Bakkt’s highly anticipated Bitcoin futures product has now gone live, although just 26 Bitcoin has been traded in the opening nine hours.

While several analysts thought the launch of a regulated Bitcoin futures product on Bakkt would drive bullish sentiment in the market with price action to the upside, it has instead disappointingly coincided with Bitcoin once again falling below $10,000.

The prices of Bitcoin on spot markets Binance, Bitfinex, and Coinbase are all below $10,000. However, on Bakkt’s futures contract, the traded price at the time of writing is at a slight premium of $10,022.

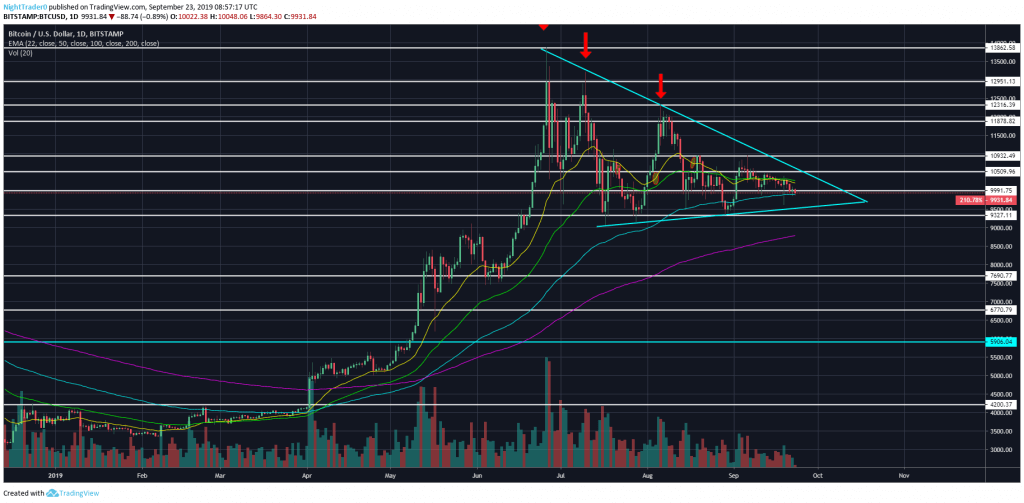

In order to retain its bullish posture, Bitcoin needs to bounce at this level – much like it did on September 11 – which is also in line with the 100 exponential moving average on the daily chart.

If price breaks down from this level, Bitcoin can be expected to initially test $9,600 before $9,350 – the latter of which has held three times since July 17.

A looming target below $9,000 is $8,800, as this was a level of resistance in June before the breakout to $14,000, and it is also on the previously untested daily 200 exponential moving average.

A bounce from this level would bring upside price targets of $10,500, $10,950, and $11,215, although significant volume needs to enter the market for a volatile move to come to fruition.

The lack of positive price action following Bakkt’s futures launch brings back worrying memories of 2017, when Bitcoin dramatically dropped from $20,000 just days after being listed on the CME and CBOE.

For more news, guides, and cryptocurrency analysis, click here.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire