You may have read the paradox already. How is the second biggest cryptocurrency by market cap also one of the most unpopular within the space? Surely, the price would be much lower if Ripple or XRP was unpopular? However, this paradox can be explained. To do so, let’s examine a couple of key differences in the ethos of XRP and Bitcoin.

Bitcoin (if you ignore the charlatan Craig Wright) is attempting to subvert the current economic system. To do this, they aim to replace a fiat-based system relying on banks with a cryptocurrency-based system built upon a peer-to-peer network with no central intermediary. Ripple, the company, and its token, XRP, is the most business friendly of all the cryptocurrencies. They want to make bank transfers quicker and cheaper with an ambitious goal of improving or even replacing the current SWIFT system.

Think of it another way, where the banking industry is replaced with the film industry. Did you ever use torrents to download a film or music? If yes, then you were downloading the file from numerous people over the internet for free, rather than from a direct source like Blockbuster. Torrenting was a peer-to-peer network that removed the need for a central intermediary. Before torrents, if I wanted to buy or rent a film, I would have to go through a central authority like Blockbuster or go to the cinema. Torrenting is similar to Bitcoin. XRP, on the other hand, is like Netflix—rather than breaking the film industry all together, they believe they can make an improved version whilst keeping the overall structure.

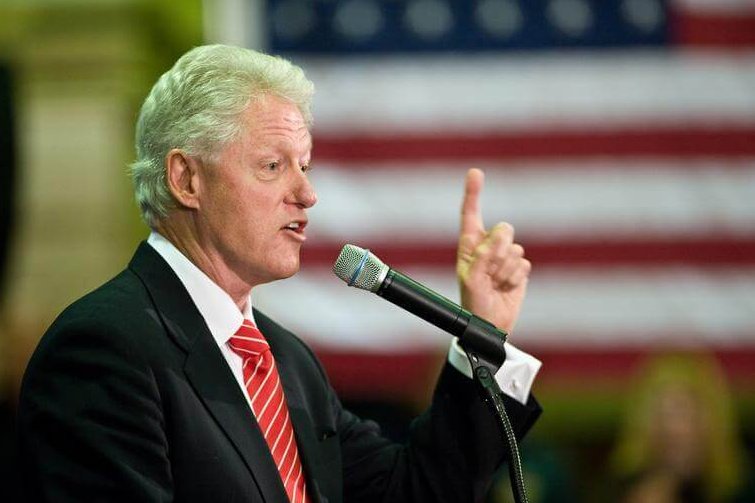

This is the first key issue many have with XRP. Banks, for many involved in crypto, are the enemy. To be working with them is a form of heresy. Ripple isn’t afraid of being associated with the status quo. This was epitomised with their recent conference where the keynote speaker was none other than Bill Clinton, the former President and well known crypto expert…

My sarcasm could easily be construed as cruel (or even totally missed through the medium of the internet). Imagine for a second if Bitcoin or another cryptocurrency managed to entice someone as influential or famous to speak on their behalf. No doubt there would be hype of some kind. We can raise our eyebrows at such PR. Yet, there is no denying that getting Clinton to speak is a level ahead in promotional terms. Of course, those within the general cryptocurrency camps would despise having Clinton, or anyone of the political elite, near their cryptocurrency.

Partnerships have been formed, or rumoured to have been formed, with many of the well-known banks. Usually this comes in the form of a bank suggesting that they’re investigating the possibility of using the platform. Concrete partnerships are still lacking though, leading to criticism from other members in the crypto space. This doesn’t stop the #XRParmy from pushing a certain level of hype though.

Another criticism levelled at Ripple and XRP is accusations of centralisation. Ripple, the parent company, hold around 60% of XRP. This has been locked in escrow for now in an attempt to reassure the public that there will be no mass sell off. However, for a supposed decentralised token, this is far from ideal. The XRP army often counter this with the same accusation of Bitcoin. The mining of Bitcoin has predominantly come from the Chinese market. However, Bitcoin has proven examples of decentralisation as clear from the User Activated Soft Fork. Those in favour of a certain level of centralisation will argue that sudden drop offs in price can be protected. Ripple has gone further by claiming that XRP is more decentralised than Bitcoin.

These are but two key differences between Bitcoin and Ripple, and this goes some way to explain why XRP is the black sheep of the cryptocurrency community. As we continue to analyse Ripple and XRP, we will no doubt see further debates, including the more recent one, what is the difference between Ripple and XRP?

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire