DeFi users all want high returns, whether they are participating in DEX, lending or yield projects. However, in the world of crypto, these are almost always variable returns – users are out of luck when it comes to fixed rates. Element Finance seeks to change that.

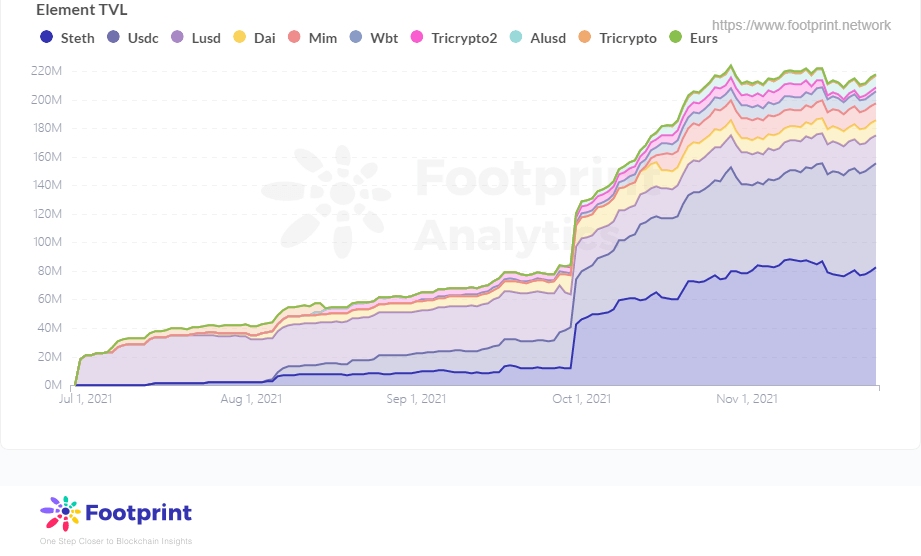

The project was launched on the main Ethereum mainnet on July 1, 2021. After announcing a $4.4 million seed round led by Placeholder and Andreessen Horowitz (a16z) in March, it received another $32 million in Series A funding led by Polychain Capital in October. In less than six months, with TVL rising to $218 million, the Element pool currently supports USDC, DAI and 6 Curve LP tokens.

Footprint Analytics :Element TVL

Element Finance solves the problems of fluctuating interest rates on most DeFi projects and principal liquidity after being deposited. Unlike other protocols, where users deposit assets to receive a variable interest rate, Element splits the base assets deposited by users into two separate tokens:

- Principal Token (PT), which represents the value of principal

- Yield Token (YT), which represents variable interest

Element Finance also allows users to provide liquidity in an AMM so that PTs and YTs can be traded against the base assets.

This mechanism allows users to form different strategies by assembling PTs and YPs. In this article, Footprint will analyse the seven ways Element Finance can generate revenue for users.

Fixed APY (buying PTs only)

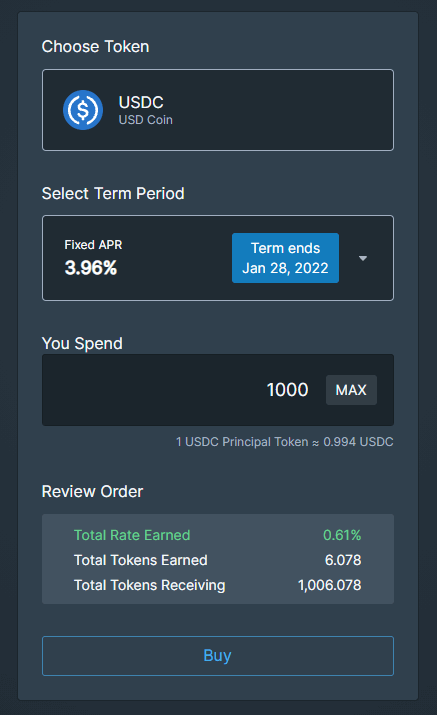

For those who want simple transactions and a fixed APY, you can make a quick investment in Element Finance through the Fixed Rates interface, choosing the base assets they want to deposit, the maturity date and the fixed APY.

Source:Element Finance

For example, if a user makes a purchase with 1,000 USDC, he will receive approximately 1006.078 PT (ePyvUDC). When it expires on Jan. 28, 2022, the user can use the 1006.078 PTs on hand to redeem the USDC at a 1:1 rate and earn 6.078 USDC in interest, with a fixed APR of 3.96% at that time.

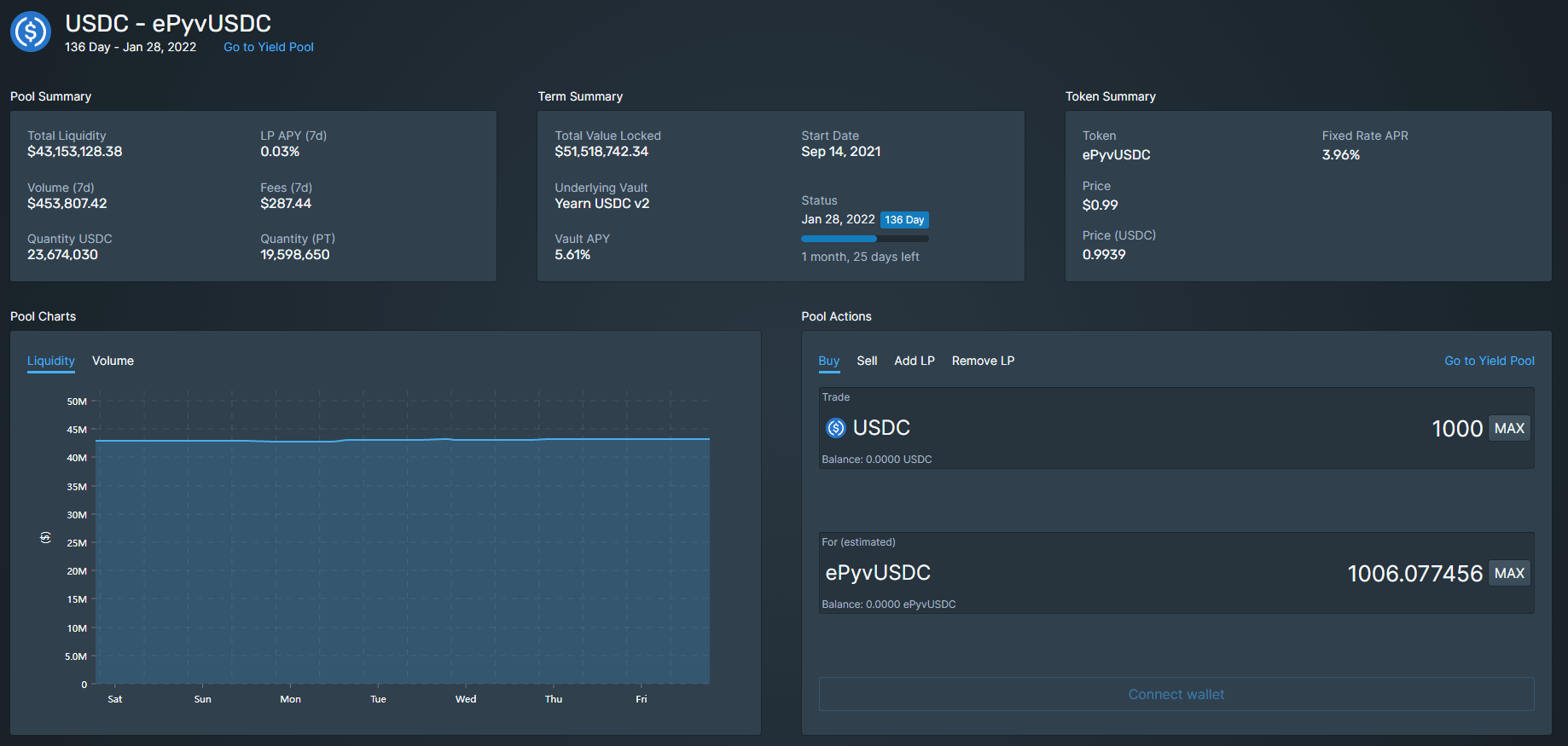

To find out more information, you can access it through the Pools interface and select the corresponding pool. PTs can also be purchased directly using USDC in Pool Actions.

Source:Element Finance

It is interesting to note that some pools have a higher fixed APR than the Vault APR deposited in Yearn, although the Vault APR may increase in the future. At this point in time, investing through Element can yield a higher return than going directly to Yearn, and the APR is clearly defined at the time of investment, so you don’t have to worry about whether it will be reduced in Yearn.

Read below to see how Element Finance achieves a fixed APY for its users.

Principal liquidity (selling PTs and holding YTs)

When users want to hold the return corresponding to the principal investment, but also want to have the liquidity of the principal, they can split the base assets through the Mint & LP interface. The split PTs will be sold in the corresponding pool, and will be sold at a discount, with the particular discount rate changing at any time depending on the proximity of the maturity date and supply and demand.

This model is similar to split-coupon and zero-coupon bonds in traditional finance, where the buyer can buy the asset at a cheaper price when the seller needs liquidity to sell the asset at a discount, and the discount rate creates a fixed APY at the time of the transaction.

The seller user still has the variable interest rate on the base asset at this point, but the principal originally locked is released. If the user originally deposited 1,000 USDCs with an expected APR of 10%, when the user sells 1,000 PTs by splitting the asset, the discount recovers 990 USDCs. The discount costs the user 10 USDCs, but if the APR can be greater than the discount rate, the user still has a net gain.

At this point, the user still has 990 USDCs, but has the exposure to earnings corresponding to 1000 USDCs. Instead of the 1000 USDCs that were locked, there are 990 USDCs that can be used freely without the risk of liquidation. The user can use the 990 USDC in the wallet to make another investment to compensate for the loss of the discount, which is equivalent to having an interest income without using any of the principal.

Leverage (re-depositing PTs and accumulating YTs)

If a user is more risk-tolerant, he can use the 990 USDC mentioned above to continuously re-deposit and increase his leverage. Through a continuous cycle of splitting the base assets, selling PTs and then swapping back to the base assets, the YT is accumulated thereby continuously increasing the interest exposure.

This strategy, called Yield Token Compounding, is liquidation risk-free compared to the leveraged strategies of over-collateralized lending protocols like Abracadabra.

It is important to note that the discount rate here is variable, and the APY of YTs is also variable at any time, and it is uncertain whether the final APY will be as high as when it was bought. If the discount rate and APY are not balanced properly, it will not be as profitable as simply putting it in Yearn. The user also needs to pay gas fees for each transaction, which can easily add up to a sizable amount.

Buying tokens at a discount (holding PTs and selling YTs)

The opposite of the above tactic is to sell the YTs of the gain portion but hold the PTs for the long tern. For those who want to buy at a discount or bet on an increase in price.

If the user also splits 1000 USDCs and sells the splitted 1000 YTs immediately in return for 100 USDCs, it is equivalent to the user owning 1000 PTs with only 900 USDCs. And when it matures the user redeems 1000 USDCs 1:1 with these 1000 PTs.

This operation is actually similar to Case 1, both are equivalent to locking in a fixed APY, and users can choose the higher yield by calculating the APY after buying PTs discounted in the PT pool compared to the APY after selling YT in the YT pool. The first strategy (fixed APY) is obviously more friendly to users who want to save money on gas fees and don’t want to spend time researching.

For users who do not want to be exposed to the risk of APY fluctuation in Yearn, they can sell PTs to lock in and receive future gains in advance when they feel the pool is giving them APY that meets their expectations.

Flexible variable interest rates (buying YTs)

As both PT and YT are tradable, users who are more optimistic about the future variable yield of YTs can purchase only YTs by using the base assets.

Users can use all the 1000 USDC originally intended as principal investment to buy YTs, and when it matures users will get the remaining variable interest. Users need to pay attention to the Vault APY in Yearn with the corresponding APY of the buy pool, for experienced users can get good returns by this way.

Trading fees (providing liquidity in AMM pools)

After splitting the base assets, in addition to buying and selling PTs and YTs, users can also earn trading fees by providing liquidity. It is important to note that when providing liquidity (LP), a portion of the base assets should be left to be grouped pairs with PTs or YTs.

Element Finance mainly uses Balancer’s AMM. The most prominent characteristic of Element compared to other protocols is that it provides liquidity without impermanent loss. Since the token pairs are the base asset and the PTs corresponding to the base asset respectively, the price of the PTs of the same type will eventually converge to the same value as the base asset. When a user’s PTs is traded in for the base assets or reversed, the final value left is the same whether it is the base assets or the PTs as both assets are of equal value.

The user can take the 1000 USDC originally used for investment, split it into PTs and YTs with 500 USDC, and use the remaining 500 USDC to provide liquidity with PTs and YTs pairs. If the APY is 10%, the return to the user at maturity is 50 USDC plus the trading fees. It is impossible to determine whether the return is a profit or a loss compared to the original return of 100 USDC by investing all 1000 USDC, but it can be evaluated by referring to the LP APY provided by Element and the activity level of the pool.

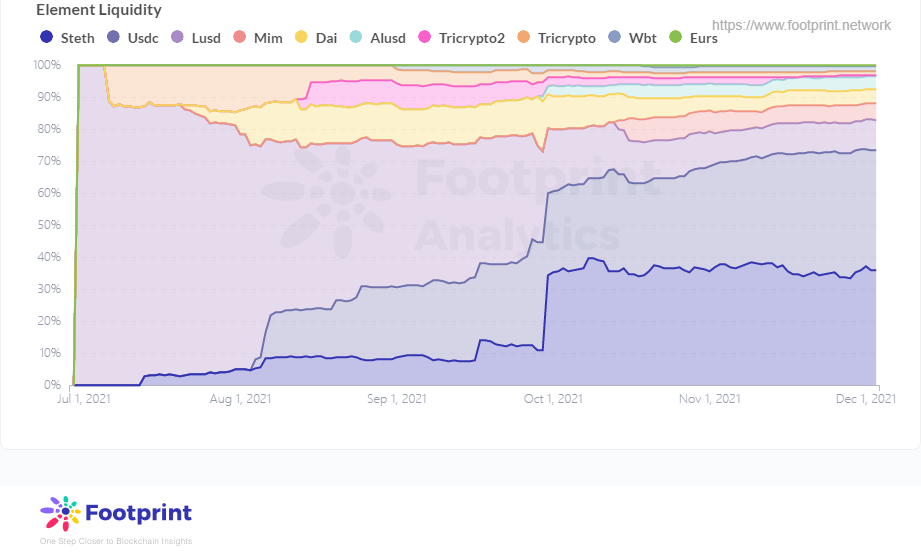

Footprint Analytics :Element Liquidity

Currently the most liquid pool on Element is USDC accounting for 37%, followed by STETH accounting for 35%, and the remaining are also mostly pools of stablecoins.

Arbitrage

For experienced users who are familiar with the market, they can also realise gains through arbitrage. For example, buying and selling assets through other secondary markets and using the difference between different pools with Element to realize gains; arbitrage by observing the difference between variable APY and fixed APY; setting a threshold based on experience and buy when the APY in the pool is less than the threshold and selling when it exceeds the threshold to earn arbitrage on the difference.

In addition to the above, users can even make other portfolios by selling PTs and YTs at the same time. Element Finance offers users a very wide range of possibilities to explore.

Conclusion

The VC a16z (Andreessen Horowitz), famous for its investments in Facebook and Twitter, has always had a keen sense of cutting-edge technology and emerging fields. It’s a positive sign that the firm invested in Element, which is innovative in solving the problem of user funding efficiency. There is no liquidation risk compared to an over-collateralized protocol, no impermanent loss compared to a typical AMM providing liquidity, and can build more Lego models in combination with other DeFi protocols.

However, the mechanism of Element is not that easy for new DeFi investors to understand. While providing more ways to play, it also requires users to invest more effort to understand how its mechanism works, calculate the actual revenue they may receive in the future by judging the market, and at the same time to reasonably assess the range of risks they can take.

Element’s continuous effort in improving efficiency of users’ capital in such an innovative way is the reason why it may be the dark horse in this new sector.

The above content represents the personal views and opinions of the author and does not constitute investment advice. If there are obvious errors in understanding or data, feedback is welcome.

What is Footprint?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Footprint Website:https://www.footprint.network/

Discord:https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_DeFi

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.