Facebook’s plans for a new digital cryptocurrency have set the entire world on fire. From governments to central banks and even crypto enthusiasts, no one seems to be happy with Libra coming to disrupt the payments industry.

Some analysts agree that Libra could have positive effects for end users. The general opinion, however, is that nothing good can come out of Libra and the benefits aren’t worth the risks.

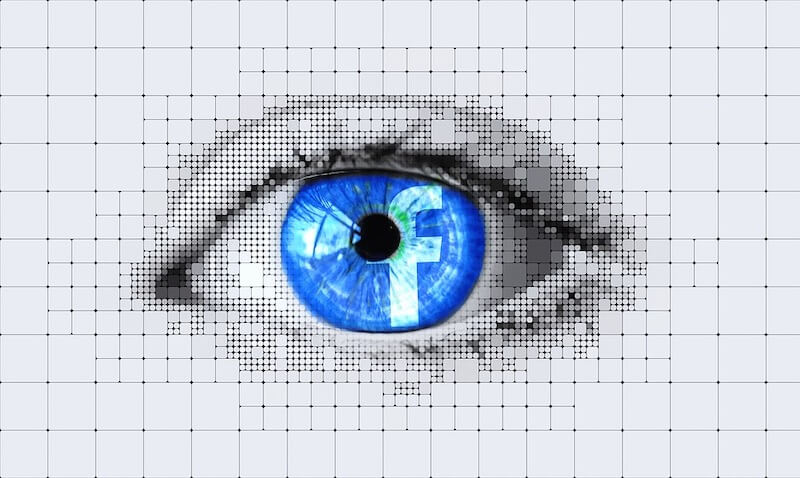

So why is everyone so concerned about Libra and its possible effects on the global financial system? From privacy issues to money-laundering, analysts and experts have a wide range of reasons to position themselves against Facebook.

Check out these three warnings from prominent finance experts.

This argument comes from the Bank for International Settlements (BIS). According to the Guardian, the BIS admits the potential benefits of Facebook’s Libra, but also warns that the network involves too many risks. Most of these risks could occur due to a lack of clear legislation regarding cryptocurrency-based payment systems worldwide.

Bank representatives believe that there’s a high risk of data privacy issues when people adopt digital currencies outside the traditional financial system. Economic adviser Hyun Song Shin – also head of research at the BIS – believes that private initiatives like Facebook’s should have tight regulations. This way, governments could encourage competition in the market and avoid money-laundering and other illegal activities.

Hyun Song Shin emphasised that without clear laws, Facebook’s Libra could put too much power in the wrong hands. The economic adviser stated:

“If even modestly successful, Libra would hand over much of the control of monetary policy from central banks to these private companies. If global regulators don’t act now, it could very soon be too late.”

Banks may fear a little competition, but that doesn’t mean their concerns aren’t reasonable. Facebook has had a long history of privacy violations, with the company currently under federal privacy investigation. Allowing Facebook to handle cryptocurrency wallets may not be the wisest idea after all.

European Data Protection Supervisor Giovanni Buttarelli explained the risks to Business Insider:

“It would be deeply concerning, for example, for a company with access to massive volumes of personal information, gathered through its social media platforms and communications services, to be able to combine this information with the tracking of online digital purchases.”

According to Bloomberg, German MEP Markus Ferber warned that Facebook could become a “shadow bank” with over two billion users. The politician also said that Libra should “set off alarm bells for regulators”, who should remain vigilant.

The concerns are understandable, as Facebook aims to create more than a simple stablecoin. The tech giant has expressed its intentions to build a platform able to support all types of financial products, including loans and credit.

Even if a regulated institution were to power the system, the operations would still occur outside traditional banking. So, it could host unregulated activities in the absence of proper controls.

Facebook’s Libra is designed to be different from Bitcoin and other cryptocurrencies. Digital coins today are still often used for market speculation rather than regular payments. What Facebook is looking to achieve is billions of people transferring money through apps like Messenger and WhatsApp, outside the regulated banking system.

The discussion is complex, and many European leaders have expressed their concerns over how Facebook’s Libra could affect the global economy. France’s Finance Minister Bruno le Maire has asked G7 central banks to compile a report on the risks of Libra’s launch. The primary concern is apparently financing terrorism.

Facebook’s Libra is struggling to find support in the crypto ecosystem as well. Many developers and founders of blockchain-based start-ups criticise Libra for not being a decentralised project.

While some crypto enthusiasts like the idea of a cryptocurrency-based network for international payments, many of them can’t ignore the dark side of Libra. This is largely because Facebook’s network won’t be decentralised.

The project requires the founding consortium to validate all transactions. This is a way for the new blockchain to scale up faster and to increase transaction speeds. But the approach goes against the core concept behind cryptocurrencies – which are based on decentralisation and anonymity.

Phil Chen, crypto chief officer at HTC’s blockchain-driven Exodus project, says that Libra is at polar opposites from what Bitcoin represents. The expert stated for the Financial Times:

“This global coin is the most invasive and dangerous form of surveillance they have devised thus far.”

The idea of putting social media and wallets together has won over the 28 giants that will form the Libra Association. Among the impressive list of partners for Facebook’s Libra are PayPal, Visa, Mastercard, Coinbase, and Women’s World Banking.

However, even with the reputation of all these brands together, Facebook seems to be having a hard time fighting against the lack of trust from authorities.

No one denies that Facebook’s Libra has real potential. However, finance experts, banks, governments, and even cryptocurrency advocates agree that the project, as presented by Facebook, doesn’t – and shouldn’t – serve the world as a whole.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire