Bitcoin Cash (BCH) has seen a decline of 3.5% over the last 24 hours, as crypto markets go into the red following Bitfinex and Tether accusation coming from the New York Attorney General’s office.

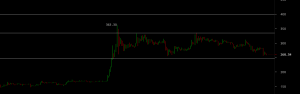

Following the asset’s break down from $280, the first major Bitcoin fork found critical support above $250 as price traded down to $254 on the Bitstamp exchange. If the support can hold this level, then we can expect to see price trend within the channel between $250 and the $330 resistance line that has held strong on a number of occasions since the early April move upwards.

Rumours of Bitmain stepping away?

https://twitter.com/btcking555/status/1121699148523352064

A new potential rumour surfacing from BTCKING555, reveals that “Bitmain is stepping away from BCH project”. In the rumour, it is also mentioned that Micree Zhan (Chinese billionaire businessman and Bitmain co-founder) was also not wanting to be anywhere near this failure and that the former CEO Jihan Wu is now on his own.

This new rumour comes on the back of reports that Bitmain’s revenue projections for Q1 are down over 90% from 2018. This will be adding more chaos to their ever delayed IPO, for the firm heavily invested in the Bitcoin forked project.

Losing momentum

Unlike Bitcoin which reached new yearly highs above $5,600 on April 23rd, Bitcoin Cash followed suit with other large-cap altcoins such as Litecoin, Ethereum and Ripple to only make a lower high of $315. Looking at other momentum indicators such as the daily RSI, BCH is now trading below 50 in an indication that price is further consolidating from its RSI daily high of 94, as seen on April 2nd.

Given that daily trading volume has been constantly hovering between $1-1.5 billion, it does look like open interest has returned back to the market following a prolonged period of daily volume under 0.5 billion throughout the months of February and March.

At the moment it looks like most the alt-market are waiting for BTC to set the short term direction for the crypto markets. If traders are looking to ‘buy any dips’ upside, profit targets will be between $300 and $330 for BCH if we see a continued push up and retest of overhead resistance.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.