With global debt only $6 trillion away from a new landmark and nominal high for the world, can the long-term resistance level for gold that was broken at the start of 2019 now act as support for a continued move higher?

Looking at the chart for gold, you can see two significant long-term lines of descending resistance. The first and most crucial line from the 2011 $1,900 all-time high for the precious metal was broken with a fall rally in 2018.

Since that rally ended, as price again hit a key level of horizontal resistance at $1,350, we have seen the price of gold fall back down and recently find new support from a trend line that had previously ended three major bull runs for the 2000-year-old store of value.

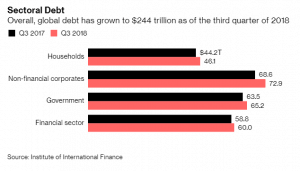

As an asset class, gold today has a global market cap of around $7 trillion. With global debt now over $244 trillion and the global debt-to-GDP ratio exceeding 318% in the third quarter of last year, is the fractional reserve ratio backing all fiat debt (now at a 35 times multiple to gold) too high globally?

The debt-to-GDP ratio is now slightly below the record of 320% recorded in Q3 2016. This comes off the back of the International Monetary Fund recently warning governments to rein in “soaring levels of debt and rebuild buffers against future risks”.

If you zoom in on just the total government debt part of this global equation, you can see that the $65 trillion reported by the IIF in 2018 is up over double the $37 trillion it was at a decade ago.

US debt now at an all-time high of $22 trillion

According to data from usdebtclock.org, we can see that US government debt alone has more than doubled in the last decade, from under $10 trillion to around $22 trillion.

With the recent debate around new US representative Alexandria Ocasio-Cortez’s outline for a new deal that includes things like medicare for all and even potentially a $10,000-a-year universal basic income, are the naysayers right to call her a “loony” assuming the 10-year program will potentially double or triple the US national debt again in what she believes may be a life-saving decade for the environment?

As this nominal figure continues to rise around the world, what correlation or significance does this really have, especially with central banks around the world moving to near zero or, in some cases, even negative interest rates?

With the stock market potentially now moving into a confirmed bear market, and with global fiat debt reaching new landmark highs, it is possible that the ‘ultimate’ store of value could break out into its own confirmed bull market following the lows of $1,050 in late 2015.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.