At the time of writing, EOS has been performing quite well, especially against Bitcoin. This follows a terrible plummet that started at the beginning of May 2018, when the price of EOS/BTC was touching 24,000 satoshis, a record high for the coin.

At the moment, EOS price is recovering, and the 20-day EMA is crossing both the 50-day EMA and the 200-day EMA respectively. Volumes have increased since the beginning of 2019, which might mean some positive price movement is on the horizon for EOS in the next few months.

The price of EOS has been following the bearish market trend, and it makes sense it’s losing its battle against Bitcoin, for the simple matter of trust. Investors are way more likely to bet heavy on Bitcoin during bear markets than they are on altcoins, even though fundamentals could point to good investment opportunities.

I’m going to assume you’re familiar with how EOS works, so I’ll ignore its technicalities here. You can read a detailed guide on its inner working mechanics here.

Just to give you a reference point in case you’re unaware, the goal of EOS is to be (more or less) like Ethereum, as in a decentralised world computer.

The key difference between both is that while the first uses a more centralised consensus mechanic called DPoS (or delegated proof-of-stake), the latter uses PoW (proof-of-work) much like Bitcoin, as PoW is the consensus mechanism that promotes the most secure and decentralised systems.

However, as the goal of EOS is not to compete with Bitcoin, some crypto-enthusiasts (and experts like Vitalik Buterin) argue that it makes little sense to lose so much efficiency to maintain so much decentralisation and security. By making the whole system considerably more centralised than Ethereum or Bitcoin, EOS promoted massive amounts of scalability. In essence, they built one of the first truly scalable blockchain solutions.

If we compare EOS to Ethereum, this is the result in terms of performance: about 80x more transactions per second (TPS) and blocks get forged 13x faster.

| Purpose of token | TPS | Confirmation time | Consensus algorithm |

| EOS – to become a network validator and to vote for network validators | 1,000-

4,000 |

1.5 seconds | DPoS |

| ETH – to be used to pay fees for computations in a world computer | 50 | 20 seconds | PoW |

Of course, this data comes prior to Ethereum’s Constantinople update and the move of its consensus algorithm to PoS (proof-of-stake), which is coming soon. Still, EOS is also upgrading and improving its network performance.

EOS issues

Some problems have arisen from all these performance gains and due to the fact the EOS network is considerably more centralised than Ethereum.

Some of the most worrying are:

- The network is growing too big: At the time of writing, the EOS blockchain is four terabytes in terms of size. One of the issues with this is that, due to the fact users tend to access recent data, block producers aren’t keeping the full history of the blockchain. Apparently, only two block producers have the full blockchain history. This can obviously be problematic, as if there are no incentives for nodes to keep historical data, they simply won’t. That leads to an exponential centralisation of the network which can result in a third party controlling most of the data and, potentially, forging power.

- Lack of rewards could damage the network: If there aren’t’ enough rewards and incentives for block producers, as discussed above, then they won’t have an incentive to forge all transactions. This could in turn lead to some serious issues around social centralisation and collusion.

Still, EOS is showing signs of massive strength

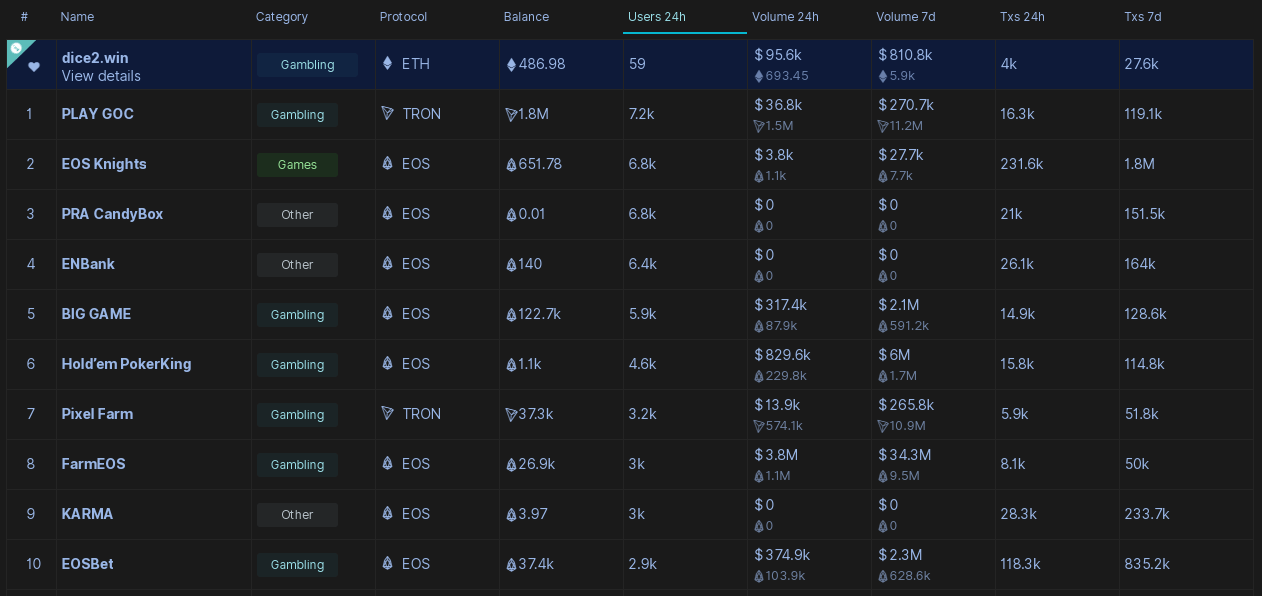

The EOS network is currently the most adopted by dApp developers and users, even though a great percentage of dApps are still gambling related. This information can be found on Dappsradar rankings. From the 11 dApps we see in the image above, eight were created on the EOS blockchain, meaning EOS is responsible for about 80% of all dApps and network usage.

Pretty impressive if you ask me.

Moreover, the sheer amount of volume is far superior to any of the other networks, including Ethereum. And we all know the result of increased liquidity in a market: it attracts more players as it is easy to transact and share value. Just look at Bitcoin, the greatest example of a decentralised network of value.

Will EOS become the go-to network for dApps? That would make EOS the most incredible value capture layer in existence, right after Bitcoin.

Let’s see what the future holds. For the time being, kudos to the EOS community for keeping the project as interesting as possible.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.