The ranking of cryptocurrency by market cap is by far the most discussed metric for evaluating success. But is there another indicator that we should also be thinking about?

According to Alexa rankings, the most popular crypto website is coinmarketcap.com. Today it sits in the top 400 websites globally, but during the early months of 2018, it was briefly up in the top 100 most viewed websites in the world.

One of the issues of using market cap as a metric to determine the success of a project is that it does not take into account any potential liquidity to maintain a certain asset price.

Over the years, we have seen many new projects quickly shoot up the market cap rankings based only on a few trades on an obscure and low-volume exchange.

Another issue is that market cap has nothing to do with the amount of money invested in a project. It only shows the perceived value of the market, and it is a poor metric to gauge the flow of funds in and out of a given ecosystem.

For these reasons, a much better metric to use is market liquidity. The data from coinmarketbook.cc tracks exactly this.

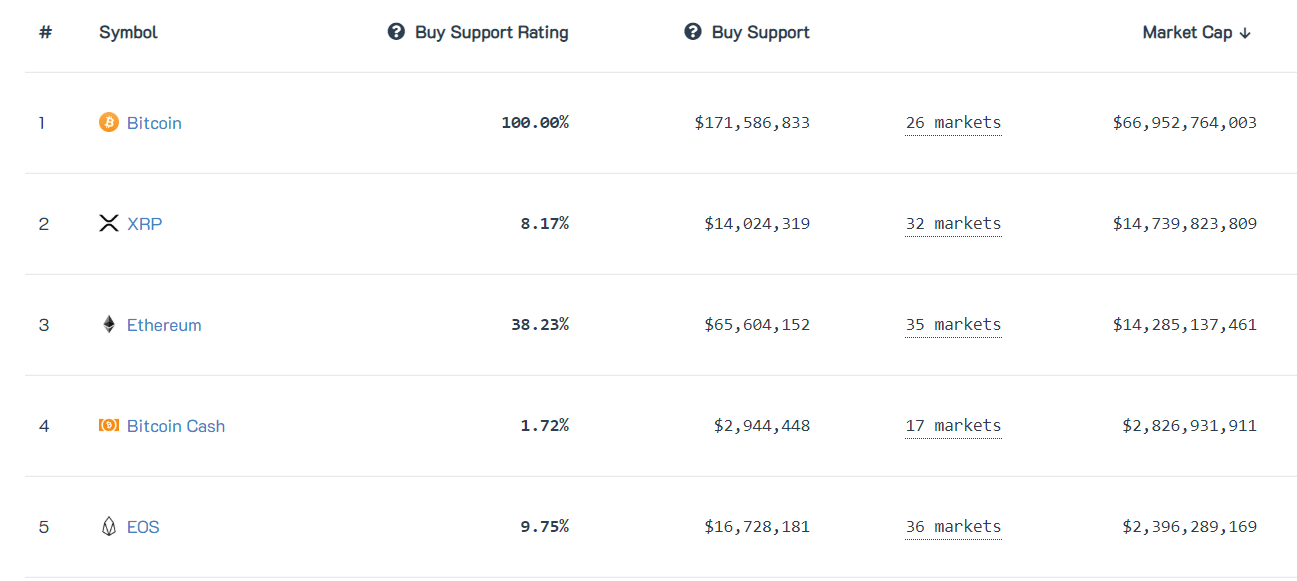

The website tracks “Buy Support” for each cryptocurrency. It does this by working out the “sum of the buy orders at 10% distance from the highest bid price.”

The website sources data from major exchanges including BitMEX, Binance, Bithumb, Bitfinex, OKEx, Huobi, Bittrex, Poloniex, Kucoin, and Cryptopia. The data also takes into account both spot and leverage liquidity and also makes the buy support calculation based not just on USD, but altcoin liquidity also.

Another novel indicator used by the site is the “Buy Support Rating” column. This is calculated as a percentage by taking the given buy support of any altcoin relative to BTC.

As you can see in the snapshot of the data above, even though Bitcoin dominates with over 50% in terms of market cap (compared to all other projects), it has a much bigger lead in terms of buy support, with over $170 million available to buy for up to 10% below the current traded price.

In second place on the buy support rankings is not Ripple (XRP), but Ethereum (ETH). Ethereum has 38% of Bitcoin’s buy support compared to just 8% for Ripple. In fact, even EOS has more buy support then XRP – a project with over six times less market cap!

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire