Open margin interest on Bitfinex has fallen by 23% since the start of the week to reach a new 12-month low.

Since Bitcoin failed to hold its $8,400 support on June 3, open interest for BTC/USD shorts and longs on Bitfinex has fallen from 45,000 to 37,000 BTC. Given the price drop in Bitcoin from $8,400 to its current level of $7,800, the decline in open margin interest equates to a drop of $88 million, as we have seen nearly 4,400 shorts and 3,300 longs close over the last three days.

The Hong Kong-based exchange offers margin trading on its BTC/USD market but only to the extent of 3x leverage. Given its low leverage and trusted reputation in the industry – it has proven resilient in surviving hacks and seizures over the last seven years without any impact to its markets or deposit/withdrawal capabilities – many consider the exchange a cornerstone of the BTC infrastructure for large holders who are looking to trade or stabilise their volatile crypto holdings.

Open margin interest at a 12-month low

With open margin interest on Bitfinex currently at around $290 million, this represents a 12-month combined low in USD terms. In BTC terms (a good measure of sentiment due to the scarce nature of Bitcoin), BTC shorts topped out at around 43,000 BTC in December 2018 and longs at around 37,000 BTC in February this year.

Given that the current combined margin interest is around 37,000 BTC (after falling 7,700 BTC since the start of the week), it looks like traders may be getting ready to move their capital from Bitfinex to trade at other exchanges like Binance, which is set to launch its own margin trading platform that is rumoured to provide just 2x leverage.

Another popular option for margin traders who are looking for a bit more leverage and liquidity in the market would be BitMEX, which recently experienced over $10 billion worth of volume in a 24-hour period on its popular 100x perpetual swap product.

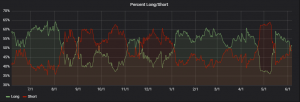

Longs and shorts as a ratio

Over the last 12 months, you can see from the chart above that shorts seem to be trending up again, following a dramatic short squeeze as Bitcoin went parabolic during the month of May. The last short squeeze saw the shorts go (as a percentage of open BTC margin interest) from 63% all the way to a low of 42% in one of the most dramatic swings over the last year.

With Bitcoin seemingly finishing its short-term parabolic rise, the margin interest has been flip-flopping around 50% as the market works out if we are currently at a fair valuation given a backdrop of trade wars and the inversion of long-term yield curves in traditional markets.

The open interest in the margin BTC/USD market on Bitfinex peaked at over $1 billion in the 2017 bull run to $20,000. It may have fallen by nearly $100 million this week, but I think that this is more likely a case of traders doing a ‘sell in May and go away’ tactic before the next storm in this OG margin and funding market for the world’s biggest decentralised asset class.

For more information on the Bitfinex funding and margin markets, check out Coin Rivet’s exclusive guide here.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.