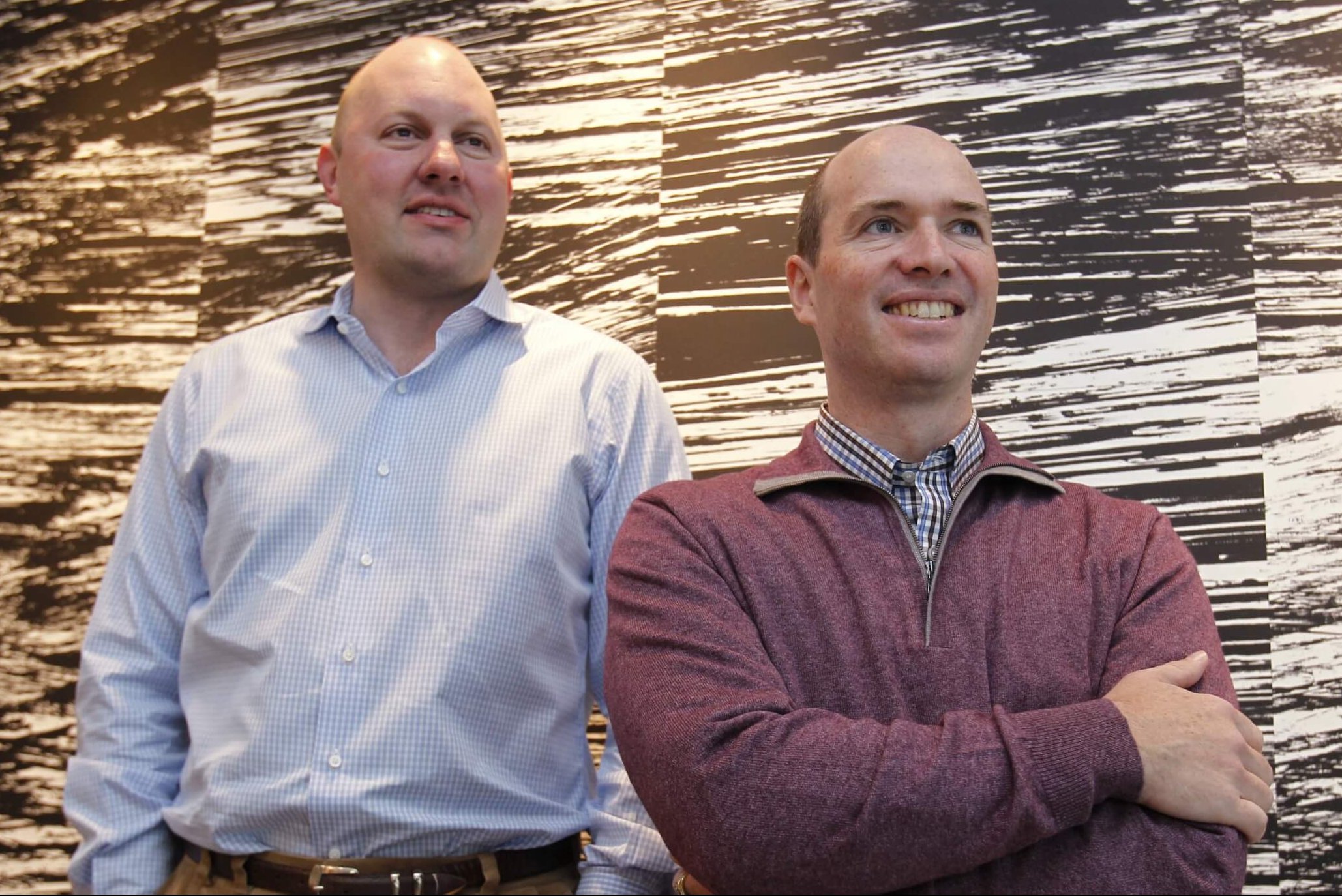

Marc Andreessen and Ben Horowitz

American venture capital giant Andreessen Horowitz looks set to give mass adoption of cryptocurrency a further boost by investing an enormous $1bn into the technology behind Bitcoin.

In a Coin Rivet article for the Daily Express, the Californian company has said it will be turning its investment focus directly on to digital assets and the blockchain programming that underpins them.

Also known as ‘a16z’, the mainstream institution is gearing up to prioritise crypto holdings across its portfolio in a move that will add confidence to the future use of online currencies like BTC and Ethereum.

Andreessen Horowitz has an almost intrinsic connection to Bitcoin – both were born from the ashes of a financial crash in 2009 with a desire to disrupt the financial world.

It’s this ‘natural fit’ with cryptocurrency which is creating a degree of excitement among financial gurus keen to see bridges being made across the chasm that appears to exist between fiat and digital currencies.

A mainstream venture capital organisation pumping such a colossal sum across the void may just be the solution.

Andreessen Horowitz already hinted at the potential move last year when co-founder Ben Horowitz labelled Bitcoin as the “leader in store value”.

“The thing that’s deceptive about it is when the new platform at the time is generally worse, in most ways, than the old platform, but has some new capabilities,” he said.

“With crypto, it’s very similar in that it’s worse in most ways than the old computing platform.

“And it’s slow. It’s really complex. It’s lacking a lot of features. But it has one feature that has never existed before – and that’s trust.”

In the build-up to crypto and blockchain investment, it is understood a16z staff across Silicon Valley are currently undergoing financial checks and declaring any digital asset holdings prior to further announcements.

Pointing towards the step into cryptocurrency, one of the a16z partners – Margit Wennmachers – said: “As a firm, we have this massive ambition to be the best investor – period – and want the flexibility to invest in what we think is the best investment.”

Andreessen Horowitz was founded by Marc Andreessen and Ben Horowitz in 2009, and is headquartered in California’s Menlo Park. The company focuses on early-stage start-up investments across the gaming, e-commerce, mobile, education, and enterprise IT industries.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire