparable to the “boundaries” discussed above. Occasionally, sophisticated players will attempt to construct optimal liquidity conditions in order to get their wagers filled.

Back To Wash Trading!

It’s often the case that there are various commissions or brokerage payments intended to ensure appropriate liquidity in markets that can be exploited by those practicing wash trading. Take this example where two individuals are charged by the SEC for simultaneously placing buy and sell orders and pocketing hundreds of thousands of dollars in brokerage fees for GameStop shares. The generalized version of this sort of scam for securities with mature brokerage markets relies on market makers being incentivized to place limit orders, particularly those sufficiently outside of the current trading price that they are considered “non-marketable,” i.e., the brokerage is ensuring that there’s always a maker for an order a customer might want to place. If the corresponding take fee is less than the make fee, then the wash trader can turn a profit by taking both simultaneously.

The component of this practice that influences the asset’s price, in regulated securities markets at least, is known as “painting the tape.” Market participants practicing “painting the tape” are essentially buying and selling some asset among themselves in order to place an artificial upwards price pressure on the asset.

In the crypto markets, where there is considerably less regulatory oversight and enforced structural norm (in some senses at least), wash trading can be pervasive and designed to achieve similar but distinct aims as the brazenly illegal case laid out above. In crypto markets, wash trading often aims to make an asset appear as though anyone is interested in trading it and often serve the exchanges themselves (somewhat counter to the above example) by suggesting that there will be less price slippage should one wish to trade the asset than one actually ends up experiencing.

Crypto Wash Trading

Over the years, there have been numerous instances of wash trading of crypto assets on centralized exchanges (CEXs). In 2019, Bitwise claimed in their own report that about 95% of the ~$6 billion in BTC spot trading activity reported by CoinMarketCap was fraudulent. Additionally, a July 2022 piece by Kaiko highlighted a huge increase in Binance’s volume after trading fees were eliminated, which is a telltale sign of wash trading.

NFT Industry: 2022 and 2023

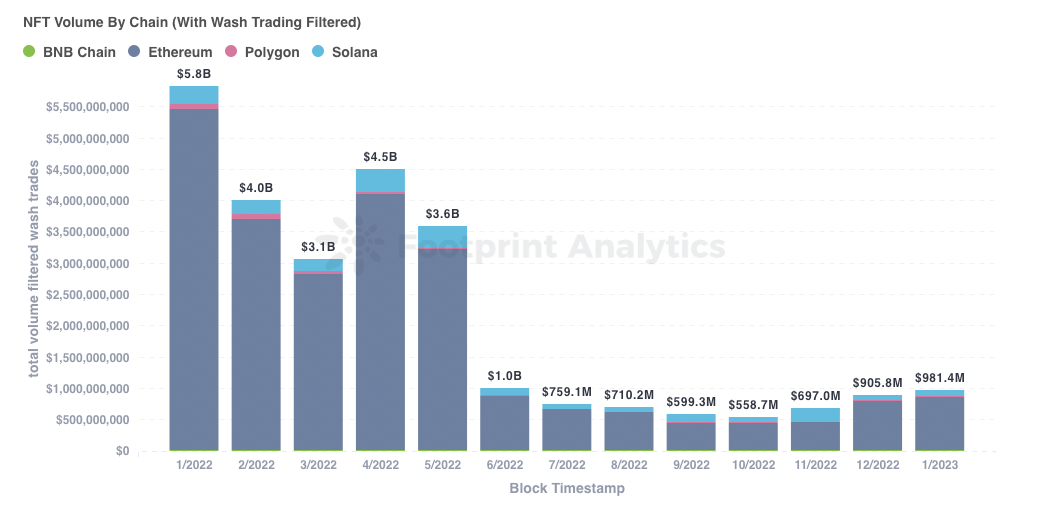

While alt-L1s like Solana, Binance Chain, Polygon, Tezos, and even now Bitcoin, have blossoming NFT communities, they still pale in comparison to the Ethereum market. Ethereum’s stranglehold on NFT volumes can be clearly seen in the chart below.

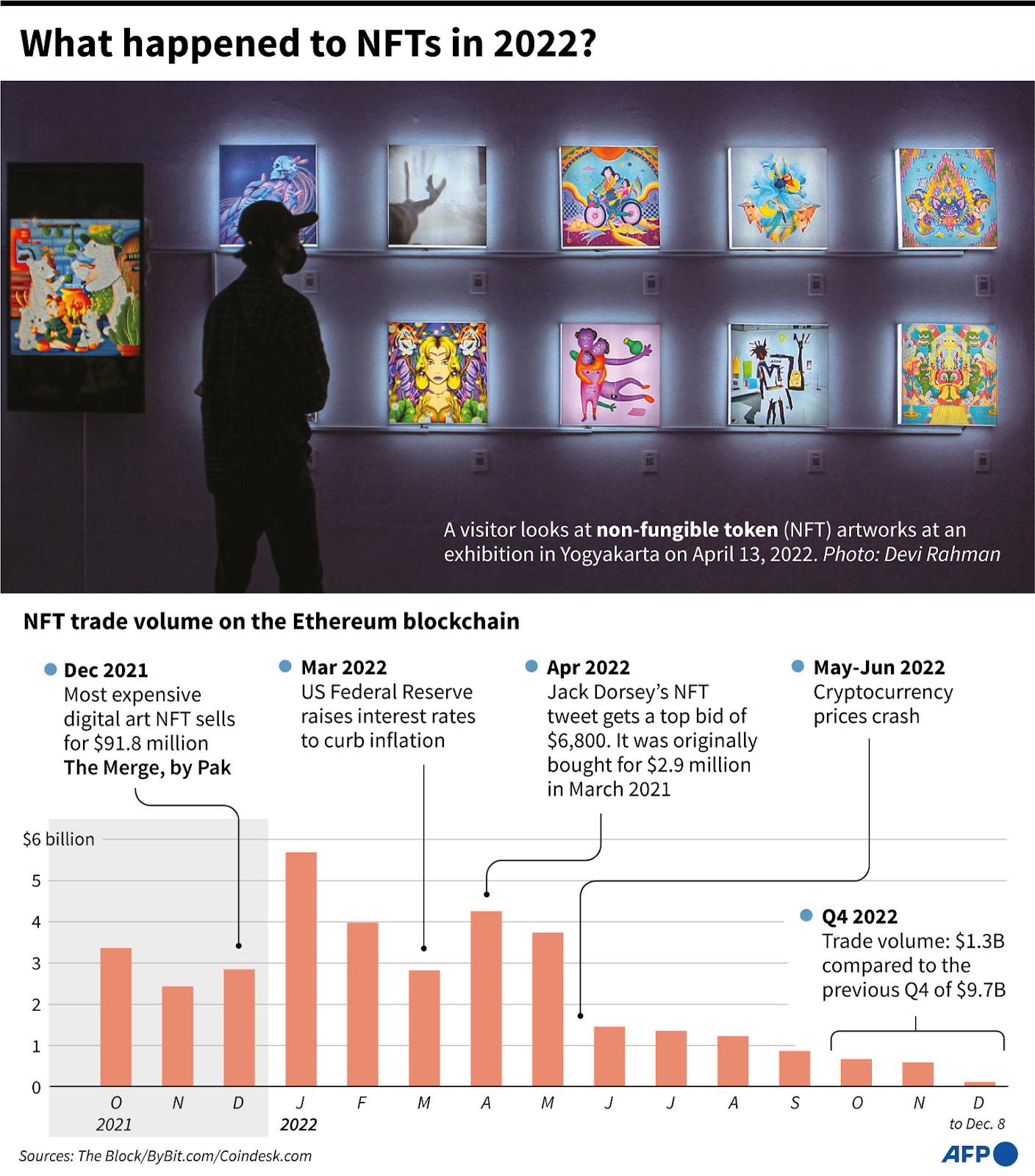

What can also be seen in the image is the severity in the decline of NFT volume over 2022. The NFT market is currently experiencing its first bear market, with NFT trade volumes across the top chains plummeting 90%+ from $13.2 billion in Q1 to ~$1.5 billion in Q4 2022. NFT users also roughly halved throughout the year.

However, despite the contraction on the retail side, companies and enterprises entered the space in droves.

The onboarding of Web2 companies into crypto can largely be attributed to Polygon and Polygon Studios. Polygon Studios = collaborates with NFT marketplaces and NFT projects on the Polygon blockchain. More than 100k gamers and over 500 apps have been onboarded into Polygon Studios thus far, with additional partnerships announced with major crypto projects, such as The Sandbox, Decentraland, and OpenSea, as well as with legacy gaming brands, such as Electronic Arts, Atari, and DraftKings.

Some of Web2 and retail’s biggest names have decided to attach their names to Polygon. Below are samples of representative partnerships with brief explanations:

- Instagram users can share their NFTs on the Ethereum and Polygon networks

- Starbucks has collaborated with Polygon to develop its Web3 experience, Starbucks Odyssey

- Mercedes-parent Benz’s firm, Daimler Group, has teamed with Polygon to develop a blockchain-based data-sharing system

- Polygon and DraftKings have entered into a strategic partnership. DraftKings will use its digital sports expertise to introduce NFTs to an entirely new audience. DraftKings operates the 12th-largest validating node on Polygon, having invested slightly under 55 million MATIC

- In January 2023, Polygon and MasterCard teamed up to create an artist incubator that’ll use blockchain and NFTs

- Reddit, the largest social networking community, has successfully onboarded over 4 million users to Web3 with the debut of Collectible Avatars on the Polygon network

NFT Trading Platforms

OpenSea and Magic Eden

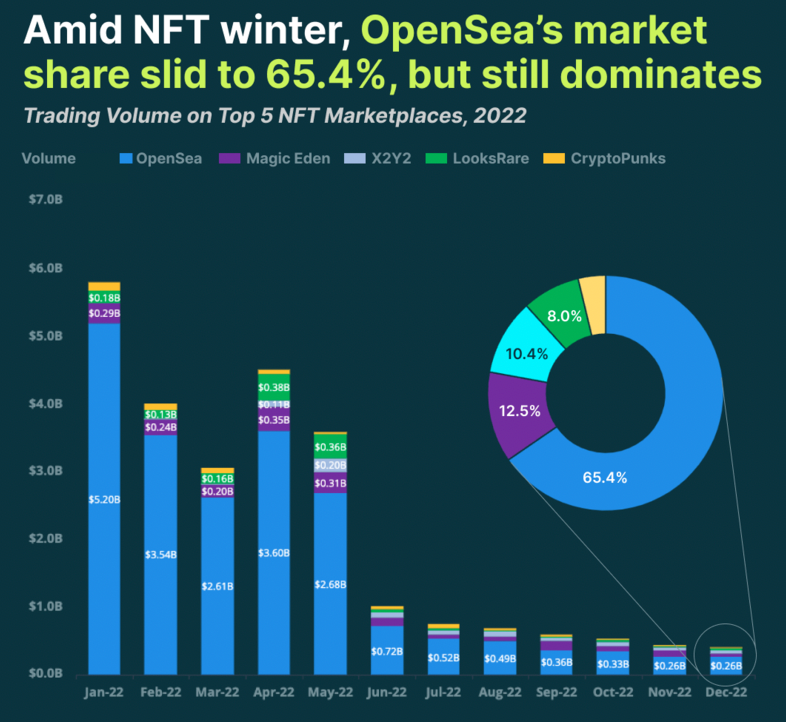

Industry leader, OpenSea, maintains ~66% market share of NFT trading volume, excluding wash trades. Solana, Magic Eden, gained popularity in 2021, taking a ~13% share of trade volume by the end of 2022. However, this is an overall decline from a high of ~24% market share. This was even before top NFT projects, y00ts and DeGods, left Solana in January 2023 for other chains.

LooksRare

LooksRare was founded in January 2022 as a direct challenge to OpenSea’s market dominance, with the objective of creating a completely decentralized and uncensored marketplace. In keeping with the ethos of Bitcoin and crypto, the creators remained anonymous under the identities Zodd and Guts.

The full decentralization involved the distribution of 100% of the platform’s revenue to users using the project’s token, $LOOK. On January 10, $LOOK was airdropped, and by the following day, sales on the platform had surpassed $115 million, surpassing those of OpenSea. The temporary flash of volume and users was fueled by the desire to obtain airdropped coins.

Since Q1 2022, LooksRare has succeeded in obtaining a substantial portion of OpenSea’s market share. However, the average price of NFTs traded on LooksRare is substantially greater, and the number of monthly traders is significantly lower. This suggests the practice of wash-trading, which is discussed in further detail below.

Blur

Released in Q4 2022, Blur is an NFT marketplace and aggregator that enables users to compare across marketplaces, manage their NFT portfolios, and purchase NFTs all on the same platform. The VC-backed NFT marketplace boasts that users may purchase NFTs in bulk or “sweep the floor” 10 times faster than on other sites.

In January 2023, the market share of Blur surged dramatically, up to ~30%. According to a team statement, crypto market participants believe Blur’s price increase is related in anticipation of the debut of its native coin, which launched Feb. 14.

NFT Wash Trading

NFT wash trading is similar and fundamentally distinct from the wash trading of fungible tokens. The trading volume (usually measured in USD equivalent value of the total amount traded within a given time period, typically 24hrs) of fungible assets is supposed to indicate the liquidity for the asset. For NFTs, there isn’t the same idea of liquidity, since each NFT is unique. The liquidity of NFTs in this sense is either totally absent or totally liquid (0 or 1, by analogy), as opposed to being on a continuous spectrum. With a specific NFT, either the owner wants to sell it, or they don’t. Wash trading NFTs is essentially the same practice of buying and selling the exact same token, though the “volume” analogy isn’t as relevant as the price for which the token is sold.

NFTs typically represent some claim on a digital or physical good. This can cause issues, from a business and property ownership perspective, when the digital good is hosted on a website since there isn’t necessarily any meaningful sense in which one owns that digital good. However, to the (limited) extent that NFTs represent claims to ownership of art, physical or digital assets NFTs can be understood to be similar to conventional markets. Asking the price for a piece of art is similar to asking the length of a piece of string in that it depends on how much someone is willing to pay for it (“this piece of string is 10cm long”, “somebody bought this NFT for $50”). Whereas other token markets can perhaps be argued to have economics that facilitates something resembling traditional fundamental analysis for equities and there are relatively well-established and intuitive means of evaluating the business model and unit economics.

NFTs can be very speculative assets. Former President of the United States, Donald Trump, recently sold a set of NFTs, and their value has dropped off a cliff by about 75% in a matter of days after their sale. Many NFT projects are shameless cash grabs, and the FBI has investigated some rug-pull-type NFT projects. The motivation for manipulating the price of NFTs is essentially exactly the same. Though some NFT platforms that charge commissions or trading fees also stand to gain from having users being active on their platforms, even if those users share ownership of the same addresses, and funds and/or are simply buying and selling NFTs between themselves at increased price points and splitting any associated costs before selling at an artificially inflated price.

A key insight with regards to NFT-specific wash trading is that NFTs are supposed to represent ownership of something reasonably unique and worth owning in and of itself, hence the unique identifier and representation of a claim to ownership (note the careful wording there in relation to the above-adumbrated concerns re: property rights and commercial rights). That is to say, if an NFT is sold multiple times in a short period of time, then it’s probably obvious that the people buying and selling it aren’t actually very interested in owning it, which leads to obviously reasonable doubt about the “sale” prices bearing on the value of the underlying asset.

At the end of the day, NFT wash trading will become less of a problem on a per-marketplace basis as NFTs come to have meaningful utility.

The Evidence

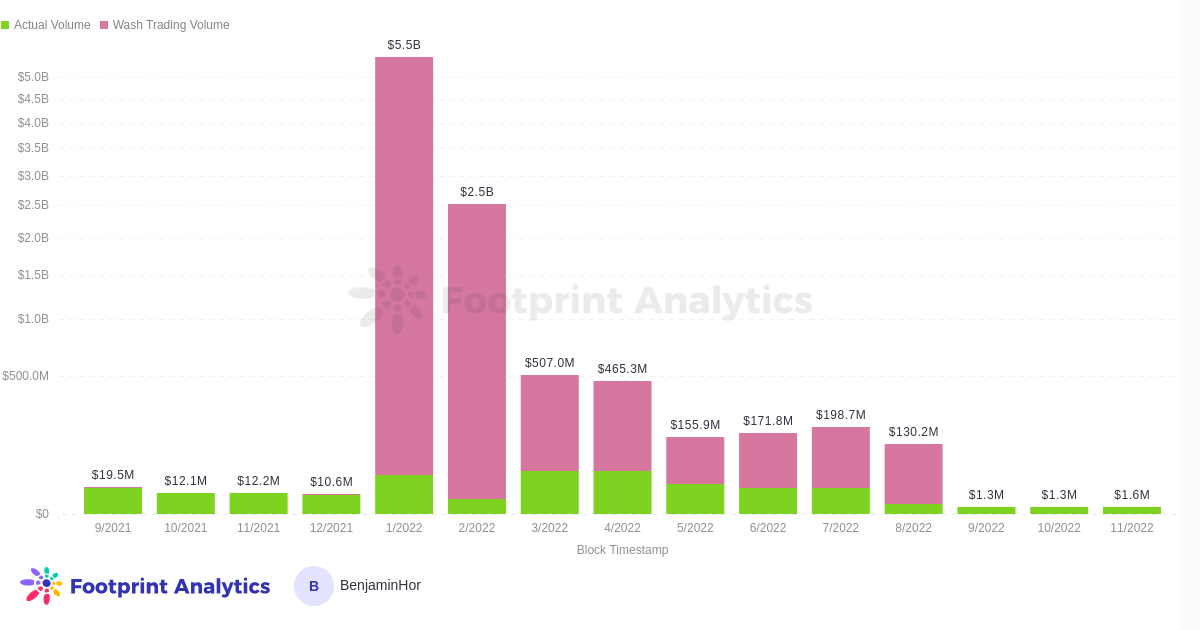

There is reason to believe that NFT wash trading accounts for the vast majority of NFT “value” on the markets if one is being undiscerning and simply counting the figures quoted in the press. Some researchers have argued (and presented reasonably compelling evidence) that 99% of trades for top NFT collections were wash trades before marketplaces eliminated royalties, after which the wash trading died overnight.

The study found, using four specific filters in its methodology:

- Overpriced NFT trades (10x OpenSea Average Price)

- Collections with 0% royalties (except CryptoPunks and ENS)

- An NFT bought more than a normal amount of times in a day (currently filtered for more than 3+)

- An NFT bought by the same buyer address in a short period (currently filtered for 120 minutes)

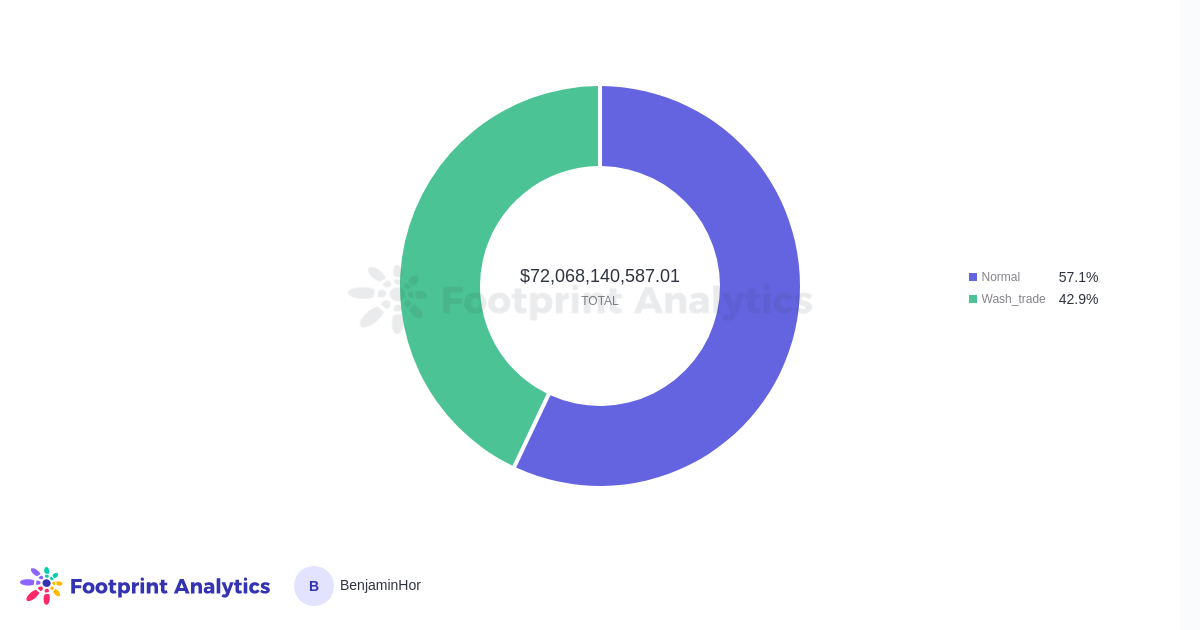

These filters identified $31B of NFT trading volume as wash trading, or roughly 43% of all ETH NFT trading in 2022.

The Why?

Every NFT marketplace is affected by wash trading. However, the biggest offenders were LooksRare, X2Y4, Element, and Sudoswap. Coincidentally (or not), all three of those NFT platforms have their own token that is (or was) utilized as a trade incentive, making the source of such high inorganic quantities abundantly evident.

Rarible was one of the first companies to project to reward active users with their token ($RARI), but others soon followed suit. In January 2017, LooksRare made the $LOOKS token an integral part of their strategy, and X2Y2 quickly followed suit with the $X2Y2 token.

People rapidly learned that manipulating these token incentive programs may be a lucrative trading technique. According to Chainalysis, certain wash traders have done exceptionally well, with 110 addresses together making $8.9 million in profit.

Footprint Dashboard and Detection Methods

Footprint Analytics provides API and visualization tools to uncover and visualize data across the blockchain, including NFT and GameFi data. It currently collects, parses and cleans data from 20+ chains into structured and semantic tables, making it easy for anybody to empower their decisions with Web3 data.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.