When looking at any piece of information, especially Bitcoin or crypto-related information, the ability to see things both in perspective and abstractly are incredibly important qualities.

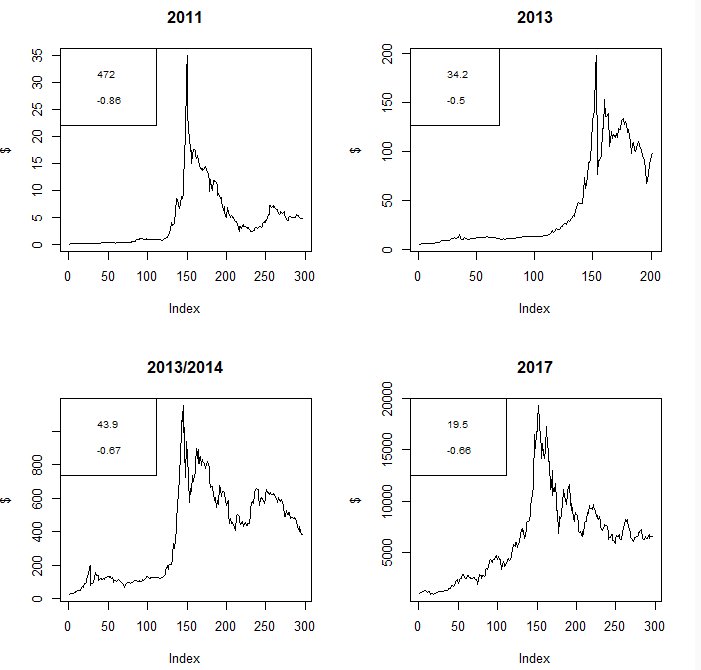

If you do not wish to end up selling or buying Bitcoin at the wrong times, which is quite easy to do, you should always pay attention to history and to the overall macro trends.

Perspective

Do you know how big the dot-com bubble grew before bursting? This image will give you an idea:

When the dot-com bubble exploded close to 20 years ago, the total market value was around $6.7 trillion. In today’s money, the value of each USD is about 40% lower. This simply means if you were to compare 2000’s prices to 2018’s prices, this bubble would have reached more than $9 trillion in value.

If cryptocurrency was a bubble, it is currently only worth about 1.5% of the total dot-com bubble value. How frightening.

The bigger picture

According to traditional news sources, the current mindset of most traders and investors is that cryptocurrencies are in some sort of downward spiral with no hope ahead.

Obviously, when we look at the bigger picture, we can see that this is not the case.

With the most recent developments in Lightning Network technology, we’re now starting to see considerably more adoption as more nodes join the network and the number of active connections and transactions increases. Moreover, two versions of the Mimblewimble protocol (an alternative solution to the scaling, security, and decentralisation trilema) have already been released this year in Beam and Grin. This shows how strong the fundamentals currently are.

It is true the entire cryptocurrency market cap has devalued more than 80% since its peak high, close to $1 trillion, in December 2017.

However, interestingly enough, it is also a fact that during the most desperate moments is when we’re given another chance.

I don’t think we’ll see such low prices for much longer. Soon, there will be an upwards correction. I would argue sometime between Q2 and Q3 2019.

Just look at the fundamentals, such as Bitcoin’s hash rate maintaining a steady uptrend and more people actually using Bitcoin in countries like Venezuela. Do you really need more to be convinced?

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.