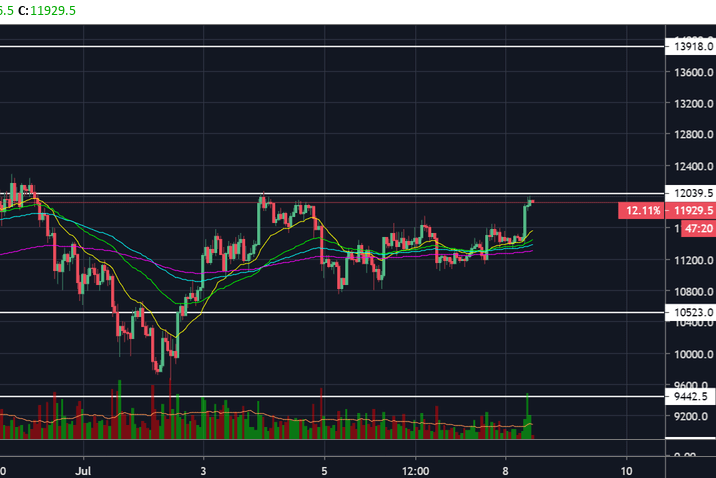

Bitcoin has rallied 6% this morning to retest the crucial $12,000 level of resistance.

A series of multi-million dollar market buys on BitMEX sparked the rally, with significant buy support also appearing on Bitfinex and Bitstamp.

This marks the third test of the $12,000 level in the past two weeks. A potential break-out could trigger further upside targets of $12,400, $13,000, and $14,000.

The daily stochastic indicator has crossed to the upside once again, which as discussed last week could trigger another substantial surge in price.

The risk-reward setup at $12,000 favours a short position, with a stop-loss above $12,050. However, if volume can be sustained, that level could quite easily be taken out.

It seems as though traders are attempting to prop the price up above $11,800 as a series of large buy orders have been appearing on Bitfinex, with traders ‘spoofing’ 1,500 BTC ($18 million) orders in an attempt to spur further price action to the upside.

A breakdown from $12,000 would be the first signal of a further correction, potentially up to 40%. Downside targets remain at $10,700, $9,700, $9,250, and $8,750.

It remains to be seen whether Bitcoin has the fuel needed to ignite a further rally, but this morning’s sharp spike to $12,000 has come from legitimate volume, hinting that further upside movement is to come.

Keep up to date with Coin Rivet’s technical analysis here.

Denver, Colorado, 24th February 2025, Chainwire

Denver, Colorado, 20th February 2025, Chainwire

Washington, D.C., 18th February 2025, Chainwire

Dubai, UAE, 27th January 2025, Chainwire

Those who enter the market at this time may be surprised to hear that Bitcoin…

George Town, Grand Cayman, 22nd November 2024, Chainwire