Bitcoin has experienced yet another negative slump in price, with more than $18 billion wiped off the asset’s market cap since the dreaded death cross on the four-hour chart.

On Monday, Coin Rivet reported that the death cross was beckoning as price hovered within the $10,200 and $10,650 range.

Just hours later, the death cross – where the 50 EMA crosses the 200 EMA to the downside – came to fruition. Price proceeded to fall to test the $10,000 level of support before breaking it to the downside.

Bitcoin has since managed a slight bounce from the $9,580 region, although short-term momentum has almost certainly shifted, indicating a further fall in price over the coming days.

The drop from $10,650 to $9,580 marks a 10.4% decline, with several analysts suggesting that this could be the start of a bearish phase in the market.

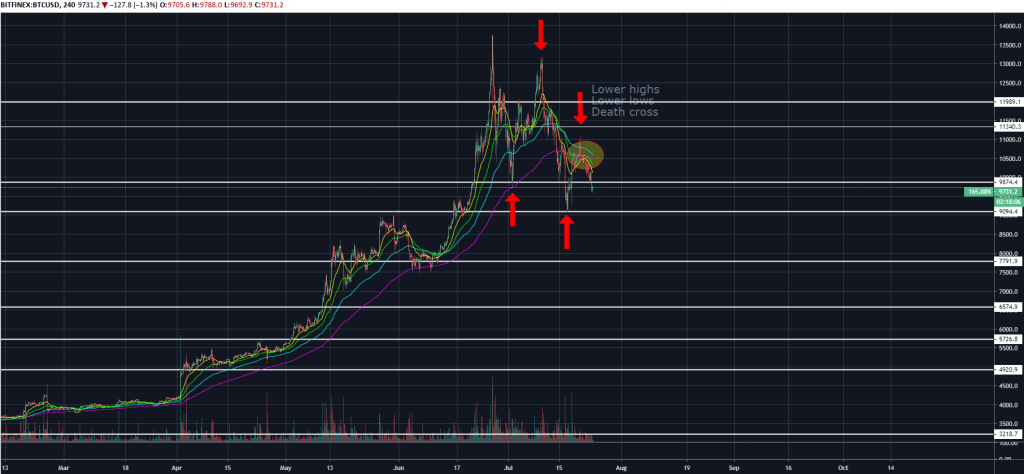

$BTCUSD beginning to look a bit like the start of 2018 here. Lower highs, lower lows and a four-hour death cross. The bulls need to buck up their ideas rapidly to save Bitcoin from falling back into the mid 8k's and potentially lower.$crypto pic.twitter.com/FYUfguH2os

— Oliver Knight (@OKnightCrypto) July 24, 2019

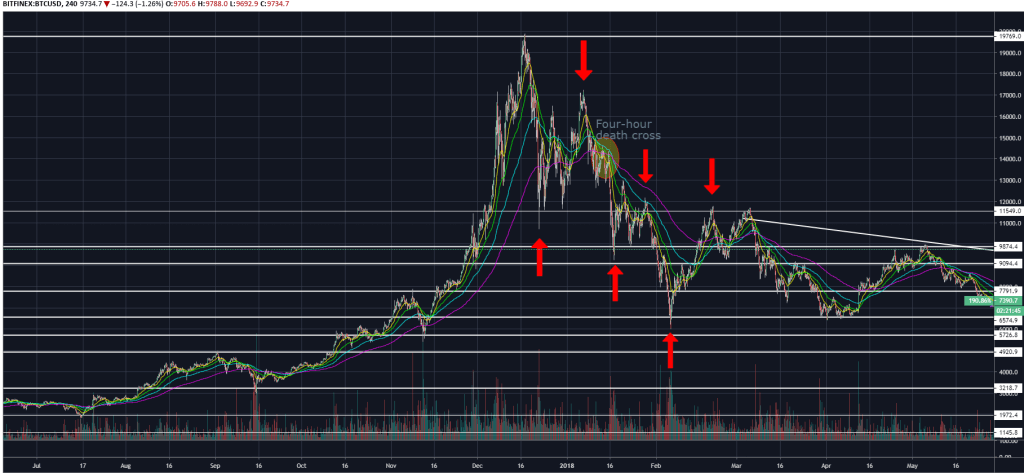

Coupled with the death cross, Bitcoin has put in three lower highs and three lower lows. This is typically indicative of a reversal similar to what was seen at the start of 2018.

Following the tremendous bull run that saw Bitcoin touch $20,000, it made lower highs of $17,300 and $11,800 while making lower lows of $10,760 and $9,220.

This time around, Bitcoin has failed to breach the yearly high of $14,000, falling to subsequent lower highs of $13,200 and $11,100.

The next notable level of support for Bitcoin would be $9,150. If that level breaks, then the $8,350 to $8,800 range seems to be the next logical stop.

The previous four-hour death cross on September 8 last year culminated in a 56% drawback for the price of Bitcoin. While a drop of that extent seems unlikely, that would put the world’s largest cryptocurrency back below the $5,000 level.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.