The total value locked (TVL) on Ethereum Layer-2 solutions has breached the $3bn barrier as DeFi ‘degens’ and Ethereum enthusiasts seek lower gas fees and lucrative DeFi opportunities.

According to data from L2Beat – an L2 comparison platform – the total TVL on Layer-2 solutions now stands at more than $3bn, with Arbitrum contributing to $2.2bn – almost 75% – of the total TVL. Data also shows that the daily transaction volume was about 267k yesterday – a growth rate of over 250%.

Most of the capital was deposited to the Arbitrum mainnet via the Arbitrum bridge over the previous weekend, with the TVL jumping a considerable amount from $980m on Friday to more than $3bn today.

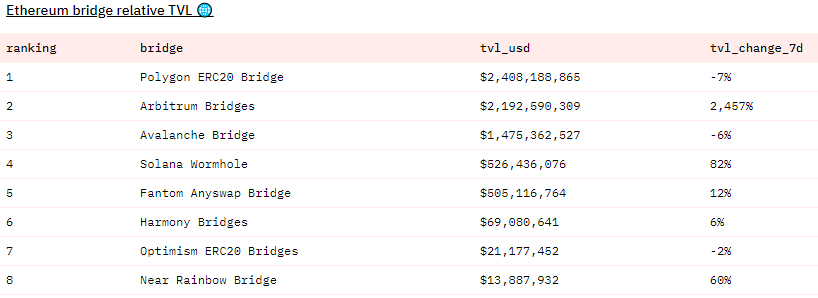

Arbitrum has seen an incredible surge in deposits on its bridge, which allows users to deposit Ethereum via Metamask to the Arbitrum mainnet. Data from Dune analytics shows that the TVL of the Arbitrum bridge has now ported close to $2.2bn in assets and has recorded a seven-day change of 2,457%

Users can deposit funds from Layer-1 to Layer-2 solutions via ‘bridges’, which simply connect assets like ETH, WBTC or stablecoins to the solutions mainnet. Currently, the funds cannot be bridged back until seven days later.

Additional data shows that across all bridge deposits made, ETH and WETH have contributed to 37% of the value ported over, equalling an estimated $2.6bn. Being an Ethereum Layer-2 solution, and with most projects using ETH as the major currency for determining yields and swaps, it’s estimated that a vast majority of assets bridged via Arbitrum have been ETH or WETH.

Much of the TVL on Arbitrum appears to be secured via ArbiNYAN, a yield farming platform that is currently providing DeFi degens with extremely high yields and farming opportunities.

Based on data from DefiLlama, ArbiNYAN secures more than $1.4bn in ETH and its native token NYAN, which equals almost 50% of all TVL on Arbitrum.

Additional data from DeFiLlama shows that ArbiNYAN dominance sits at a staggering 88% and remains the leading project on Arbitrum. Surprisingly, the TVL of ArbiNYAN far eclipses that of the UniSwap and SushiSwap protocols on Arbitrum, which only secure $27m and $21m respectively.

Arbitrum way ahead of the competition

The closest competitors to Arbitrum are dyDx – an L2 exchange – and Optimism, another L2 platform. The TVL on these platforms equals a respective $330m and $155m, with their market share being remarkably lower than Arbitrum’s offering.

The release of Arbitrum was much-anticipated with the Ethereum community and has secured a number of high-profile DeFi platforms including Aave, UniSwap, Bancor and Synthetix. The interest in the project is additionally reflected in its market dominance and gradual adaptation within the DeFi space, with many other leading platforms and exchanges expected to offer an Arbitrum-based product in the future.

Arbitrum is a Layer-2 rollup solution, which means that transactions are handled ‘off-chain’. This works by handling the transactions on an external Layer-2 network – in this case Arbitrum – and then posting the transaction data on a Layer-1 network like the Ethereum mainnet. Layer-2 solutions were introduced to the Ethereum ecosystem to tackle rising gas fees and scalability issues that the current Etherum offering faces,

Known as optimistic rollups, layer-2 solutions like Arbitrum work under the assumption that transactions are “honest” and do not require further input to prove their validity. By utilising this method, Arbitrum can be scaled to a greater degree, greatly reduce fees for users and post faster transaction completion.

Data from L2fees shows that the average transaction cost on a Layer-2 optimistic rollup like Arbitrum and Optimism is considerably lower than existing Etheruem gas fees, with the average cost of a transaction currently around $2. Additionally, Arbitrum and Optimism are currently being throttled as they’re in ‘beta’ stages following their recent release, meaning that once unleashed, fees should fall even further.

Further growth is expected for Arbitrum as developers continue to build innovative DeFi platforms, with many anticipating that Arbitrum could eventually overtake existing Layer-1 solutions in DeFi TVL. Data from DefiLlama shows that Arbitrum sits at number six in TVL rankings, recently overtaking Fantom and Tron, and catching up to other platforms like Avalanche, Polygon and Terra.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.