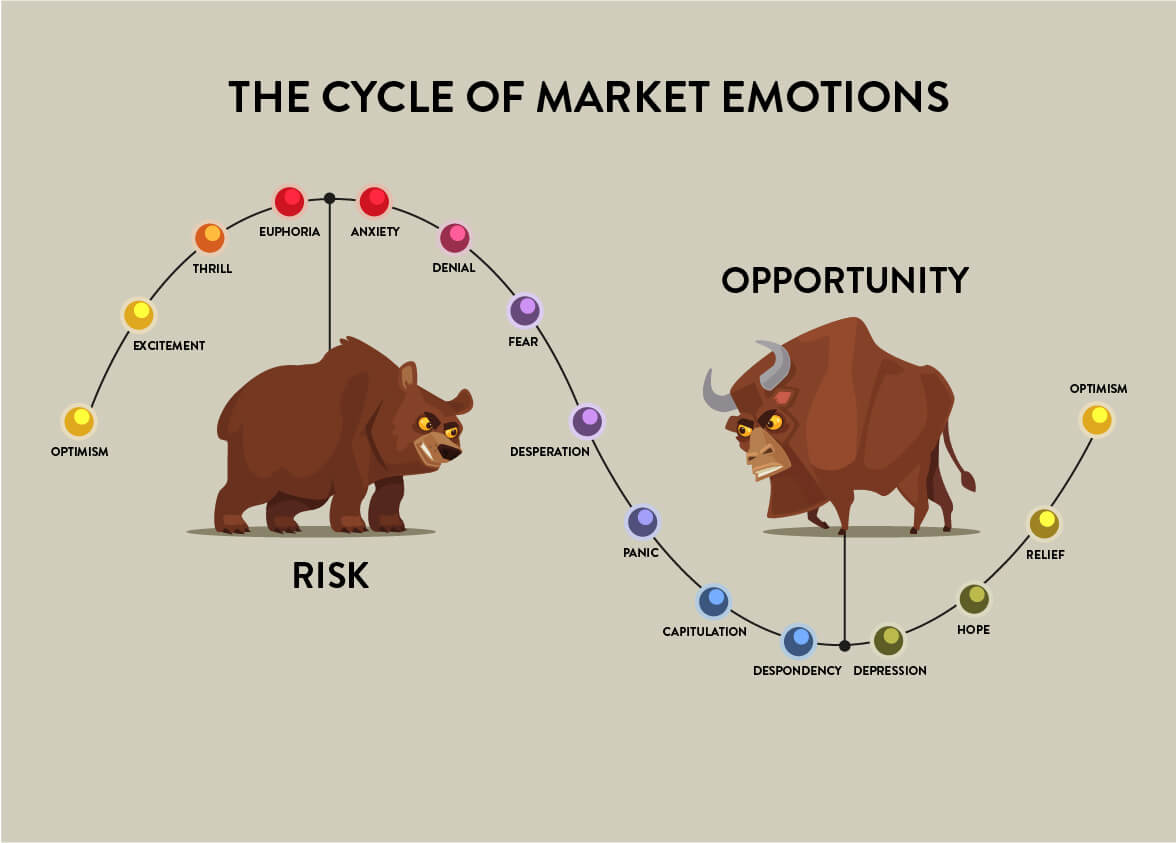

I’ve seen the word ‘capitulation’ mentioned a lot in relation to cryptocurrencies towards the end of 2018. There is an old (and very well known) chart that describes the emotional cycles that investors have in relation to their investments.

Can this be applied to the cryptocurrency market cycle and the sentiment of crypto investors?

This represents the start of the cycle when the investor makes their first investment. After doing their research and timing their entry into the market, the investor has a positive feeling that they’ve made a good choice and their investment will grow.

If there is any initial movement upwards in value for the investment, then optimism is quickly joined by some excitement. The investor thinks about investing more, repeating the success and making even bigger gains.

Thrill will quickly set in if early successes (or the growth of the market) pushes the value of investments higher. The investor congratulates themselves on their decisions, their correct choices, and their expertise in getting involved in the market. It’s easy, so they seek out more opportunity.

The easy profits continue, and all of a sudden, the investor is Gordon Gekko*. The profits keep rolling in and the investor can do no wrong. There is literally nothing the investor can’t do, and they tell all their friends and family about their success.

Suddenly, the market does something it isn’t supposed to do and moves downwards. Now the investor is faced with the prospect of losing some of their investment. But it’s early days. The investor can rationalise their decisions and reassure themselves they are still in profit and their investment strategy is sound.

This is the moment that financial risk comes into play, and it’s this early stage of anxiety that can lead investors to sell. If enough investors sell, this can develop into a bear market. A bear market is generally characterised when prices fall mainly due to the doubt and fear of investors.

If markets continue to fall with little sign of a rebound, then denial sets in. Here the investor continues to believe that things will improve and reassures themselves that their strategy is still correct and the market will rise again.

Suddenly the market looks like it’s never going to go back up. This has a major effect on investor confidence.

The investor is scrabbling around for any tactic or idea that could help improve their situation. Options will be explored to exit the market to recover enough funds to limit any loss.

All hope in the market improving or correcting itself is lost.

The investor is no longer concerned with making a profit. It’s all damage limitation from this point onwards. All the investor can think of doing is getting out of the market and recovering some of their money.

This is real bear market territory now, and investors selling off investments leads to even bigger falls in a viscous circle.

We’ve seen this stage of capitulation in the crypto market in Q4 2018.

This is an emotional low point. The investor walks away with whatever they could salvage from their initial investment and gives up on things ever changing.

For our investor, this is a low point, but for some in the market who believe in market cycles, this point can also represent opportunity and the possible start of a bull run. A bull run is when prices rise in an investment market.

Despondency gives way to depression, and the investor relives their failures and analyses where they went wrong.

What is life without hope? And investments wouldn’t exist if markets didn’t improve following a downward move or a trough. The investor now begins to realise that markets are cyclical. As the old financial services boilerplate warning to investors reads, “the value of investments can go down as well as up”. As the market improves, the investor thinks about getting involved again and starts to investigate opportunities.

Investment sentiment is turning positive, and it’s time to get back into the market. The investor’s faith in their decisions is renewed and when their latest investment moves into profit, they begin the cycle again.

So, this cycle is typical of many markets, and it’s no different in crypto. The trick is to know (or be able to take an educated guess) where the market actually is on this cycle.

In reality, there is no easy chart that looks like the one we use to illustrate our article, but there are tools available to help investors to try and identify trends and understand market cycles.

If you enjoyed our article about the cryptocurrency market cycle, you may be interested in our range of cryptocurrency guides on our site, along with the latest cryptocurrency news.

*a fictional character from the 1987 film Wall Street. The character has become synonymous with obvious and enthusiastic financial greed.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire