There will only ever be 21 million Bitcoins. At the time of writing, just over 17.8 million BTC have already entered circulation, and the network has a strict (and predefined) issuance schedule to reach the 21 million limit by the year 2140.

In this article, we examine the technological and economic factors that protect the decentralised network’s scarcity factor.

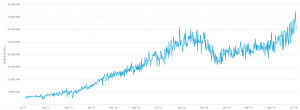

$2.3 billion in online mining hardware

The Bitcoin mining hash rate has once again hit a new all-time high, this time peaking at 75,000,000 TH/s. Based on estimates from Litecoin founder Charlie Lee’s September 2018 conference talk in San Francisco, the current SHA-256 hash rate for Bitcoin translates to around $2.3 billion in online mining hardware for the hashing network.

Hourly costs to keep this mining network online and operating (based on a $0.10 per kWh electricity cost) come to around $700,000 in electricity expenses alone.

The mining network is responsible for hashing ‘pending’ Bitcoin transactions into new blocks (approximately every 10 minutes). Miners are rewarded with transaction fees and, of course, the new BTC issued into circulation as a mining block reward.

This mining infrastructure can be seen as a defence against so-called 51% hash rate consensus attacks. As the hash rate rises, this type of attack becomes ever more expensive to pull off in terms of both the procurement of billions of dollars worth of SHA-256 mining infrastructure and also the hourly costs to sustain an attack on the network.

9,957 network nodes

Each new block is validated by a network of geographically-dispersed full Bitcoin nodes.

According to the network tracker at bitnodes.earn.com, we can see that there are currently 9,957 reachable and in-consensus Bitcoin nodes online on the network. Each node holds a full historical record of the Bitcoin blockchain (or every Bitcoin transaction ever processed) and validates each block mined by hashing the network.

One key consensus rule that each node validates against is the number of Bitcoins in circulation and the strict issuance schedule of mining block rewards. During the first four years of Bitcoin’s existence, the issuance schedule was defined as 50 BTC for each block, or approximately 300 BTC in new Bitcoin supply each hour.

Hard-coded into the nodes’ consensus rules, it states that after every 210,000 Bitcoin blocks since inception, the issuance schedule is cut in half. This happened for the first time on November 28, 2012, and then again on July 9, 2016 as Bitcoin’s block reward was cut to first 25 then 12.5 BTC.

If a miner were to produce a block that invalidated these rules (like paying themselves an incorrect block reward), then the node network would reject this block – with the energy and hardware required to mine this block being completely wasted.

Protecting consensus rules

The consensus rules for supply are protected by the nearly 10,000 network nodes validating the live hashing network which is responsible for processing Bitcoin transactions and issuing new Bitcoins into circulation.

As we enter a new age of digital assets, scarcity and a limited supply are key properties that can give tokens like Bitcoin value on its decentralised and immutable network for payments.

As the network hash rate and node count both continue to increase, this only reaffirms and strengthens the operational factors that govern the supply schedule to make Bitcoin the world’s biggest (and most protected) digitally-scarce asset class.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.