Bitcoin is ten years old today. In that time, we have seen over 550,000 blocks mined on the network, and they are still coming in every 10 minutes.

Over the course of those ten years, Bitcoin and the wider cryptocurrency ecosystem has seen and survived multiple hacks, forks, regulations, prosecutions, 51% attacks, bad actors, and more.

This level of immutability/immunity in the network makes it odds-on to survive not just the next decade, but many more decades into the future.

In those ten years, we have also seen Bitcoin “die” over 339 times (and counting) according to the latest stats on 99bitcoins.com/bitcoin-obituaries.

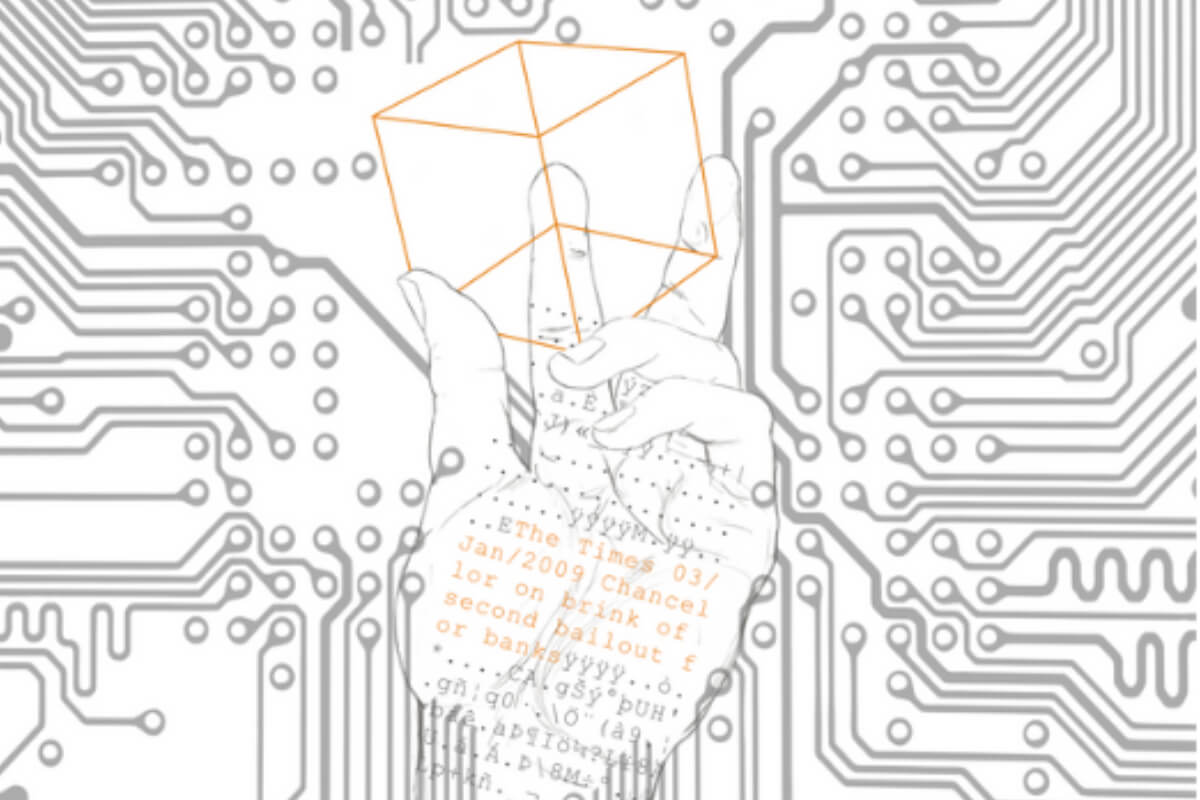

In the hash of the Bitcoin genesis block, we can see the message, “Chancellor on the brink of a second bailout for the banks”. How fitting then that we see a headline ten years later about the “debt spiral” engulfing British academic institutions.

Could they also soon be asking for state bailouts to repay those 40 and 60-year bonds they were selling to fund the university infrastructure at second-tier universities?

In their four-page spread, The Times outlined some of the “credit-expansionary forces inherent in traditional fiat banking”. On the back page, they talked about how the debt cycle is one of the primary drivers of modern economies today. But the adoption and transition to a supply constrained asset (such as Bitcoin) may actually lead to an upturn for the whole financial system.

BitMEX CEO Arthur Hays also provided an opinion piece in the paid advert, to give his “two sides of the coin”.

Hays introduced his concept of a digital society requiring digital cash, stating: “There is a very big difference between a truly decentralised cryptocurrency like Bitcoin and what could be called centralised ‘e-money’ [today]”.

In the article, he mentioned the rapid adoption happening in China, as more and more people are switching from physical cash to digital currency platforms like WeChat Pay.

It’s also worth noting that this morning, BitMEX sponsored a full four-page advert (on the front and back pages) to thank Satoshi and celebrate Bitcoin’s 10th birthday. After doing a little research into newspaper advert pricing, this may have cost BitMEX around $250,000 – $500,000.

Today also marks the first major proof of keys celebration. The idea is that people show sovereignty over their own crypto assets by pulling funds from third-party custodians (like exchanges).

The movement also has a large amount of community support from a number of key influencers. This is widely demonstrated through the addition of [Jan/3➞₿ ?∎] to many CT (crypto Twitter) usernames.

Many of these participants were also involved in changing the course of scaling consensus before, in prior movements like UASF and NO2X.

The idea is that users can show ownership of their own private keys by pulling their funds from exchanges or other custodial partners. Another way people may participate is just by performing a transaction to themselves. This would show that they do actually have access and control over their own keys.

You can’t do this with ‘traditional’ assets like shares or bonds (which your broker has a claim on). Last year, we saw over 400,000 transactions happen with over 250,000 Bitcoins moved on the BTC blockchain.

Let’s see if we can beat that figure this year!

Credit to Aurelius van Volten for the posts graphics,

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire