Bitcoin looks primed for a major move to the downside after falling by 3% following yesterday’s weekly candle close.

It now lies precariously above the psychological level of support at $10,000, with the 100 EMA on the daily chart at $9,800 emerging as a potential short-term downside target.

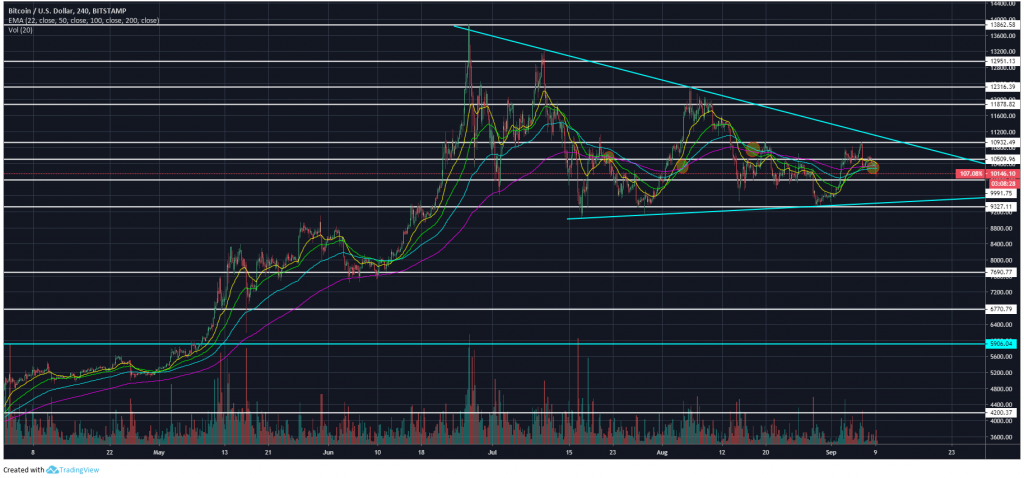

The recent breakdown in price comes after yet another rejection at $11,000, which marks a fourth consecutive lower high.

Since reaching a yearly high of $14,000 in June, Bitcoin has consistently failed to achieve a higher high, being rejected at $13,200, $12,200, and more recently $11,000.

This is typically a bearish charting pattern as it demonstrates bullish exhaustion as well as a lack of continuation.

The four-hour exponential moving averages are currently battling it out to prevent a golden cross. The 200 EMA has been above the 50 EMA since the death cross on August 17, which resulted in a 13% drop in the following 12 days.

But the 50 EMA briefly crossed the 200 EMA back to the upside over the weekend, tempting a golden cross before this morning’s sell-off saw it cross back to the downside.

In order for a bullish cross to come into fruition, Bitcoin would need to close four-hour candles back above $10,400. If Bitcoin can bounce and that scenario plays out, it would be feasible to see Bitcoin rise to above $11,000 in the coming days before testing $12,000 and potentially new yearly highs.

For more news, guides, and cryptocurrency analysis, click here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.